Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

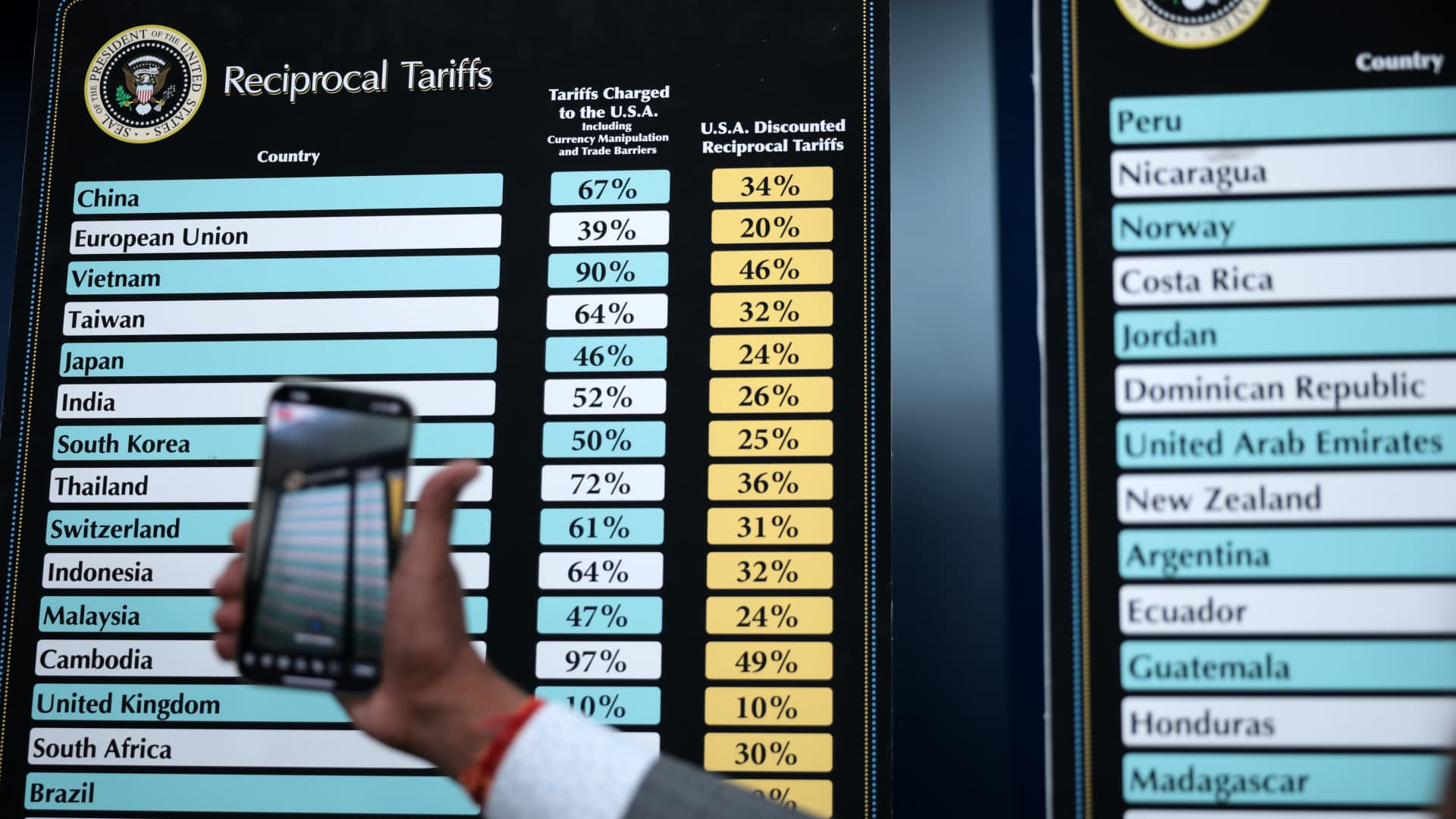

The draws of the US “reciprocal tariffs” are charging other countries, on April 2, 2025 in the Washington, DC in the White House in the James Brady press room.

Alex Wong | Getty pictures

US President Donald Trump Out on Wednesday “reciprocal tariff“The rates of more than 180 countries and territories will face a new trade policy.

The announcement shares thrown and asked for shelters to the assets that investors need to be safe.

Analysts usually accepted a pessimist on the announcement by assuming the risk of a recession for some even the United States

This is the design of the reactions of experts and analysts:

Tai Hui, APA’s General Market Strategy, JP Morgan Assets Management

“Today’s announcement can increase the average US average tariff rates since the beginning of the 20th century, because these tariffs can cause inflation.

“The scale of these tariffs is concerned about the risks of growth. US consumers can refund the costs due to the import of pricier and can postpone capital costs among uncertainties about trade partners trade and potentially revenge.”

David Rosenberg, Rosenberg Research and founder

“When he wins the Global Trade War.

And many will be transferred to the consumer, so we are a few months of shock for the American household sector. “

Anthony Raza, Head of very active strategy, UOB assets management

“They got acquainted with the most extreme numbers we could not understand. If they were with them, maybe something that will take time for negotiations over a year.

David Roche, Strategist, Quantum Strategy

“These tariffs are not a transition. The President will be felt in prison, not only the wrongdoing of globalization, nationalist policy and not only for the economy.

Currently, wait for negotiations by the EU (US services) and China (US Strategic and Business interests). Flower garden tariffs will be semi-semi-market. The United States and EU will also be global. “

Shane Oliver, investment strategy and chief economist, amp

“Our rough calculation is 2nd April announcement will raise the US average tariff level to the levels of the 1930s Smoot / Hawley tariffs This, in turn, will add to the risk of a US decline – with another blow to the confidence and supply chain – and with a larger blow to global growth.

“The risk of the US decline is probably 40% and how important the global growth and how important the global growth responds to the policy stimulus of countries like China.”

Tom Kenny, great international economist, ANZ

“Today’s US mutual tariffs are worse than expected. The effective tariff ratio related to the import of goods is likely to climb 20-25% of the highest in the early 1900s.

Inflation thinks more high and capital sold after productivity on index bonds and thinks that the market will grow and add to inflation to the market. Market prices of federal funds quickly come to the ratio points to lower the federal reserve. “

[ad_2]

Source link