Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

As President Donald Trump attended the trade policy Stock riotsDon’t fall from the word “Salvation Day“Tariffs have yet hit the quarterly financial statements of the country’s largest loaners in which consumer spending samples often emerge

Earning reports for credit card companies have remained strong as consumers borrowed, spent and credit cards have been opened for more than year.

“Consumer continues to be sustainable and sensitive,” said Citigroup’s Chief Financial Worker Mark Mason is the company Call for quarterly earnings last week. Mason also stressed the revised consumer feeling.

“We have seen a change in the basics and travel and fun,” Mason said.

JPMORGAN CHASE Credit and Debit-card is a 7% increase since the price, but people have carried the rising credit card balances. In addition, Bank of America In the previous quarter, the loan owners were recorded in a year with a decrease of late payments and spending a year before the expenditure of credit and debit card.

Despite positive growth, major credit card companies are preparing for the economic crisis and violations, and the highest levels increase in five years.

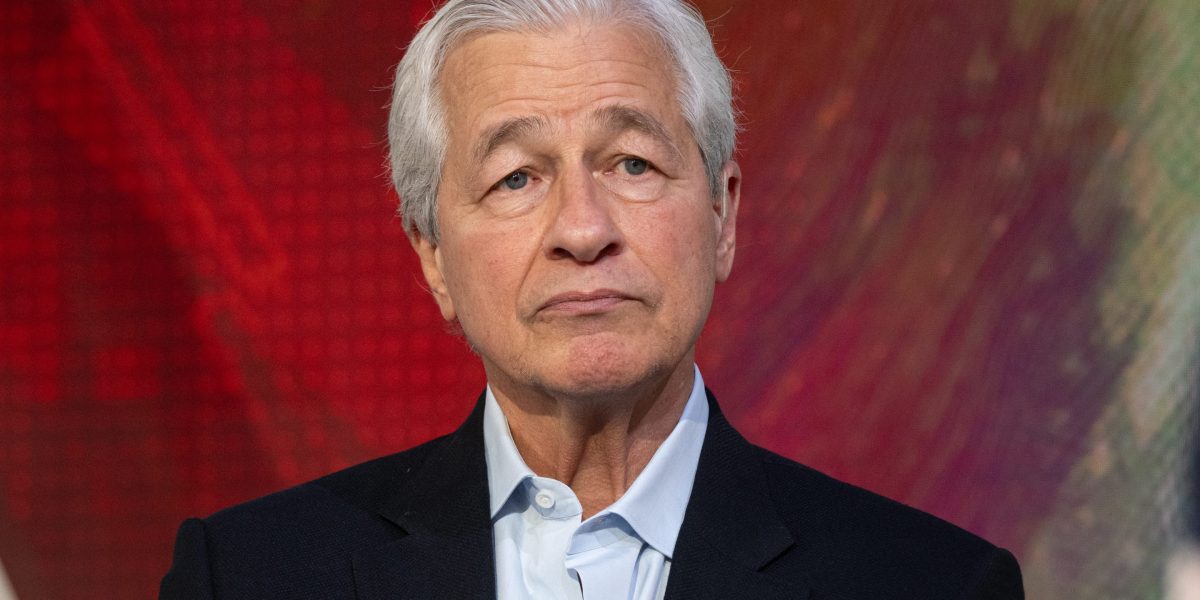

“Currently, the focus is effectively unusually abnormally unusually unusually abnormally unusually unusually unusually unusually unusual,” JPMorgan Chase Finance Head Jeremy Barnum, in the last period of the bank the call of earnings On April 11th.

JPMorgan added a risks of a recession in 60% Rainy day funds Credit losses (ACL) increased by $ 973 million to $ 27.6 billion, to pay these losses to $ 27.6 billion, to pay these losses to pay these losses.

In addition, the company has allocated $ 3.3 billion in loan loss provisions – an increase of $ 1.9 billion to the fight against unpaid loans a year ago. JPMorgan also saves $ 1.5 trillion in cash and marketable securities.

JPMorgan did not respond immediately Lucky Survey for comments.

In addition to JPMorgan, Citi protects security if an economic decline occurred. The bank increased more than $ 2.7 billion a year, more than 15% of loans.

In addition, Citi increased its total over $ 1 billion in the first quarter, from $ 1 billion to $ 22.8 billion to $ 22.8 billion, while the US economy went to the south. The Bank also holds a strong liquidity and capital position with cash levels reaching $ 960 billion.

Citi did not return immediately Lucky Survey for comments.

This story was first displayed Fortune.com