Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

Unlock Watch Bulletin Free from White House

Trump’s second term Washington, your guide for what tools for business and world

Republican congressmen when they are originally so-called “A great beautiful law action“Some US President Donald Trump advisers said that I said,” Three “plan or said.

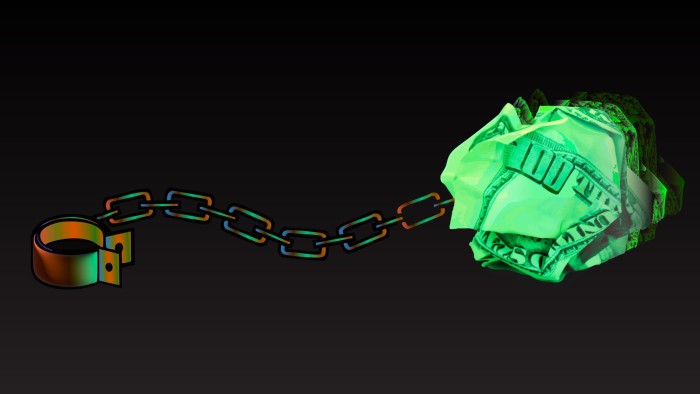

Future historians can make a good complaint with the lack of self-consciousness – and / or Trump’s awareness. “Threesome B”, after all this, is the tag of credit rating groups, the growing standard risk is a tag to determine the bottom limit of investment prices.

The “Triple B” campaign, which will borrow more than $ 3 billion in the next decade, especially the Dangerous Financial Infection, especially the Moody’s America’s AAA rating.

The issue is now the Congress budget department, which is currently in the next decade of 98% in the ratio of debt, 125 percent will increase. Nor does Moody’s predicts that last year will increase by 6.4 percent to 9 percent to 2035.

More anxiety is borrowed payments Had $ 880 billion last year, Foreign foreign items about Medicare and military. “Any great power to spend more debt services than defensive risks that consider a great power” Historian says Niall Ferguson.

The worst of $ 880 billion will be almost balloon. Most of the treasures were sold when prices are low. However, 10 and 30 years, now rose to 4.5 percent and 5 percent, 5 percent. If Scott Bessent, the Treasury Secretary, can cut the debt and / or less market prices.

Can you?

He insists that he could do the team for three reasons. First, they believe that America can leave the debt: Kevin Hassett, director of the National Economic Council of the White House, Projects Tax reduction and regulation will increase by 3 percent growth in the late this year “north”.

In addition, they think that the debt will be reduced due to the use of the policy they tell me, as tariffs Possible taxes in foreign capital receipts).

And finally, as this week, as high as the global confidence in the dollar assets, this week, Michael Faulkender, the global bond flow remains strong, is highly participated in the US Treasury market. “

Perhaps. Last week, the information provided by the data, the holdings of non-Americans, 12 percent in March 12 percent of the $ 9 percent recorded a record of $ 9 billion. However, this was before Trump’s tariff shock in early April, never thinking of this new bill.

And $ 16 billion auction for 20 years of bonds on Wednesday Attracted the harmful demandSome investors urge to worry about a feeling turn.

So far, this is still silent, 4.5% of the 10-year-old productivity is shocked harshly according to historical standards. If you participate in the market, there are at least five other subtle but disturbing developments.

One is that it has recently become economically disappears because it has recently weakened economic data. “It’s weird” says Robin Brooks BrookingsThis interpreting this as a sign that the growing rates cannot blame the growing expectations.

Second, inflation be adjustable bonds, even nominal productive, and inflation expectations were flat in the apartment, as well as noticeable expectations.

Third, the so-called premium of treasures – A theoretical calculation The presence of long-term debt risks – is constantly violated and much more In Europe. This “formation of the premium of financial risk”, is a sign of brooks. “

Fourth, foreign demand changes to the treasures. Chinese used to catch the largest stock. But in the last ten years, it has calmed down its purchases, so it will stand behind the Cayman Islands, Canada and Luxembourg. This emphasizes the increased impact of the potential flight Hedge funds.

The latter, the ratio of foreign proposals in the 30-year Auction (“indirect” buyers) recently slipped down 60 percent compared to Apollo’s Torsten Sløk notes. This also shows the concern of the growing global investor.

Allow, emphasize that these five turns are not definitely not separated from a complete exploded crisis; America is still protecting excessive privileges. And bessent There are several tools to deal with bond variabilityif they erupted. These include debts and regulatory reforms to operate as market manufacturers.

But the main point is: tectonic tiles in the markets, the financial consciousness varies as they exaggerate; Indeed, some investors have already wrapped 5 percent productivity for 10 years of productivity. Bessent soon encounters a new debt ceiling drama and sells more than $ 9 billion in the next year – Jitters may increase.

Trump’s “BBB” label around the huge bill may seem resolutely. The only silver lining in Sordid Saga is probably a rising bond product if something can curb Trump’s Wilder instincts. Here’s to hope.

[ad_2]

Source link