(Bloomberg) – Halion days of corporate debt, with commercial wars, with trade wars, the relentless requirement for the loan.

Most read from Bloomberg

“The cracks visible in the credit market last week have made this week,” Bank of America Corp. Strategist Neha Khoda added that markets now pricked in the recession.

Tariffs are expected to grow in the world economy and are expected to increase policies in the United States. Last week, this is widespread in six months, but is widespread near the historical lower falls, that is, if a recession occurs, they will be able to move more. As some hedgeic foundations are already increasing, the volatility increases and investors are assembled to assets such as gold.

“Bigst levels, Bugst levels only high,” Viktor Khosla, the founder of the Opportunity Credit investor, said in an interview with Bloomberg TV on Wednesday.

Here are five graphics that emphasize the feelings shown in debt markets:

Junk Risk Rewards

With the growing high productivity spread in the United States, Goldman Sachs Group Inc. strategists increased, as tariff risks increased, and the White House flags have acted sharply, and this wanted to endure short-term pain to solve the trade deficit. Now highly productive, previously expects to reach 440 main points in the third quarter compared to 295 key points. As of March 13, 335 was the main point.

“Recently, we moved from a market that used to sell rumors and selling the facts,” said Bain Capital Credit Europe Gauthier Reymondierier.

CDs

Algebraic investment portfolio manager Gabriele FoA warned of high-productive loan default swaps in February in February, and every time in the frosted expansion of credit risk, the northern American high productivity index has fallen to the lowest level since August, and the north American high productivity index since August.

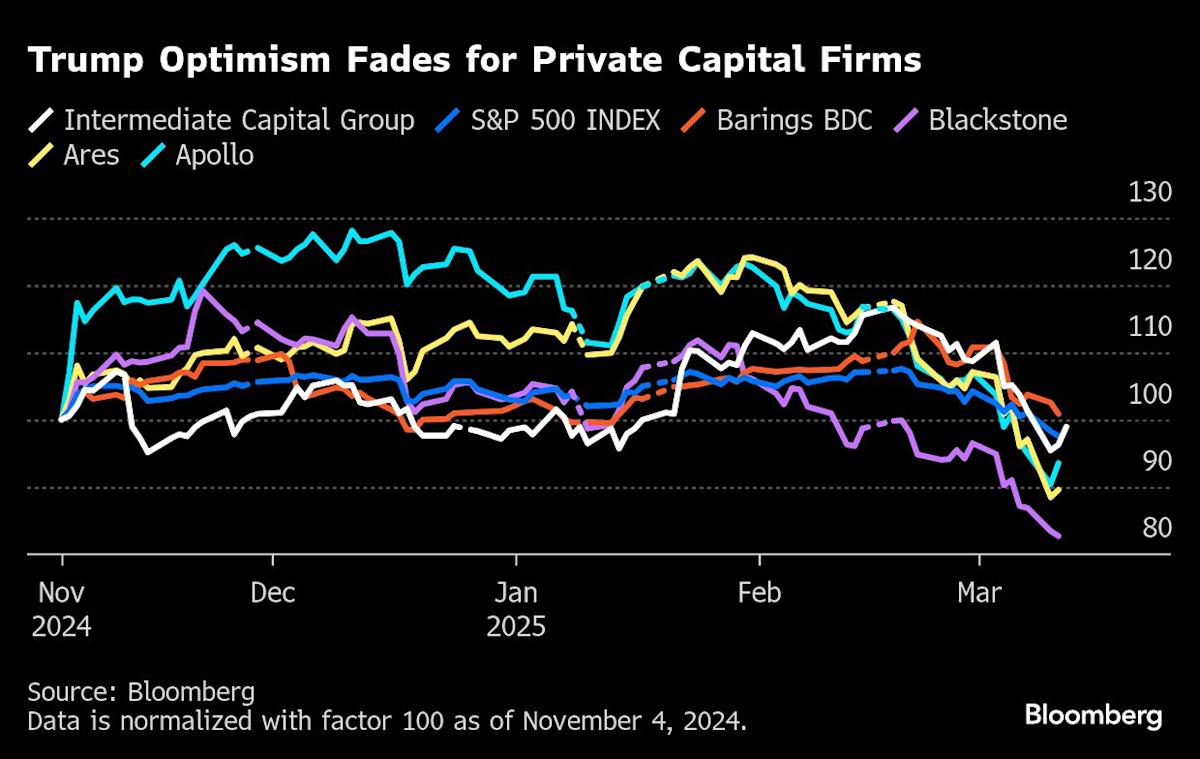

Hit private markets

The whip of the US economic policy makes it difficult for private capital companies to sell holdings, and many private loans have added more expensive debt to portfolio companies.

A number of participants in London, a number of participants, a number of participants, in private companies, companies and companies were aimed at the risk of direct creditors to direct creditors to the corporate loan.

“The private loan asset has received a lot of money on class,” said the management partner claire in the capital investing in special funds. “We haven’t had a long time for a long time. It can still be a lot of trouble.”

Levers Loans fall

Connections and purchases have a plus or productive credit market for releases for the past year, the probable investors canceled any transaction that came to the market, many of them were re-evaluated. Money managers become more voters, reducing aggressive prices and credits with low ratings with five deals taken from the syndicate in recent weeks.

Credit streams

Imagine, the flows usually come as they contribute to the density of the spread, supporting loan prices in recent months. However, according to the US LSEG Lipperi, these year saw the first influx this year, according to LSEG Lipper, investors made money from high fertility bonds for about two months. Of course, a blip can prove when investors entered a loan as a result of fixing the capital market.

Again, debt markets are “passive,” BC’s credit head in BC said Ted Goldthorpe. “It’s not good”, because when those foundations are very large, “the main oriented and foundation focused” is very streamed. “

Click here to listen to your loan edge podcast with BC partners Goldthorpe

In view of the week

-

Credit markets weakened this week as the growing shares of trade wars this week were sold. A number of companies have delayed the sale of bonds in the United States. Predictors from Barclays PLC Goldman Sachs Group Inc. were forced to review spread calculations in a broader way.

-

Global banks provide personal information of a new job accumulated in favor of the most active investors in a $ 56-billion market, which provides specific information to the best seller networks of a $ 56 billion market to gain corporate bond trade.

-

Investors have high coupons to earn a profit from odd time, the spreads of the odds on high-productive bonds are the most densely densely over the years and are less on the path of fresh debt. Money managers dubbed the tendency of “Tire” for garbage.

-

Rio Tinto PLC, $ 9 billion in investment bonds, the Arcadium Lithium PLC has only increased funds for the purchase of the PLC.

-

Elsewhere, Morgan Stanley sounded investors in the potential $ 4 billion in debt package for Finsta Group Holdings Ltd.

-

Ardagh Group is negotiating with creditors for a debt reconstructure agreement that will see that Irish billiarder Paul Coulson has lost control of Coulon’s packaging company.

-

A group of banks led by the UBS group, the energy beverage maker Celsius Holdings Inc. was launched a $ 1 billion debt package for Wednesday.

-

The broadcast service provider EW Scripps Company has signed a contract with lender to pay or extend $ 1.3 billion in loans, and provided $ 450 million loans from the KKR & Co.

-

The money managers who have purchased advanced bonds supported by US corporate loans should also notice how many more company companies are taken and the US residential debt market. Collateral loan liabilities began to look for an expensive relative to the mortgage liabilities in the ship that can close future earnings.

-

Deutsche Bank, according to German secondary companies, increases the size of an important risk transfer associated with the average portfolio of the German portfolio, to people with the issue of the highest investor’s asset class.

In the action

-

Bank of America Corp., the head of the US credit strategy, the head of the US credit strategy, helped to the newly established role after the course of a high-income credit strategist Oleg Melentyev.

-

JPMorgan Chase & Co., Wall Street’s largest lender is hired from Corp to Corp. Bank.

-

Canadian Emperor Trade Bank, Harry Culham, the chief executive Viktor Dodig, who will retire in November after giving more than the fifth big loan of the nation, was successful.

-

HSBC Holdings PLC has determined that Alex Paul’s internal combinations and purchase team. Paul will be located in Hong Kong and play a new role next month.

-

Deutsche Bank, Goldman Sachs’s market loan, Goldman Sachs’den Bond Trader James Wilkinson.

-

Millennium management struck one of the most profitable traders in the capital of Eisler.

-

Citigroup Inc. was helped in investor services until the CHRIGROUP Inc. for following a high rise in the work of the services after receiving a record income in 2024.

-

Banco Santander SA, Peter Huber, called the Spanish loan, called Armando Baquero as a new global insurance.

-

Goldman Sachs Group Inc. Hable Citigroup Inc, Veteran Tetsuya Oka to increase investment banking in Japan.

– With the help of Soni Basak, Kat Hidalgo and RAO RAO.

Most of the Bloomberg read from BusinessWeek

© 2025 Bloomberg LP