Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

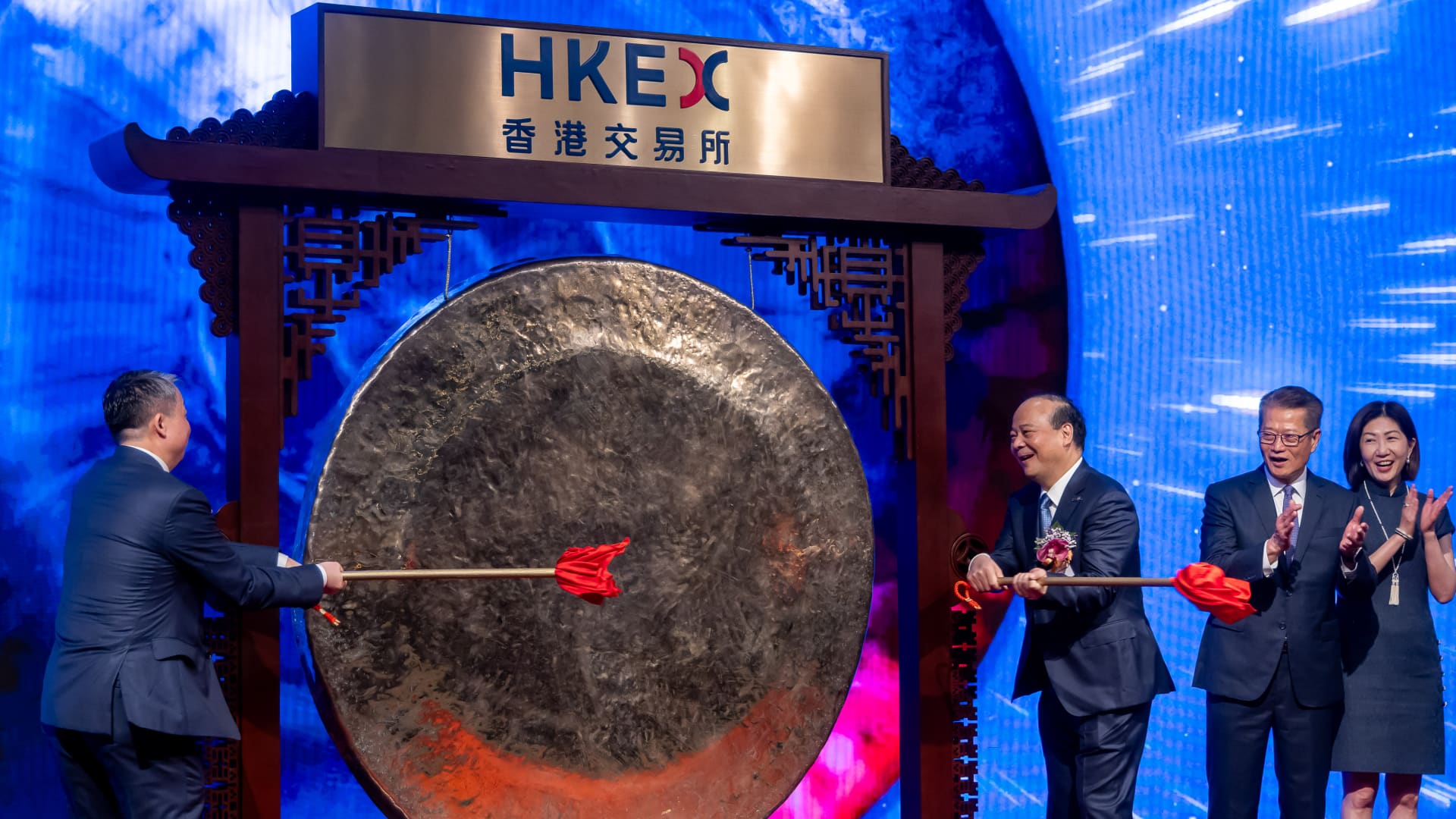

Robin Zeng, Modern Amperex Technology Co. Ltd. (Catl), third rights, third law, Paul Chan, Hong Kong’s financial secretary, second right and Bonnie Chan, Hong Kong Exchange and Clearing Ltd, Tuesday, Hong Kong Exchange CATL list ceremony 20, 2025.

Paul Yeung | Bloomberg | Getty pictures

Investors and enthusiasm from the Hong Kong’s capital capital stock markets are back, because Chinese companies flock to the city for fundraising in recent years.

Similar deals and a The state is charged For companies listed in Hong Kong, the data supplier provides information supplier, according to DOATOGIC data, increases capital increase in capital increases for the first and a half years since 2021.

The new list of new lists in the Hong Kong stock market was about $ 1.8 billion in the first half of this year, in 2024 to $ 14 billion in 2024, 2024 dollars in 2024. In the end, a special purpose purchase companies have been exceeded to raise capital through an IPO or create capital with another company or to combine capital.

This is the largest list of world list this year, the city is on the city, Nasdaq and New York Exchange. Pwc Preded up to 100 iPo This year in Hong Kong, over $ 25.5 billion in total financial collection.

Angry came after years IPO activity in the city Pandemic feeling after risk and stuttering between economic growth.

In the first half of this year, there are 43 new lists in Hong Kong, $ 15.6 billion, the total amount raised in 2024, the financial information platform showed wind data.

In comparison there was only Listed 73 in 2023According to HKEX data, increase $ 5.9 billion.

Updated interest, including Beijing’s regulatory tails, including the regulatory tails of the A-Sharing lists, in large market liquidity and HSBC, the head of the Chinese capital strategy in Hong Kong, including the fears of the Chinese capital strategy, including the fears of China, including the fears of the US markets, are burned.

“The IPO boom in the Hong Kong market is undoubtedly managed by a double list of AHH (stocks),” the Sun said. A-Shares apply to materials listed, H-Shares are listed in Hong Kong.

“Green more and more companies use income to finance globalization,” said Sun, Hong Kong dollars, because in global markets are more than Chinese Yuan.

A jump in Chinese capital prices last SeptemberThe expectations of a stronger economic stimulus helped to turn the tide of bears on the bears about China.

Earlier this year, the release of DeepSEEK’s low-preceding, but stronger model, further increased a rally in China’s technological shares, because investors began to re-evaluate China’s innovation to reconstruct Chinese capital.

“Market assessments have been widely added to historical average, the historical average level, providing a better background for FondReaza.

Hung-Kong’s hanging Seng index near Wednesday, this year has made it 21% this year, one of the main markets that play it globally.

The Chinese government is likely hoping to create additional financial costs to protect the economy of any trade-related shock.

In a turn that appears to support the private sector, Chinese President Xi Jinping explained it The best business leaders of the nation in February The country needs their help to ensure economic growth.

In this turn, for the long-awaited approval of the Pekin for the long-awaited approval of Pekin, especially for more expected consumer-capers, especially geopolitical headlines, Said Lorraine Tan, Kapital Research Director.

Last year Chinese securities regulator Measures aimed at tracking rapidly Approved for compatible mainland technological companies in Hong Kong. Hong Kong regulators also launched the so-called “Technology Enterprises Channel” In May, specialist will facilitate IPO approvals for technology and biotechnic companies, especially those listed in LoN.

“Perris Lee, Perris Lee, Perris Lee, Perris Lee, Perris Lee, Foundy, said in the city, Perris Lee, Perris Lee, Foundy, said in Hong Kong.

Another driver for a rally on Hong Kong market, Hong Kong, Deepseek entered Hong Kong shares in Hong Kong, entering Hong Kong shares due to artificial intelligence transactions.

The south-assigned stream is followed by the crossings of the border Stock connection schemeAccording to the wind data, in 2014, the scheme was raised in April-June in April-June.

According to LSEG, China’s Benchmark CSI Benchmark in 300, liked it with difficulty this year.

This is the list of land in Hong Kong, according to the Sun, Hong Kong said that Hong Kong restricted about half of the daily share turnover of Hong Kong said that he said to transfer money to the list of about half of about half of the daily share turnover.

These factors helped Mainland China trade companies to search for a secondary list in Hong Kong, including the Battery Manufacturer Modern Amperex technology.

The company has already been listed in Shenzhen, the company raised More than $ 5 billion one The middle list in Hong Kong In May, this year this year is what is the world’s biggest suggestion.

More than 200 active IPO applicants in the pipeline, more than 40 companies have already been companies in the main stock exchanges, showed wind data.

High-level companies looking for a basic list in Hong Kong includes a mixed group of bubble tea retailers, gum retention and walking platform platform operator Caocao Inc.

“Especially in the HKD, appetite is to reflect the extensive plans for expanding the foreign markets to raise maritime funds,” HSAO.

The house was called on the voltage of the incision and the United States, Beijing, the leading companies to expand their leading companies globally and diversify production places.

In addition, the Hong Kong market, AI, renewable energy, digital consumption and biotechnics, Broechnic, digital consumption and biotechnics, BNP Paribas, are more “inclusion”.

Hong Kong, the highest US-China tension, has chosen a preferred iPo space for many Chinese companies, Trump management can order a pest from the US exchanges.

“A medium list provides additional insurance for Chinese companies listed in the United States, which is not possible to be listed,” Lee said that they are trying to draw a “plan” with the “plan” and the “plan”.

[ad_2]

Source link