Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

Beautiful systems, smoking.com and godaddy grow rapidly, but still trades in modest assessments.

All three companies provide cloud-based work models with reliable repetitive revenues.

Investors looking for value in Tech may want to look at the shares that do not pass this eye today.

The stock market is developing in the summer of 2025. Despite an uncertain economy, the leading stock indices regularly put new heights. This S & P 500 (SNPINDEX: ^ GSPC) The index has become 19% in the last quarter, the more variable Nasdaq-100 Rose 26%.

But still in the technological sector, there are some great values hiding in a straight landscape. Some incredible growth stocks have never received memo on voting in 2025. When modest stock charts combined with great long-term job prospects and a modest assessment, it is time to take a second look worthless growth stocks.

Let me promote you Beautiful systems (NASDAQ: Beautiful), Alarm.com (NASDAQ: ALM)and Devout (NYSE: GDDY). These three innovative technological shares are the fastest growing companies you can get at a reasonable price today.

There are a few things in common in these shares:

Sell programs and services with their cloud-based work models, long-term contracts or monthly subscription plans.

Customer lists are primarily in the center of 20 million small enterprises from 20 million small enterprises of God, almost exclusive attention to the scale clients of enterprises.

Many of them are mission-critical tools for information security or physical security monitoring. Your company is likely to be loyal to long driving after a contract with one of these companies.

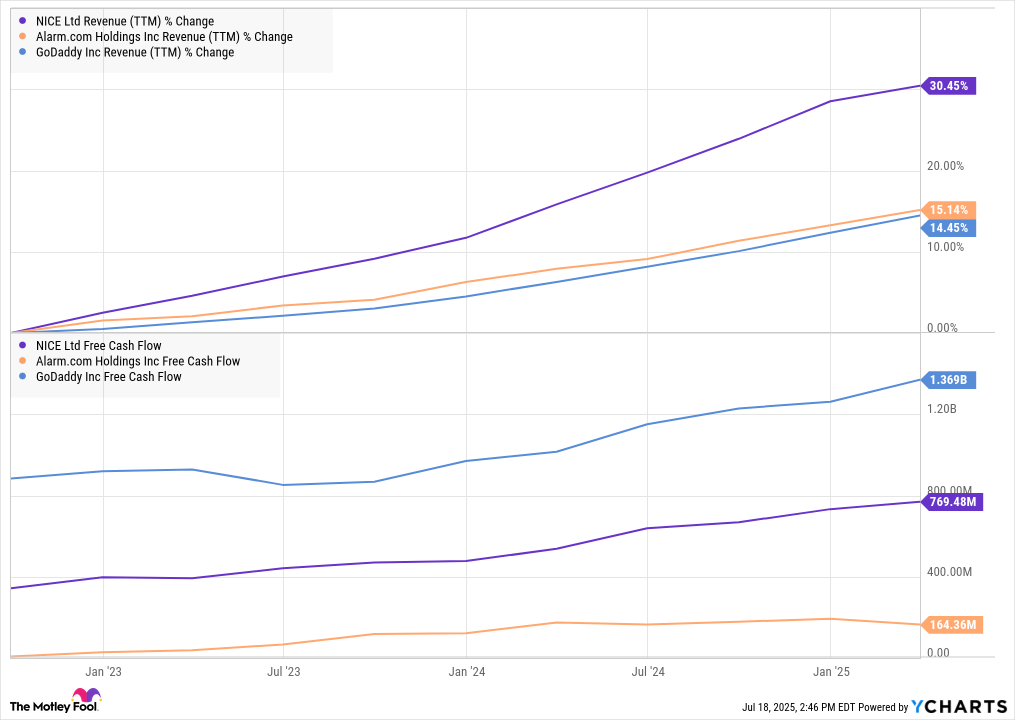

Their profitable business models are stronger income growth and firm Free cash flow Over the past three years:

With these caliber work descriptions and financial results, you are expected to trade beautiful, smarc.com and godaddy shares to trade in blue-high appraisals. However, all three shares are reduced from year to year and do not seem expensive. For more than 50-fold money flow and double-digit price sales rates, this trio is a convenient breath in a world where “magnificent seven seven” shares are trading:

|

Stock |

Free cash flow (TTM) |

Sales Price (TTM) |

Market |

|---|---|---|---|

|

Devout |

17.5 |

5.2 |

$ 24.0 billion |

|

Stylish |

11.6 |

3.5 |

$ 9.7 billion |

|

Alarm.com |

16.4 |

2.9 |

$ 2.8 billion |

Information collected on 7/18/2025 from Finniz.com. TTM = 12 months last.

[ad_2]

Source link