Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

More than 10,000 founders, investors and technological insiders will be collected in San Francete West on October 27-29 TechCrunch breaks 2025 – One of the most anticipated technological conferences of the year.

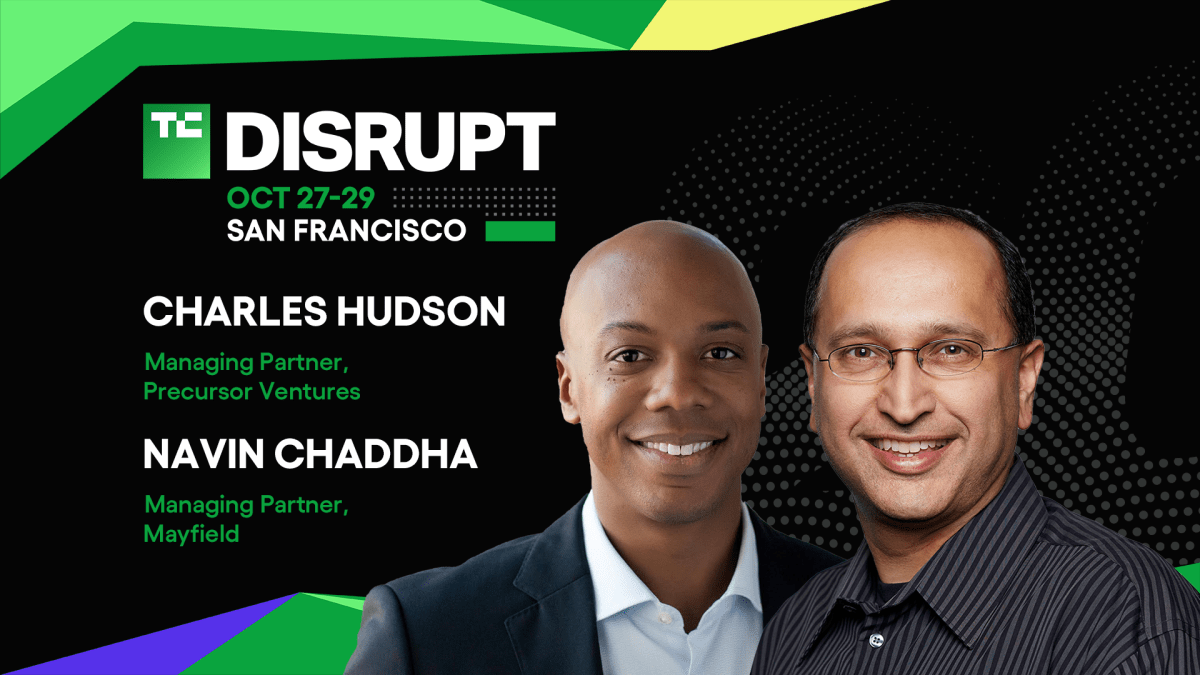

250+ technological leaders who took the stageDo not miss this stop panel about builders reflecting two of the most respected early scene investors in the builders: Charles Hudson Prekursor enterprises and Navin chaddha Mayfield. Their session dips on one of the most rigid moments in any beginning’s journey: zooming out your first round when you are all.

This is honest and tactical chat Increasing your first institutional check, it will cover the fact that it is really important to tell a compelling story without traction. Hudson and Chaddha, the founders of the founders, eyebrows in a row, the most common mistakes will share the signs that entrepreneurs participate in the fundraising.

In advance, the seed and seed fandreys are often before a product, the user base or traction. This means that investors have bets on the founder. And this is how many little things are to make the call better than Hudson and Chaddha. Hundreds of founders between them are the earliest stages, the show show and often before a code line was sent.

Charles Hudson, who manage partner Precursor enterprisesInvest in more than 400 companies and supported more than 450 creatures. He recently founded his reputation in supporting people with bold ideas and unique perspectives “You are more important to believe in the founder’s narrative and adaptability of the founder. This is not just to solve a problem – no matter what I believe.”

Navin Chaddha, managing partner MayafieldBreakout brings ten years to determine the founders and guidance companies. The capital cost of investing is more than $ 120 billion, the majority of the earliest phases are the most material values. “First, we invest in the second and the third of the product in the markets” Said. “We are looking for the founders who are stringed for managed and sustainable with the mission.”

Regardless of your growing or planning for the future, this session will provide you with real, effective recommendations to navigate you with clear, confident and confidence. Don’t miss in addition 200+ Sessions occurs in five industrial phases. Sign up to save now Up to $ 675 before prices rise after July!

Techcrunch event

San Francisco

|

October 27-29 2025

[ad_2]

Source link