Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

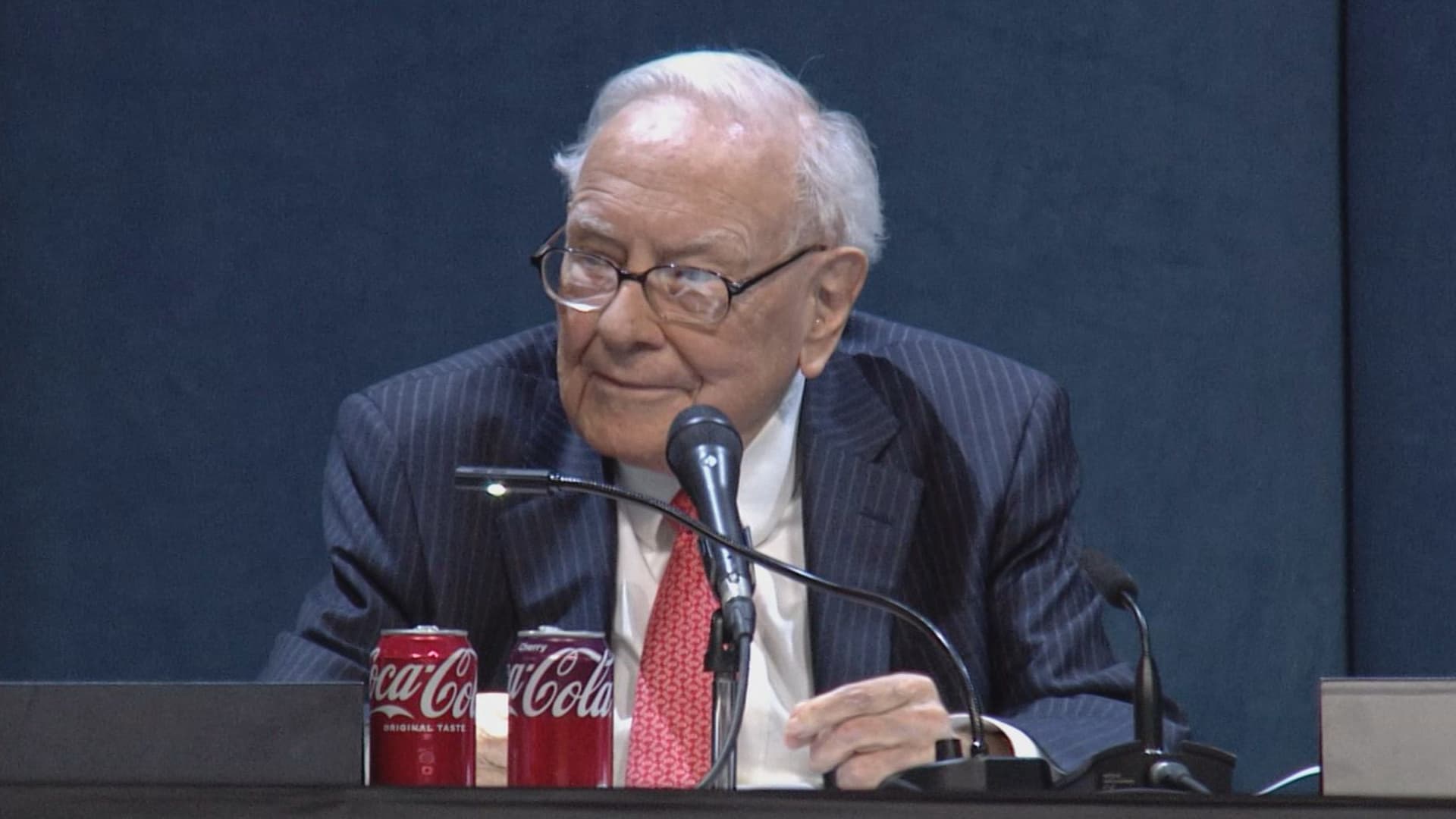

Omaha, Nebraska – Warren Buffett brushed the last stock exchange volatility that sounded investors over the past few weeks on Saturday.

“What happened in the last 30, 45 days … it’s really nothing” Berkshire Hathaway CEO said at the annual meeting of the conglomerat.

Buffett noted that in the last six decades, Berkshire Hathaway shares three times three times decreased. He noted that there is no fundamental issue with the company during these times.

He gave that the last movement of the United States should not be characterized as a “giant” action.

“It didn’t have a dramatic bear market or type,” Buffett said.

S & P 500, YTD

These statements of Omaha Olacle, President Donald Trump sees the Baku after the markets after the markets after the concerned about the controversial tariff policy of President Donald Trump.

This S & P 500 The laptal on Friday The longest winning strip Since 2004, Wall Street has been a loss of those on primary sales after Trump’s start policy. Marks a surprising rebound for US shares after benchmark index at a point bear market Last month is a term used to explain more than 20% enemies from the last high before entering the land, based on an intraday.

Buffett said other periods are more “sharply differently” than the current investor. Investors reported that the market should be ready for the day of the 94-year-old life and the preparation of problems.

Shared it Dow Jones Industry Medium On August 30, 1930, he sat in 240 and fell to 41.

“If your shares make a difference no matter if you make 15% or not, you should get some different investment philosophy,” Buffett said. “The world is not going to fit in you. You should adapt to the world.”

“People have emotions,” he said. “But when you invest, you should check them at the door.”

[ad_2]

Source link