Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

Blackrock Chairman and CEO Larry Fink, ‘Claaman Countdown’ accepts tariff talks with variability of China and market.

US financial markets, President Donald Trump, one of the Covid-19 pandemics, said that President Donald Trump has played one of the most changing weeks to play with a retaliate plan.

When the dust is settled, all three earned earnings on Friday, added to the advanced week.

| Ticker | Safety | Last | Change | Change% |

|---|---|---|---|---|

| I: Dji | Dow Jones on average | 40212.71 | +619.05 |

+ 1.56% |

| SP500 | S & P 500 | 5363.36 | +95.31 |

+ 1.81% |

| I: Comp | Nasdaq composite index | 16724.455599 | +337.14 |

+ 2.06% |

Dow Jones Industrial Average Week 5%, S & P 500, about 6%, Nasdaq Composite won 7%.

Again, three large indices remain negative for years.

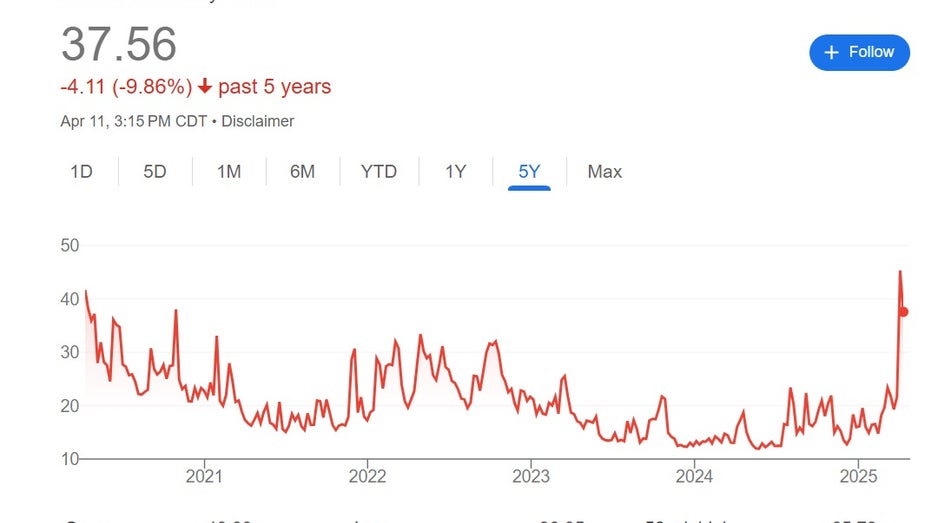

The last numbers did not come without nail bite. Chame’s variability index, known as the fear device of Wall Street, Dow, Dow hit a five-year height because of more than 2,000 points during several sessions.

CBOE’s variability index (Courtesy: Google)

Among those sellers, panic, experts say

This Dow won 2692 points on Wednesdaythe biggest daypoint of history. Today, the total trade volume is the highest since the highest 2019 dollar, at least since the highest 2019. This is the same day that stops my tariffs in a pivot in a surprise.

Dow Jones Industry Medium

.

Blackrock CEO Larry Fink On Friday, the market marked the strength of the market in the conference call with investors and said he was optimistic about the capital markets.

| Ticker | Safety | Last | Change | Change% |

|---|---|---|---|---|

| Black | Blackrock Inc. | 878.78 | +20.00 |

+ 2.33% |

“We do not see systemic risks without a pandemic,” Fink said. “The financial system shows safe and healthy and health. Markets trades more than any other time than any other time.

Uncertainty around tariffs is given by the investor’s solution, the White House insists on the US trade representative Jamieson Greer.

“He confirmed that more than 15 proposals were at the desktop on a day. As I said before, we heard from more than 75 countries around the world,” he said.

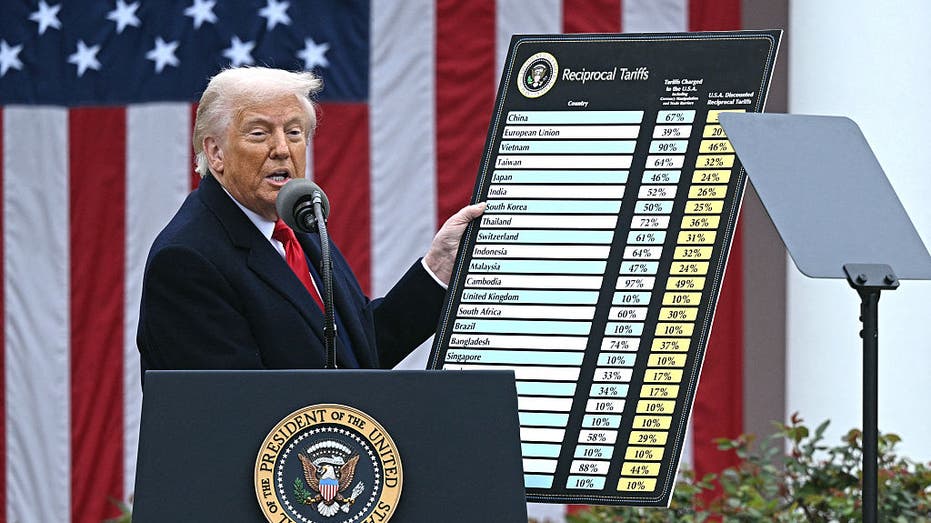

President Donald Trump warns a schedule on mutual tariffs during an event entitled “Call America again” in Washington on April 2, 2025. (Through Brendan Smialowski / AFP Getty Images))

Government bonds blink a further concerned signal as investors pulled money due to the concerns of a recession. When productivity increases, prices fall. Benchmark for debt costs such as 10 years of treasury, mortgage loans and individual loans, the highest of the highest in February is 4.5%. The weekly 50 plus the main point jump is more than 40 years.

Treasury Secretary Scott Bessent Wednesday was asked about this trend.

“A little, there are a few big, players who have to make the goal,” said Maria Bartiomo during an interview on “Maria in the morning in the mornings”. “I believe there is nothing systematic about it. I think it’s a worried but normal hole in the intestinal market.”

Large banks weighs Trump tariffs: ‘Significant tension’

Bessent was also asked about the USD and the Chinese.

“Indeed, you have weakened the currencies for everyone. And again, when I heard all these stories, if I want to use the dollar as a trade currency, it doesn’t look like a very good reserve asset for me,” Bessent said.

Euro and Japanese are up to 8% greenery.

A handful of wall firm, the street firm, increases the probability of the decline of the United States. Jpmorgan Chase CEO Jamie Dimon shared his mind this week.

| Ticker | Safety | Last | Change | Change% |

|---|---|---|---|---|

| Jpm | JPMORGAN CHASE & CO. | 236.13 | +9.39 |

+ 4.14% |

“I hear this now everyone. ‘I will cut a little, I will wait, I will see what will happen.’ This is a kind of recession, “Dimon said in an exclusive interview on Wednesday “Mornings with Maria.” When asked if he was waiting for a recession, Dimon replied: “I will delay my economists at the moment, but I probably think it is a probable result.”

The company, Goldman Sachs, now reduced 45% chance of one of America to 60%.

The University of Michigan expressed his surveys for consumers on Friday Consumer thinking The index fell from 57 to 57 this month, from 57 this month.

“This landing was a wet, income, education, geographical regional and political affiliation, consumer director Joanne HSU research and unanimously.

In April, consumer thinking was plunged. (Photographer: Patrick T. Fallon / Bloomberg, Getty Imager / Getty Images)

Evaluation fears, tariff uncertainty immerse to consumer sentiment

“The risk of sensitivity, individual finance, revenues, inflation and labor markets, many warning signs of this month,” Numerous symptoms of consumers, commercial war developments have lost more than 30% of December 25 December.

The consumer price index decreased by February 0.1% for March, but 2.4% each year, above the 2% mandate of the federal reserve.

When expenses are easier, the price of items such as eggs and unwidden soil beef remains at 60% and 10%, respectively.

The precious metal saw some variability this week, but an ounce of $ 3222.20 has always rose. Weekly earnings were the biggest since 2020. Prior to the increase in tariff wars, several strategically conveyed several strange views in a hedge of inflation hedge and traditional safety shelter in inflation.

Gold rose to an ounce of an ounce of $ 3222.20 this week. (Through Getty Images / Getty Images by Arne Daerert / DPA / AFP

Get the fox work on the way by clicking here

“Although traditionally inflated and realistic fictions are the main drivers of gold prices, the central bank purchase, behind the current gold price increase, it turned out to be the main catalyst,” he said. The team sees Gold reaches $ 3,500.

| Ticker | Safety | Last | Change | Change% |

|---|---|---|---|---|

| Gld | SPDR Gold Shares Trust – USD ACC | 297.93 | +5.62 |

+ 1.92% |

The largest cryptocurrency with the market value has risen on Friday, above $ 83,000. However, in December 2024, 21% of $ 106.734.51 have always fallen.

[ad_2]

Source link