(Bloomberg) – The financial markets are considered by investors on Monday with investors aimed at increasing the geopolitical tensions of Israel and Iran.

Most read from Bloomberg

On Sunday, Israel said new rocket attacks from Iran and said that strikes were made simultaneously, because the two countries are still in the most serious connection of long-term enemies.

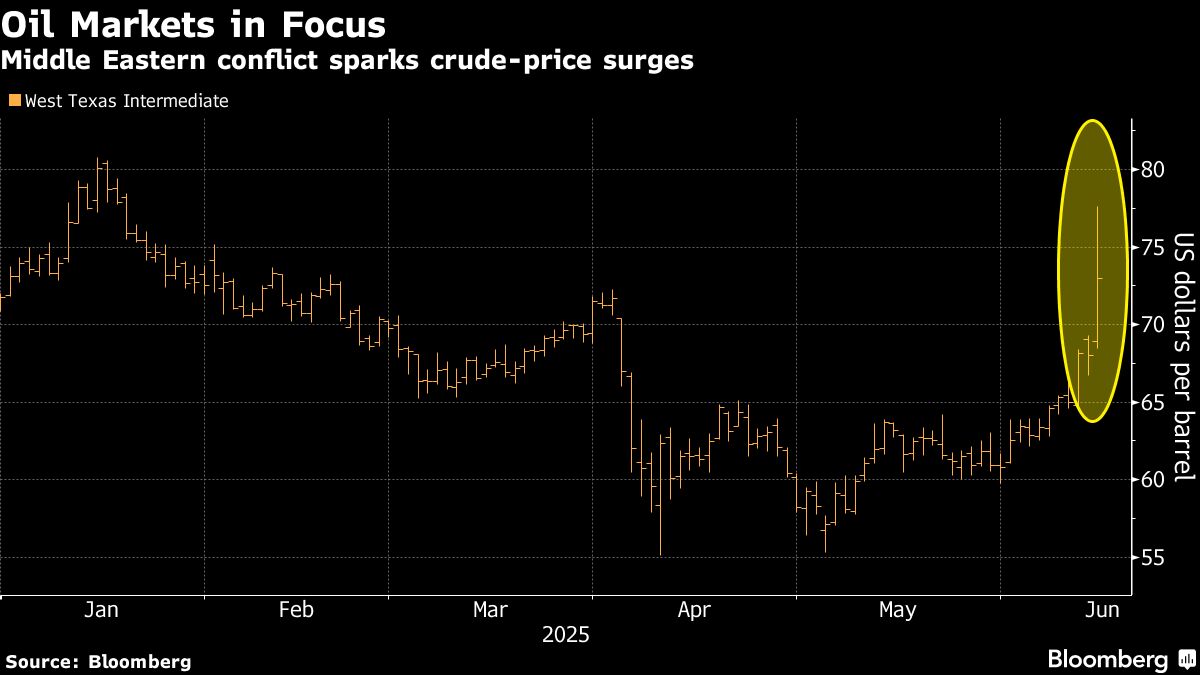

Until now, the largest market reaction has been in oil, raw prices may cause violation of conflicts with more than 7% of conflicts. Although fresh inflation treasures are violated, there is a traditional shelter like gold and dollars.

The US currency has been higher than the eve of the eve, which is confronted by his big peers in early Asian trade, but again. Norwegian Krone slipped after the greasy lifting last week.

Some investors expected to wait last week to wait for the tension to take into account similar stands among the two growing people. However, the extension of the conflict and the intensity of existing military operations is likely to overshadow risk assets on Monday. The MSCI World World World Correction has fell to Iran from Friday to Iran since April since April.

“This is a significant escalation of these nations to the point where the war in the war,” said Michael O’Rourke, the main market strategy in Jonestrading. “Competitions will be larger and longer”, especially after the last earnings, with weak capital markets.

Regional Risks

Most Middle Eastern Stock Indices in the region fell on Sunday. The main size of Egypt, the biggest loss was the biggest performer who saw the biggest losses in the production of Israeli gas production than a year. In Saudi Arabia, Tadawul Gauge’s ups were restricted by Aramco winning higher oil prices. Israel’s benchmark, military supplier Elbit Systems Ltd. As a higher level ended.

Traders, global trade relations, US President Donald Trump, economic cross-trump, economic cross-trumps, Russia and Ukraine, Russia and Ukraine, Russia and Ukraine, Russia and Ukraine are fresh geopolitical risks.

“If it does not go fat, it does not last higher, it is more likely to control the market,” said Dave Mazza, CEO Mazza, CEO, round investment. “It can give shopping, but it will be difficult to earn savings from here by collecting the last parts of the markets.”

Strategists and analysts’ comments on how to respond to investors will respond to Monday are as follows:

George Saravelos Global Head of FX Strategy in Deutsche Bank AG

Iran can rise above a barrel in a fully violation scenario in connection with the closure of oil supply and Hormuz. Under the more restricted scenario, the oil price of oil prices, which is more restricted to the reduction of Iranian exports without a more violation, will be limited to this scenario of the scenario that is currently evaluated by the market.

Wolf Von Rotberg, Bank J. Safra Sarasin capital strategy

Markets must be ready for a long period of uncertainty. The conflict will most likely last more days. The risks are bulging on the negative. In addition to exposure to the energy market, potential oil supply is the best ways to add a portfolio in the Middle East, which can be accelerated by chain chain disorders and its structure growth.

Hasnain Council, Strategist

Oil price spike reflects the risk of Iran’s exports to leave offline, but 20% of global oil fell into a serious violation of the Strait of Hormuz. Eastern European markets show an example of how the regional markets will be restored when there are indicators of conflict Spillover.

Martin Bercetche, Frontier Road Ltd.

Sustainability is here to stay here and the markets have not yet been corrected for geopolitical question marks. This weekend became a escalation, so the markets must react negatively, but I know enough to know that uncertainty will continue and I guess the markets.

Alexandre Hazez, General Investment Officer in the Group of Richelieu

Oil prices decreased in several months and reducing the prices of central banks, can now be a very disruptive factor for the economy and have a previously excluded scenario. How will central banks react in the situation of the oil crisis? There is an open risk for both inflation and growth. The only protective assets remain fat and gold. The dollar is expected to strengthen.

Gilles Guibout, head of European capital in AXA IM

This is probably a catalyst that will probably earn more earnings in stocks. Capital markets have lately, especially in the United States, especially in the United States, a high-assessment, weakening economy and a share per share to grow sharply. There is really nothing in terms of tail for the market. In terms of sectors, oil qualifications will likely be in severe demand because it was obtained under the sector. The spike in the oil price is changing the direction of travel.

Christopher Dembik, Great Investment Advisor in Pictet Asset Management

Since Wednesday, hedge funds and traders got the cover by receiving Vix calls. Most likely, these positions will be strengthened and tactically can be added to gold and especially in defense shares. As for the oil, the rest of the market since the end of May was the net buyers. There is no reason to cancel these positions. It is different for institutional investors. Many simply have added hedges, but they know that they have little changes to their separations, because this type of geopolitical phrase knows that the incident has little effect on its portfolios.

Cross-Asset Sales Trader in Anthony Benichou, Liquidnet Alpha

In connection with oil, Saudi has enough reserve power to keep everything under control, and Iran does not have very good choices. If we hit our assets, they risk drawing us direct conflict. Unless the United States participates, the real fat shock does not come. Iran’s Tabriz processing plant also appears on the holiday and the supply. OPEC can easily correct for any small loss, as they do during Russian-Ukrainian breaks.

Andrea Tueni, Saxo Banque is the head of sales trade in France

Seriously this conflict is not a game modifier for shares. It is localized and its true main effect is in fat. I do not think that Iranians will surround the Strait of Hormuz, but, of course, will change the size of the conflict. The same thing is the same if the United States is directly involved, but this is not possible. It is said that it is open, openly tomorrow.

Arthur Jurus, Head of the Swiss Investment Department Oddo BHF

The long-term increase in oil prices, central banks can suspend or increase the current disinfational trend, which will force the current levels for a longer period. The main uncertainty is evolved between the US dollar evolution, a potential oil shock and the US government’s continued monetary regulation. Global economic growth can be revised again. In such an environment, high quality capital, strong cash flows, low debt and positive earnings, most likely outperform.

Rafael Thuin, Head of Capital Market Strategies in Tikehau Capital

Currently there is a limited geopolitical risk award along the capital markets, but we can imagine it will start at a price. At the same time, there is a change in a controversial regime as it is concerned with safe weather. The dollar does not act as typical hedges used by such events and treasures. Now the gold or silver or silver or different types of silver playing this role.

Dennis Debusschere, founder of 22V research

Excessive, really hard for the risk of war or geopolitical. Is there a little lighting in the NVIDIA before the nuclear measure? Put a little risk reward in the world catastrophe? No. There is a meaning to have tail hedges against such a conclusion.

A continuous sale, air strikes, etc. in the markets based on war. This is the main factor. Thus, inflation spit is expected to be temporary and our stocks have no obvious minus point of station, get a dips related to war, it was profitable.

Doug Ramsey, Chief Investment Officer in Leuthold Group

Of course, I could not see the wave like the opportunity to zero. The confidence of the consumer and CEO is already very low and the conflict can hit another note.

Steve Sosnick, head strategy in interactive brokers

Short-term, as this situation develops, the weekend and the following days can be said that more title risks for US shares. It has all the way it can go south. Given the positive moment and mood among traders, this only guarantees only humility. I prefer to look at the goods and bonds when you enter the geopolitical game. They draw less attention by narratives. Oil traders say they did not think of us. Perhaps not panic, but not open.

Vincent Juvyns, General Investment Strategy in ing

I’m not waiting for the seller. Maybe the market will be a little heated, but I do not expect a route. Although we are neutral in the active class, we do not think we need to reduce our capital. Currently, the scenario of our base work is the conversion of the conflict into a large regional crisis.

Ben emons, Fedwatch consultants founder

Financial conditions will be more higher than oil prices, increased productivity and low capital. Thus, what happened on Friday is likely to be a continuation. The key is where the oil goes from here. Bonds do not offer a safe shelter because higher oil prices will change the inflation form.

Strategy in Michael Brown, Pepperstone Group

This is a historical medium and more long-lasting game change, but if history is a guide, the markets also tend to be very fast to risk geopolitical, but fear continues rapidly. Gold and raw likely are short-term great winners. I waited for an opposite of any gross that needed another increase in Iran’s crude infrastructure.

Marco Papica, head strategy in BCA research

Investors should be flexible. In the very close period, the markets will use this conflict to sell a bumper product after May. However, this is a lot of risk of purchase. In particular, the inflation effect of higher oil prices will not affect both temporary and monetary policy. No central bank goes to an increase in Israel and Iran.

Art Hogan, B. Riley Head Market Strategy in Wealth Management

As a current, one of the most difficult parts that will react to geopolitical events and how to react to our last past, it is very difficult to model the economic value. Although we are still in the escalation stage of this current attack on Iran, we will be difficult to gain confidence in the markets until we have seen this current attack ramp.

– Elena Popina, Yigin Shen, Ye Xie and Vildana Nagrik to help.

(Updates with early currency actions)

Most of the Bloomberg read from BusinessWeek

© 2025 Bloomberg LP