Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

Listen and subscribe to boot suggestion Apple podcasts, Stain, YouTubeOr where you find your favorite podcasts.

Short-term nvidia (Nvda) Investors may have forgotten something in their race to empty the Foundation after savings this week: the long-term profit tails of the sovereign artificial intelligence.

“I think that you will hear a lot about the construction of these infrastructure,” A16Z Generator Partner and Mistral AI Board Member Anjney Midha Yahoo said in Finance Opening proposal Podcast (see the video above or listen below). “Sometimes these are indicators. This can be reported – it takes a while to understand that the enterprise budgets are changing after the state priorities.”

The establishment of the AI infrastructure by large countries is to take a large number of forms.

At the beginning of this month, the European Union signed a new European Fund for AI, 200 billion euros in 200 billion euros, including EU Gigafactories. Openai, Oracle (Orclc) and SoftBank (SFTBY) He said in late January, in the coming years, the AI infrastructure project called Stargate will invest $ 500 billion.

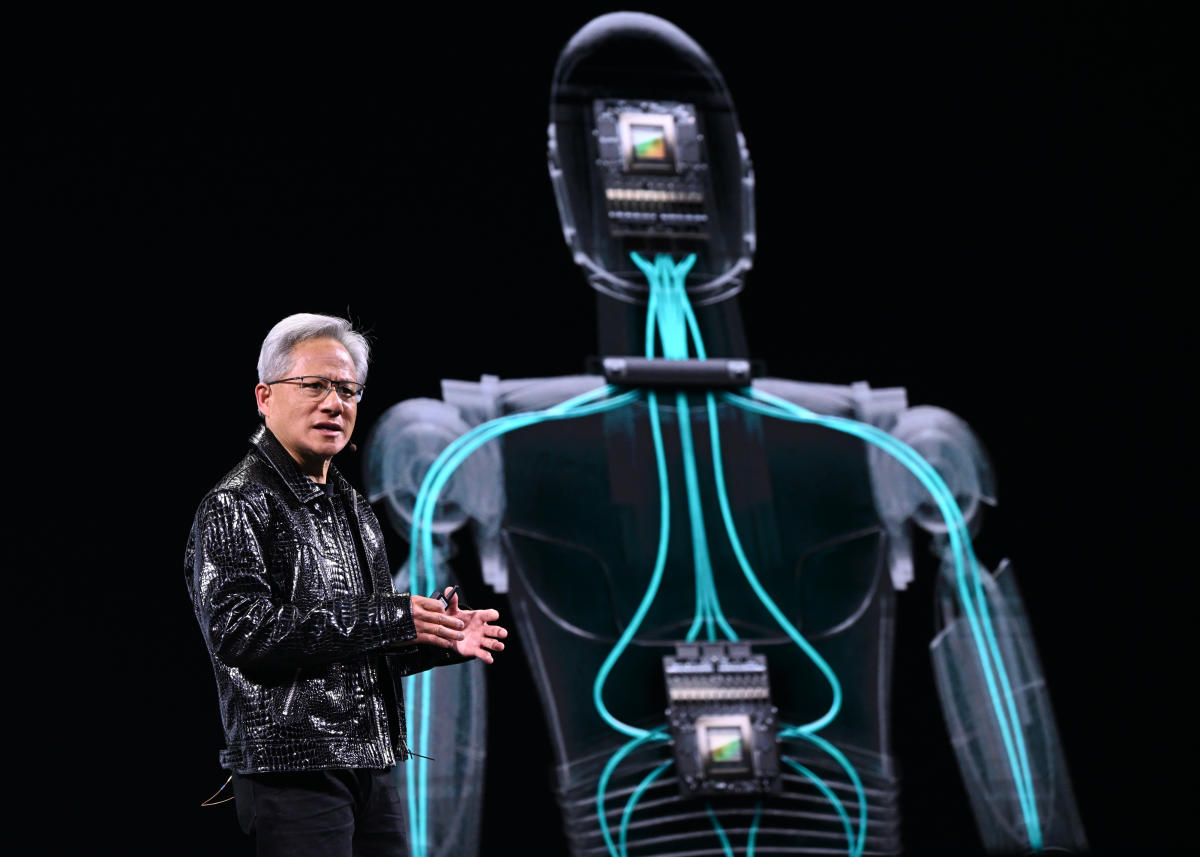

Experts say that the AI leader, which forms the foundation of buildings, will be exterior chips developed by NVIDIA.

Read more: How does Nvidia make money?

NVIDIA, Canada, Denmark and Indonesia have announced the development initiatives of the sovereign AI infrastructure managed by the AI chips.

“We think that the AI models are a critical national infrastructure,” said Midha. “We think this is a critical national infrastructure that turns the AI factories into intelligence. And I see the segment is accelerated.”

Sovereign AI represents a long-term opportunity for NVIDIA, can take part of a shareholder in the near future Mixed First Quarter Outlook shared this week.

Free release of earnings by Tuesday Nvidia said that 70.6% of the total profit limit of up to 71% In the first quarter that fights the new Blackwell chip ramp in the new quarter.

The margin of 71% is “a little worried”, Benchmark company managing director and chief research analyst Cody Acree Yahoo spoke about the domination of the financial market. “I think this is the indicator of more price pressures, more than AMD ()Very) And more sensitivity to its customers, as they spend their dollars to create their own ASICS (application specific integrated schemes). “

After the transition between earnings and losses on Thursday, NVIDIA Stock 8.48% was closed. The Foundation increased slightly in the preskard on Friday.

[ad_2]

Source link