Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

Be informed with free updates

Simply register China Business and Finance Myft Digest – Delivered directly to your box.

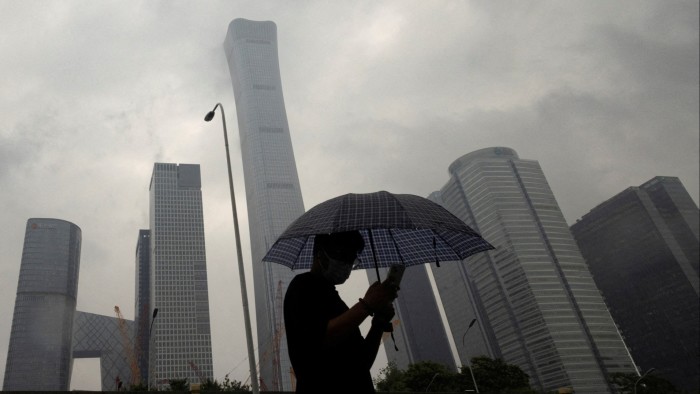

China accelerates the efforts to build a number of huge banks and brokers because it is forced to strengthen the financial sector and lower economic blows in better weather conditions.

In one of the 20 countries, the country’s village banks, according to the data, were closed its doors over the past year Chinese‘National Financial Regulatory Administration, after an annual property crisis, reconstruction of the banking sector.

In a separate information compiled by S & P global ratings, the compounds took place in Chinese securities companies, which managed more than five in five sector assets since 2023.

The consolidation campaign aims to produce several powerful, dynamic companies that can change the fragmented financial sector in China and compete with JPMorgan and Morgan Stanley’s Likes.

President Xi Jinping previously called on the regulators to “enhance the effectiveness of financial services for a real economy for the real economy.” Last month The Chinese Securities Regulatory Commission has repeated the need for “increase core competitiveness through the combination and purchase of top-tier investment banks.”

A system that is larger ATM And brokers will help to form a financial policy in the long run of economic transitions near China.

The pace of the merger, the pace of the merger reflects the worst risks from the financial system of the authorities and now reflect the fact that China can get in the form to support China’s growth.

“It is likely to be likely to be more than a few years than a few years,” he said. “The key only strengthens the ability to reduce the number of institutions and manages the risk.”

In recent years, Pekin, Evergrande and pushing, closed the bankruptcy village banks, closing the bankruptcy village banks, wanted to reduce the risk of an infinite financial system Local Governments for reconstruction of their debt.

As a result, “China’s financial system is already at the most stable point in the last decade,” said Richard Xu, financial analyst at Morgan Stanley. “The timing sector has the right to make it easier to make it easier and increase efficiency.”

In 2025, analysts are waiting for more consolidations between state brokers, trust companies and financial leasing groups, as analysts are trying to create lean and more competitive financial institutions.

After the increase in the last loan, the authorities are trying to re-change the economy. As part of this, they want to reduce the number of banks. China’s 3603 rural banks are about 95 percent of the country’s loans, but manages only 13.3 percent of total assets.

Brokers were also affected by sedimentation in Deal streams. “We can see more wide shakes, which are involved in more than one brokerage under the umbrella of the same state active managers,” he said.

Local property manager, the house of six state mediation Sasac, the regulators, the oldest investment banks, Guotai Junan and Haitong securities are pushing the remains between public ads and documents.

When Beijing changes its institutions for a more changing global economy, analysts also expect international lending to bank decisions such as international lending, reconstruction of debt Belt and the road Renminbi countries and use.

“In all these functions, the Chinese finance will switch swords with the financial institution of the United States and therefore meaningful, protection and rationalize to expand and rationalize China’s financial industry,” Magnus.

[ad_2]

Source link