Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

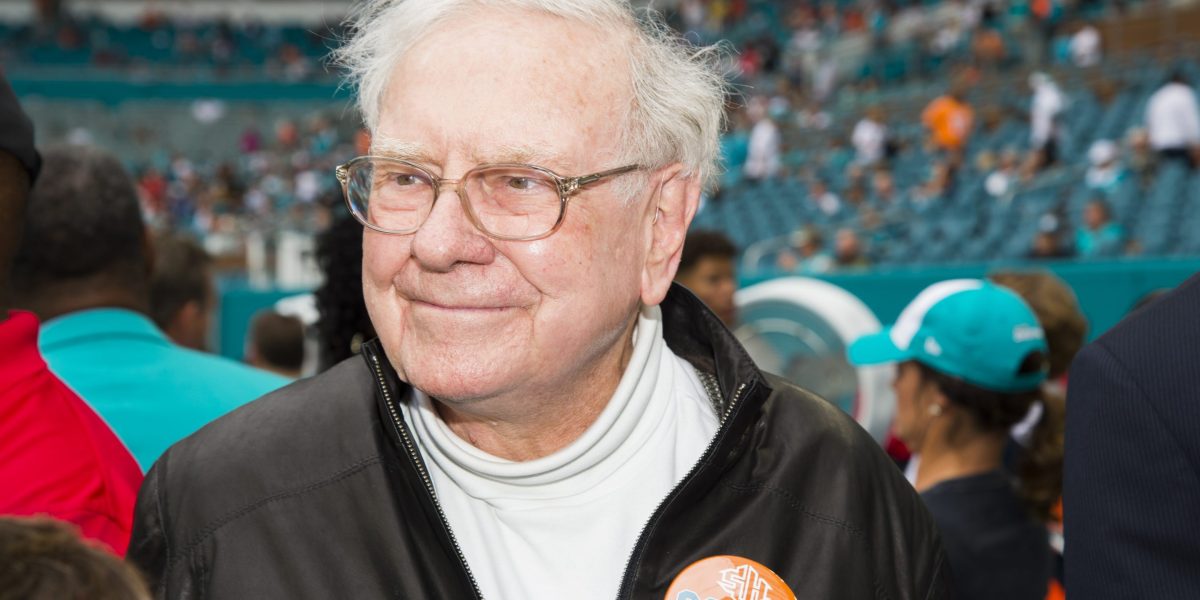

The best CEO, the legendary investor said he planned to step as the head of the Berkshire Hathaway by the end of the year.

Buffett, Berkshire Hathaway Energy said CEO Greg abel should seize General Conglomerat, as the head of the stunning shareholders at the annual conference.

“Omaha” Oracle “, pulled more than one number of tributaries JPMORGAN CHASE CEO Jamie Dimon.

“Warren Buffett represents everything that is good about American capitalism and America – everything that invests in the integrity of our nation and its work in general,” According to Reuters. “I learned a lot from him to this day and I am honored to call him a friend.”

Apple CEO Tim Cook also reacted to the announcement of the surprise. Berkshire began to receive the Apple Foundation in 2016 and added more shares.

Berkshire remains the largest position in the iPhone manufacturer’s portfolio, while selling more than half of the Holding in the Apple Foundation last year.

“It’s never like Warren, and myself, not in countless people, and I have inspired his wisdom.” X. “It was one of the great privileges of my life to know him. Warren’s Berkshire is not a question that Greg has left in big hands.”

Earlier, Buffeth, Buffeth, Buffett collected definition on the chef.

Not only Buffett surprise shareholders nor abel nor the board knew what members were announced. Buffett said that their children who serve as a director are in advance.

“He surprised me, but it amazes me,” said Ron Olsen, a member of the board CNBC. “Warren lived a life full of surprises, and very few decisions were something other than the sensation.”

CFRA analyst explained Cathy Seifert Associated Press Buffettin’s decision was probably very harsh, but it is better to leave their terms.

“I think it will be an effort to protect the environment” like an ordinary work “in Berkshire,” he said. “This is still being determined.”

Meanwhile, J Sterna & Co. J Stern & Co. Chief Investment Officer Christopher Rossbach, Rossbach, who has a perfectional shareholder, struggled with tears.

“It’s completely monumental,” he said Financial times. “Berkshire Hathaway is an incredible job and is an incredible achievement. It stands for everything that is best about capitalism and entrepreneurship.”

This story was first displayed Fortune.com