Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

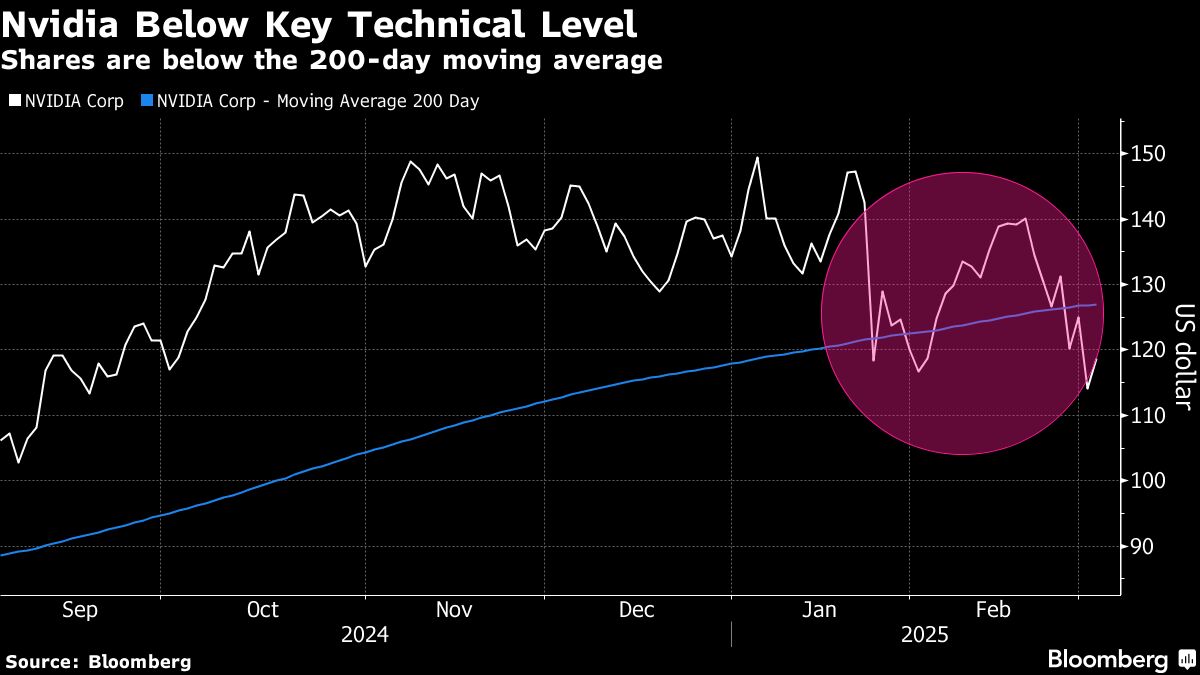

(Bloomberg) – Hammered Nvidia Corp. Shares have market technical staff who follow the basic speed indicator for the signs of more anxiety in last month.

Most read from Bloomberg

Chart watchers are based on a 200-day-moving average, for the first time in January two years, a long-term speed measure. When Nvidia rises modest on Tuesday, market experts are built on a moving average trajectory.

“This is definitely a change of character compared to the last two years,” said Todd SOHN, old and technical strategist in Strategist Securities LLC. “On the tactic basis, it is difficult to drown super drowning on a first name, and once it starts the slope of the slope.”

SOHN says $ 113 per share for NVIDIA, in early February, $ 113 per share. Rick bensignor, Bensignor investment strategies and the CEO of the former Morgan Stanley Strategy, has a similar field in the spotlight.

“I’m tending to think that it’s more to go to the negative” said Buzignor. “We could have supported from here to $ 110, but under this, my minimum negative goal is 107- $ 103.” Added that next support is about $ 90.

NVIDIA shares slipped between a little profit and loss in early trade on Wednesday.

Nvidia Downturn came inside the broader market uncertainty, the largest technology resources shaken the most. Recently, the magnificent seven-group technological megacapers fell to the recent area – more than 10% of the peak. Nasdaq 100 index flirts the same level.

Since Deepseek’s emergence, there are more than special fears that weighs in NVIDIA, there are more questions around the tariffs of President Donald Trump, and they will be exposed to China.

NVIDIA is responsible for more than 30% of the NASDAQ this year. Tesla Inc and Broadcom Inc, Slide are second and third largest contributors, and both are close to 200 days of moving average.

“It is possible that we see a long-term peak in stock. NVIDIA remains a way to play AI, and people continue to discuss AI,” he said, the main technical analyst in Kingsview partners. “The stock market looks tired on the long-term basis. The 200-day trend is a sign that is the weakening of the momentum and the turning of work.”

[ad_2]

Source link