Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

The writer is a professor of economics at Harvard University and the author of ‘our dollar, our problems’

The US financial policy is running from the rails and seems to be less political to correct it until a large crisis has occurred on both sides.

2024 budget deficit was 6.4 percent of GDP; Reliable forecasts show that Donald’s Donald will pass 7 percent of GDM for the rest of Trump. And it is likely that there is no more black black black black black girl who caused the crater and balloon. With more than 120 percent of GDP, a kind of budget crisis is more than a budget crisis in the next five years.

It is true that we will not worry if they trust us to prioritize the bondholders to complete the bondholders in the markets, local and externally – in order to avoid partial stool through all and inflation.

Unfortunately, if the debt and inflation are in the long history of crisis, an extreme majority occurs in such situations. Typically, when the crisis is already very high, it is very high, a large shock holding politicians in the waist, is a catalysis of a large shock, and when the financial policy is infelated.

Undoubtedly, a great beautiful Bill Accor protects tax discounts from the first period of Trump that helps grow all the possibility. However, in the 1980s, Ronald Reygan shows that the evidence of several rounds of several vegs returned to Ronald. Indeed, in the 21st century, there was a major contribution to the constant flowing in debt. And Trump’s new tax laws have a raft with high degree of distorted supplements – no tax on tips, working hours or social security – it’s not useful. Not surprisingly, the Congress Budget Administration concluded that the bill will be added to $ 2.4 for debt for the next decade.

The real problem for politicians was a conditional condition that American voters never deal with victims. And why should they be?

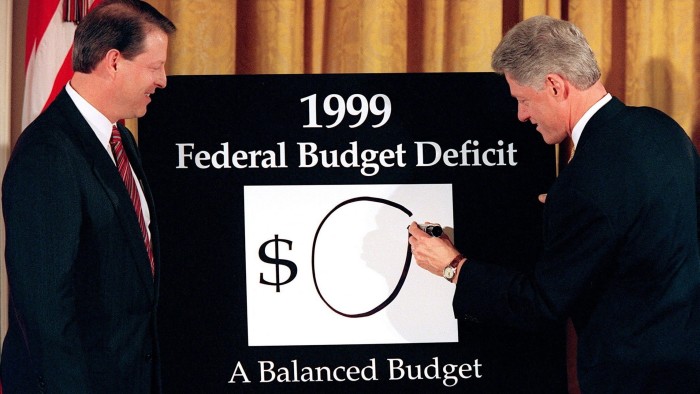

Bill Clinton last toured the budget for the fact that the Budget balancing the budget, both the Republican and democratic leaders visited themselves to avoid fruitless cuts. If there is a recession, a financial crisis or pandemic, voters are considered to get the best recovery that money can get. Who cares about 20-30 percent of GDP in debt?

What has changed, unfortunately, today long-term real interest rates are higher than in 2010. Inflation indexed between 2012 and 2021, an average of 10 years of US treasury bond products around Zero. Today, more than 2 percent, and interest payments are likely to be a larger force that increases the rate of US debt. Real percentage is more painful today than two decades, when the United States has a debt to GDP, it was now half.

Why are real rates rise? Of course, a reason is both the state and the global debt levels. This is just one part of the story, but not necessarily the most important part.

Other factors – geopolitical tensions, breakdown of global trade, military expenditures, potential energy needs of AI and populism – are all important. Yes, inequality and demographics, so it is still another path, so a number of prominent scientists still believe that a resistant turn to the ultra low real percentage rates will eventually save the day. But for the US or more, which aims to be a global hegemon, do you need to bet on the farm?

Indeed, although long-term interest rates have fallen, it is equally possible that the United States can rise by 10 years of the United States, as a result of 6 percent or more. Trump will increase in the desire to dream of a dream of the desire to dream of a desire to dream of a desire to dream of the desire to want less foreign money to the United States.

As I have argued, this will be aggravated The latest bookThe dominance of the US dollar is now dominated by China’s dollar, European reminders and crypticists as the majority global underground economy.

Trump’s tariff wars, tax threats, foreign investment and efforts to violate the rule of law will accelerate the process only. Indeed, if the US is able to close the current account deficit, the reduced flow of foreign capital will increase interest rates and growth will suffer.

Because the US debt trajectory is sustainable, it does not mean that it does not need to be done dramatically. After all, instead of allowing interest rates to continue to move, the government turns Japanese style financial repressions, thus slowing any crisis.

However, slow growth is unlikely that is a desirable result. Inflation is a higher scenario, which has given a way to the government (or heirs), which is a way to violate the independence of the federal reserve. The US High Debt and Inflive Political Balance will be the main booster of the next crisis, and most scenarios will be the influence of American economy and the dollar global status.

[ad_2]

Source link