Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

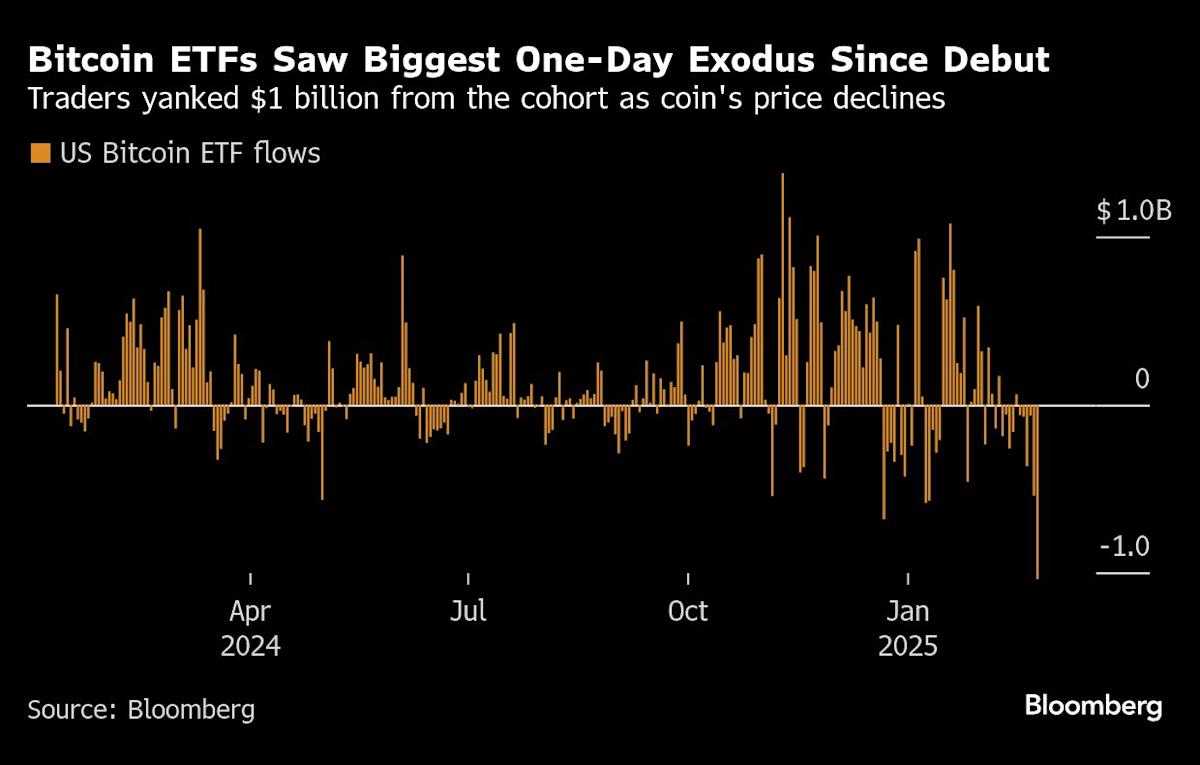

(Bloomberg) – Investors, in January last year, the Spot Bitcoin, which has a great day output since the Debate of Kohort, has more than $ 1 billion from Excho-Trade funds.

Most read from Bloomberg

According to the Bitcoin Foundation (Ticker FBTC), according to Bitcoin Bitcoin Trust ETF (Ibit), the escalation of the loyalty. This is reduced to Bitcoin’s price, as risky assets are shaved in front of the uncertainty of investors. As a group, Bitcoin funds extend a consecutive $ 2.1 billion in a row, 2.1 billion in a row, the longest extent since last June.

The world’s largest digital asset has always been in the lowest level since mid-November this week, since mid-November, this week is under pressure this week. Other crypters slide with an index tracking with an index tracking over the pace for the largest four-day fall since the beginning of August.

Although Bitcoin funds sees an exit, investors have benefited from a joint-stock sale to the combined exchange in a session in a session (QQQ) and SPDR S & P 500 ETF Trust (spy).

“Digital assets are still managed in the retail stream, despite its institutional flows over the past 12 months,” he said. “This separates them from capital and fixed income. I think it means that the average hand is less deprived or less deep pockets to take a loss. Thus, it is more likely to pain.”

Kendrick predicts that Bitcoin will trade around $ 80,000 – in which point will “take the wave.”

Matthew Sigel, the head of Vaneck’s digital-activated research, was probably called the popular trade strategy, the popular trade strategy, the main trade in prices between futures markets. Some use ETFs from the variability of cryptoids or used a short position in derivatives.

“This strategy also includes bitcoin futures to lock Bitcoin futures in a low risky turn (often through ETFs),” Sigel said. “However, gains from this trade recently collapsed and made it less attractive. As a result, hedging funds using ETFs, probably, causing significant refunds.”

[ad_2]

Source link