(Bloomberg) – Asian capital, Wall Street traders fell after navigating falling shares between Whiplawing tariff headlines.

Most read from Bloomberg

In Australia and Japan, the shares, but also capital indices for Hong Kong, but more than 1%, although futures futures have capital indices. For Japanese criteria, drops were reflected in the sense of risk and a new Thursday rally.

S & P 500 sliding 1.8% and NASDAQ has sank 2.8% with technological heavy measurements on the threshold of a technical amendment. After the US futures, Broadcom Inc., Broadcom Inc. was partially retreated. Chipmaker convinced investors that spent their shares in the market market for an artificial intelligence calculation of about 15% higher in market trade.

The sign of fragile feelings during the regular trade period on Thursday, US shares could not overcome the road after a decision that postponed the Mexican and Canadian goods by President Donald Trump. Seesawing Outlook on tariffs, Sfarm Payrolls data before Friday was added to a low in Wall Street.

“Currently, the trade policy is dominated by market activities,” said Chris Larkin from Morgan Stanley E * Trade. “Tariff can go on a bumpy walk for traders and investors until cleansing of smoke.”

The post-hour rally was spread to technological companies between the hardest shot on Thursday. NVIDIA CORP. And Marvell Technology Inc., who is strange during the worldview during the main session.

Trump released Mexican and Canadian goods, which is covered by North American trade agreement, which is known as USMCA from 25% tariffs. The movement was the last series of stop-start movements on the handles focused on countries.

Later, in addition to the comments from the Treasury Secretary Scott Bessent, but the approved tariffs will come. Bessent rejected the idea that the tariffs will ignite the new wave of new inflation and have to see them to have a disposable effect.

Mityuria at the short end of the curve on Thursday, but changed a little bit. One index of the dollar fifth most long-lasting lane in almost a year. Mexican peso and Canadian dollars rose to the news that the potential tariff was violated. Australia and New Zealand crop dropped on Friday.

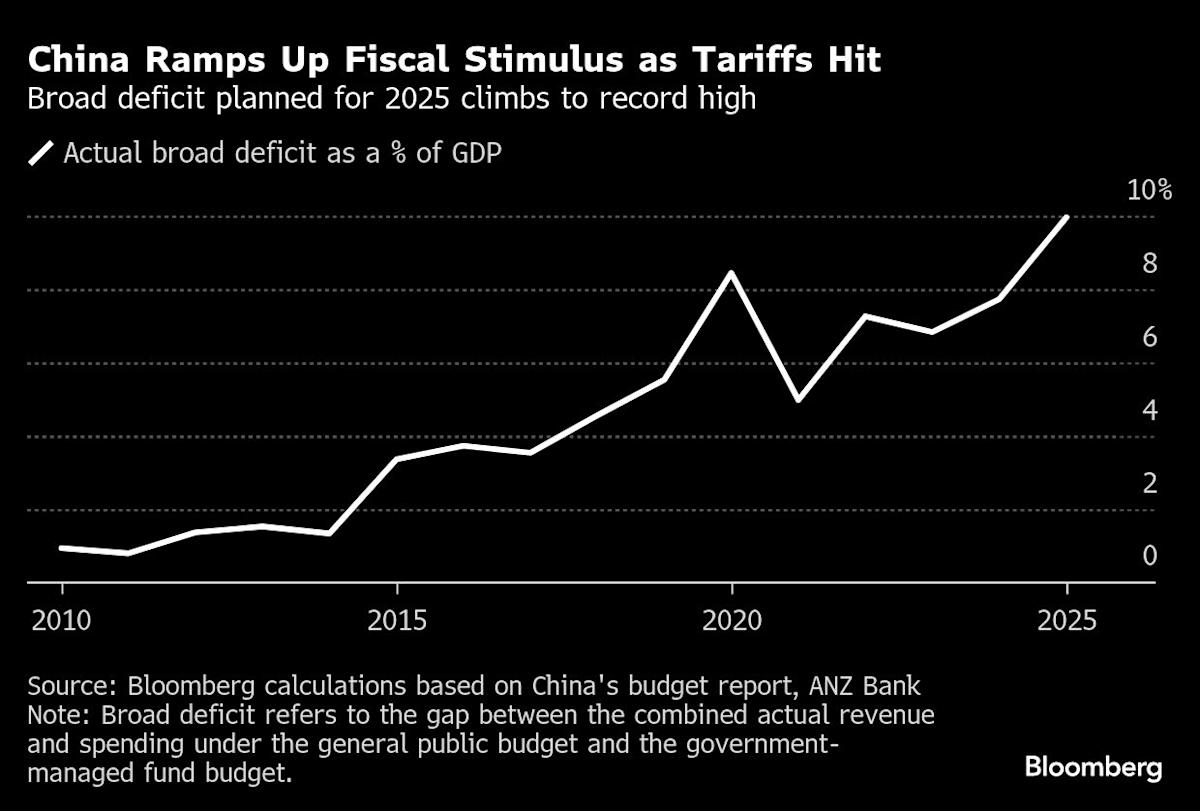

In Asia, China’s central government has extensive financial policy tools and space to meet possible domestic and external challenges, Chinese Finance Minister Lan Foan said in the framework of the annual legislative session on Thursday. People’s Bank of China, Governor Pan Gongsheng, Governor Pan Gongsheng, reduce interest rates and reduce the ratio of reserve requirements for lending and requires a reserve in “Appropriate time”.

In another place of the region, the data for broadcasting includes inflation for foreign resources for Thailand and Taiwan and Singapore.

The impact of the Non-Password near Friday, the impact of salary information, merchants, rocky geopolitics, the effects of tariffs are interested in global growth and inflation effects, can help traders move forward to interest rates.

The Labor Statistics Bureau will provide an update on the basic support for the Friday sheet, the main support for Fed officials, at least January-January – households and economics.

Fed Chair Jerome Powell was slotated to talk to a monetary policy forum on Friday afternoon. The politicians meet the next March 18-19 and are expected to be sustainable as they measure the labor market and inflation trends, but also measure the changes in the last government policy.

In the meantime, the fed reserve Governor Christofer Caller said he would not support the reduction of interest rates in March, but this year sees room to cut two or more twice.

“If the labor market seems to be caught, then there is a lot of inflation,” said Waller Thursday, if you think the CFO Network Summit “If you think the target is moving towards the target. I would not say at the next meeting, but of course I could go.”

In commodities, a profit on Thursday, a small number of parts from a barrel from a barrel with intermediate futures on Thursdays with a barrel with a haircut. Bitcoin traded over $ 90,000.

The main events this week:

-

Eurozone GDP, Friday

-

US Affairs Report, Friday

-

Fed President Jerome Powell gives a basic speech at an event hosted by Chicago Booth Business University

-

Fed’s John Williams, Michel Bowman and Adriana Kugler, Friday

Some basic movements in the markets:

Shares

-

S & P 500 futures increased by 9:03% 0.3%

-

ASIN Seng futures decreased by 1.3%

-

Japan’s topix fell 1.9%

-

Australia’s S & P / ASX fell 200 1.3%

-

Euro Stoxx 50 futures increased by 0.5%

Currencies

-

Bloomberg Dollar Spot Index has changed less

-

Euro has changed less than $ 1,0791

-

Japan has changed less than 147.96 per new dollar

-

Yuan in the sea changed at 7,2452 per dollar

Cryptovalas

Bonds

-

10-year-old treasury productivity did not change at 4.28%

-

Japan’s 10-year productivity did not change at 1.515%

-

Australia’s 10-year productivity rejected four main points to 4.44%

Commodity

This story was produced with the help of Bloomberg automation.

Most of the Bloomberg read from BusinessWeek

© 2025 Bloomberg LP