Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

Albert Edwards warns analytical optimism for US technological resources.

Historically, analyst, analytical optimism caused the performance of the exchange market.

Tech-stock capitalization said that the market-sensitive dot-com bubble level said.

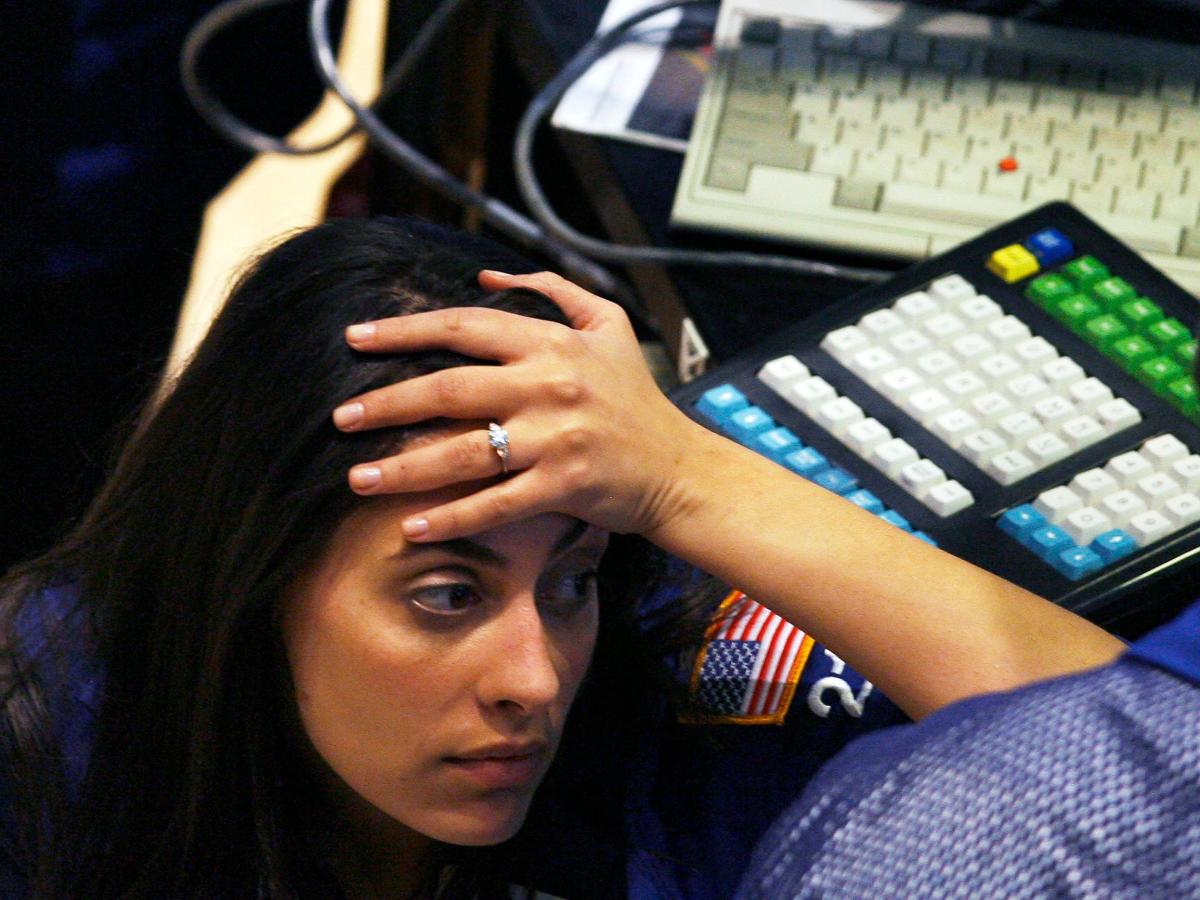

Societe Generale Strategist Albert Edwards has been skeptical AI reserves in the United States can live up to the hype their surroundings. Now, the exchange analysts covering the technological sector begin to grow suspicious.

On Thursday, he often testified in a customer note, he probably published a number of graphs that investors are always involved in the heights. Analytical optimism provides a source of optimism supporting technological shares that support the market’s effective rally – “Serious risk” shares, he said.

Here are some of them. The first is a 12-month moving average percentage of analysts that earn a profit for sharing. Since 2024, about 58% fell from about 50%, but the NASDAQ continued to increase. Historically, such landings in optimism coincided with a dipping of the NASDAQ’s 200-day moving average.

“If there is a fast decline in analytical optimism for Nasdaq, the tide is coming out,” he said. “Indeed, the index is still a small miracle of macros that he trades on 200 blue.

Analysts have a connection between an interior because they earn the expectations and reality of reality. Now, expectations began to start turning to the south and fall for a short time.

Reviews for S & P Composite 1500, the first time since the ribound managed by Chatgept, began to land down.

“This is the schedule that investors need to be really nervous,” Edward said. “Blips’ blips played around the announcement circles, despite the ‘blips’, analytical optimism for the S & P 500 has been a number of sub and downside. Both 6, 12 months of actions turn down to the average.”

Again, Edwards, the problem of the problem of expectations, the excess of the worldview of investors and this extreme is the negatively falling.

“In ordinary times, it would not be a serious threat to capital investors, but the nose is a potentially large risk when we are bloody high values and optimism.”

Behold, let’s take a look at the technical sector and how pretty the US shares are. Tech shares now form a higher interest rate at Dot-COM Bubble – which is popular to call Edward – and the US shares make up 75% of the global market cover.

[ad_2]

Source link