Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

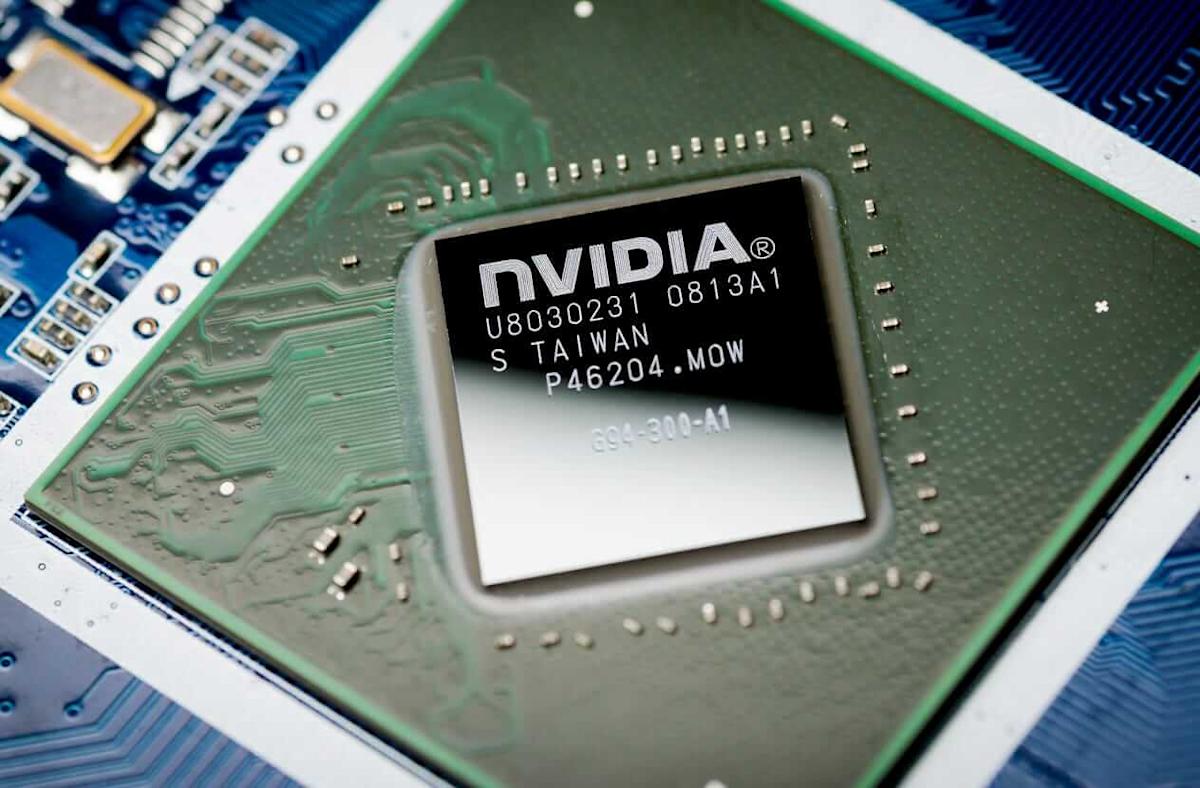

Despite the latest market variability and geopolitical concerns, Bernstein analysts protect the sore throat on NVIDA (NVDA), claiming that the NVDA and the AI revolution in NVDA is still in the early stages of the NVDA.

According to Bernstein, Nvidia begins a new product period with the groundbreaking Blackwell GPU, who lives in unprecedented demand. Investment firm there is a target price on the price of $ 185 for NVDA Stock, $ 145.

The Blackwell Chips of NVIDIA is sold for next year, which requires supply requirements, in 2025, this dense supply environment supports price and growth for future quarters.

The technological leadership of the chip producer, Microsoft (MSFT), Google (Google), meta (meta) and TESLA (TSLA), allowed to manage more than 90% of critical machines.

NVIDIA, a global labor deficiency crisis, with 50 million filled positions on production and logistics sectories. By a hexagonal strategic partnership, NVIDIA allows the development of AEON, a developed humanoid robot developed for industrial applications.

AEON uses NVIDIA’s robotics ecosystem. AI SuperComputers provides a simulation environment for train fund models, Omhniverse platform testing and optimization.

Finally, robot computers perform models in real world applications. This integrated approach accelerates the development time by adopting Core locomotive skills in a few weeks.

Humanoid robot solves the needs of the critical industry, including reality seizures, manipulation tasks, part inspection and complex industrial operations.

And most importantly, the innovative work in the NVIDIA’s Humanoid Robotics of NVIDIA is just a small part of the past. In addition, investors offer information centers, high performance calculation, sovereign AI, autonomous vehicles, games and more.

After a retreat in 2025, NVIDIA assessment was reconstructed in length in length than forecasted income. Today, the Tech Fund receives a 5-year average of 49.2x averaged 33.6x forward.

[ad_2]

Source link