Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

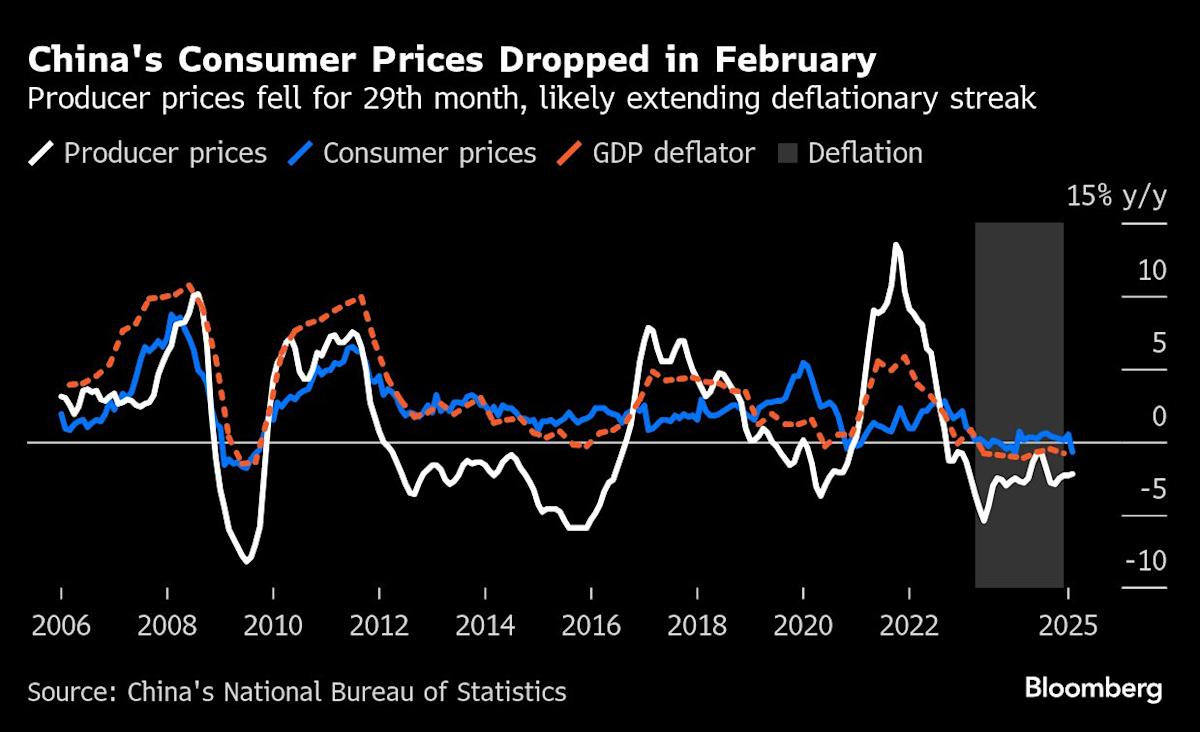

(Bloomberg) – Shares in Asia, Monday, Monday, Monday, China deflation and the Federal Reserve Department of Jerome Powell for acknowledging the uncertainty in the US economic outlook

Most read from Bloomberg

Australian shares have changed less, capital index futures for Japan developed the lowest cases for Hong Kong. S & P 500 and Tech-Heart Nasdaq, the renewed Tech-Heavy Nasdaq’ın fell. After writing the seventh week of the seventh week of Monday, he fell on Monday and extended Bitcoin drops. The bonds fell and slipped for the worst week of the worst week since 2022.

For the combination of countless headlines, a roller-coastal ship for markets around the economy, tariffs and geopolitical developments. In this regard, it is a level that measures the expectations for the S & P 500 swings last week – last week, the size of the last week is rarely done in 2020-2022.

Powell admitted the unknown combination of uncertainty for the US economic outlook on Friday, the authorities said there was no need to reduce interest rates. In addition, he expects 2% to continue inflation and proposed that the price increase from tariffs could be temporary.

“Powell was pleased to have a slightly rejection of progress and inflation expectations in inflation,” said, “the founder of his life has a positive impact on markets.”

The treasury product came on Friday and the dollar was back after his comments, because after opening the market expectations, the Central Bank may restore interest rates as soon as possible. The bonds were caught between the signs of the US economic growth in the last month and the signs of glue inflation.

The United States’s work growth has been suspended when the United States has increased when the unemployment rate increases – a mixed image of the labor market. In February, the postponed salaries in February increased by 151,000. Unemployment rose up to 4.1%.

“Friday work was weaker than expected, because this report does not take into account the interruption of the latest government work from the DOG,” the head investigator of the Wealth. He added that the report “proposed to take a break to hire workers until the tariff policy and economic outlook are more confident.”

[ad_2]

Source link