Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

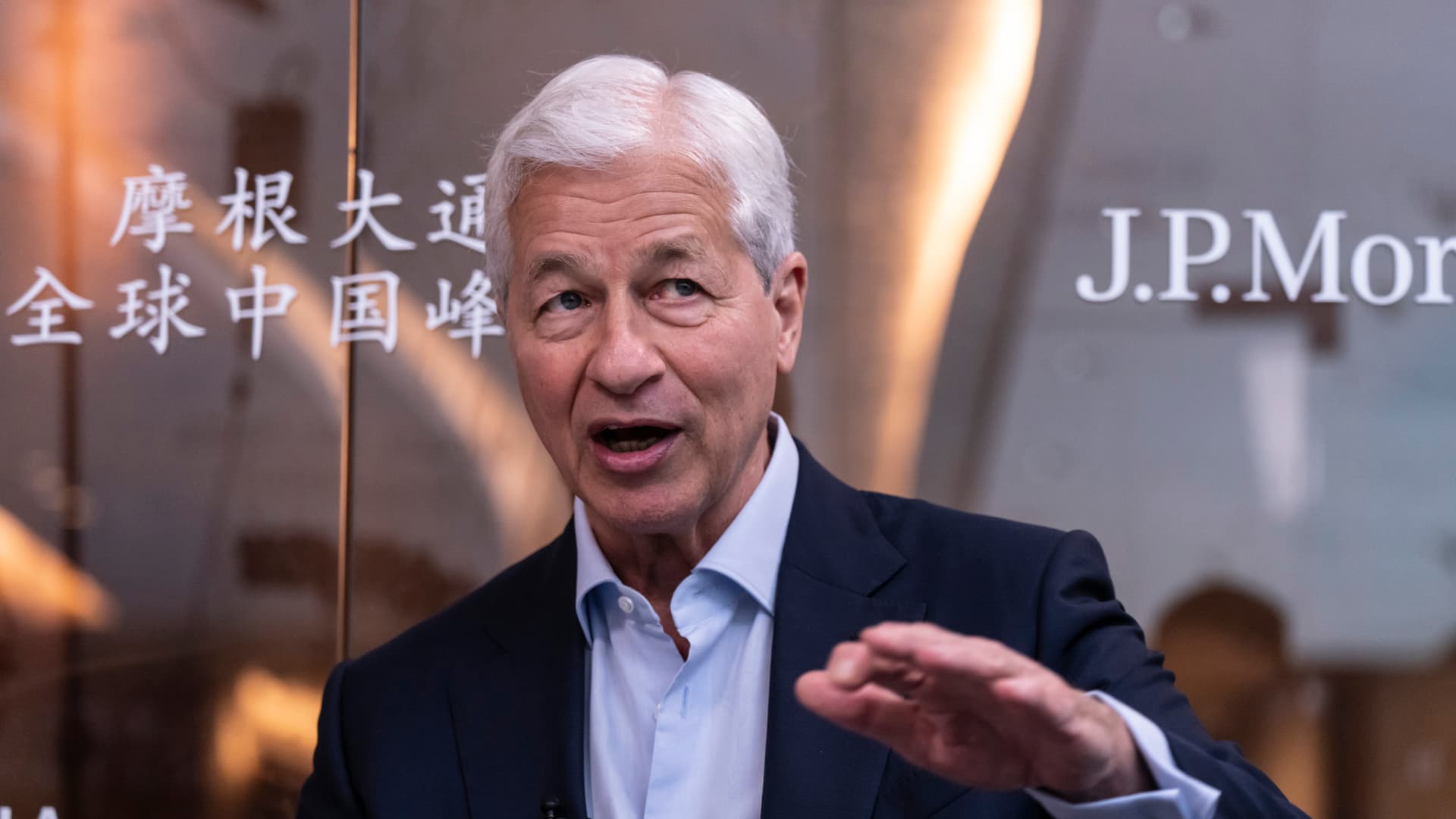

Jamie Dimon, JAMIE Dimon, JPMorgan Chase & Co., Bloomberg Television, China, China, 22 May 2025 during a Bloomberg television interview in the JPMorgan Chinese summit in Shanghai.

Qilai Shen | Bloomberg | Getty pictures

A laggard in an online investment game, JPMORGAN CHASE Now he believes that this is a leader.

On Friday, the Bank has opened new tools that allow investors to open and report new vehicles and reporting the deposit bonds and broker broker certificates to investors.

Users can set up specific screens and connect on the same bank app or on the same bank app or on the web portal, for JPMorgan leaders to check account balances. The actions are part of the bank’s credentials between investors who trade several times a month.

“Our goal was to create a pretty simple experience for customers who want to get fixed income,” he said Paul VienickJPMorgan’s Wealth Management Arm online investment head. “We transferred this exact thinking process (purchase) and ETFs to the simplicity and stable income space.”

JPMorgan, the largest US Bank in the United States Bank, is relatively punishment compared to other online brokers. Despite the fact that in recent years, the bank, including the ability to buy fraction shares, only $ 100 billion in management passed.

Including those compared to online investment giants Charles SchwabLoyalty or e-commerce of decades to collect investors and get competitive platforms.

The bank attempted to pronounce the trillions of the trillions of their self-governed investors first Free trading service In 2018. JPMorgan called it a “investment” and sold its new name in a lifestyle that includes open-prominent placement in tennis.

However, by 2021, JPMorgan saw that the brand hoped and just noticed to call himself on a self-directed investment platform.

That year, the employment in the work, about $ 55 billion in the assets of CEO Jamie Dimon called the company’s product in her the usual sharp road.

“We don’t think it’s a very good product yet” Dimon tell Analysts at the Financial Conference. “So we manage those things.”

Some of Jpmorgan’s Pivot was to hire the TD Ameritrade veteran, Vienick Morgan Stanley and Bank of AmericaIn October 2021, the bank’s efforts to overhaul.

“There was a recognition in wealth management, we hold a number to do something common,” said Vienick, the bank’s Midtown New York headquarters said in the last interview.

This includes more money management Wealthy Americans A push that JPMorgan has helped through financial advisors in physical places 2023 The acquisition of the first republic. JpMorgan Banks have half of the country’s 19 million rich house, but there is a 10% share of investment dollars.

Now, although the industry provides more services, which provides more services, which provides more services, it recognizes good online tools.

About half of those who use a financial advisor invested in themselves by online means.

Now the bank is more engaged in the investors, which tends to receive more bonds than having shares several times a month and several times and to receive more bonds than having them through mutual funds.

Currently, customers offers up to $ 700 to transfer funds to a self-directed platform.

Vienick said that the next, bank users are working to ensure the ability to perform post-work shareholders.

JPMorgan is a bank with a bank to convince the bank’s customers to strengthen more wallets with the bank or to strengthen their credit cards with the firm. Therefore, it will allow an investor to have a single view and transfer money immediately between the accounts.

The Bank’s Advantages – Ensure that Vienick is confident in a wide branch network, deep balance sheet and dimon – JPMorgan will end the other great players in the end online brokers.

“I have every belief, there may be a business trillion dollar work outside the management of basic resources,” he said. “It will take a hard time. This will mean that the customers will convey what they want.”

[ad_2]

Source link