Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

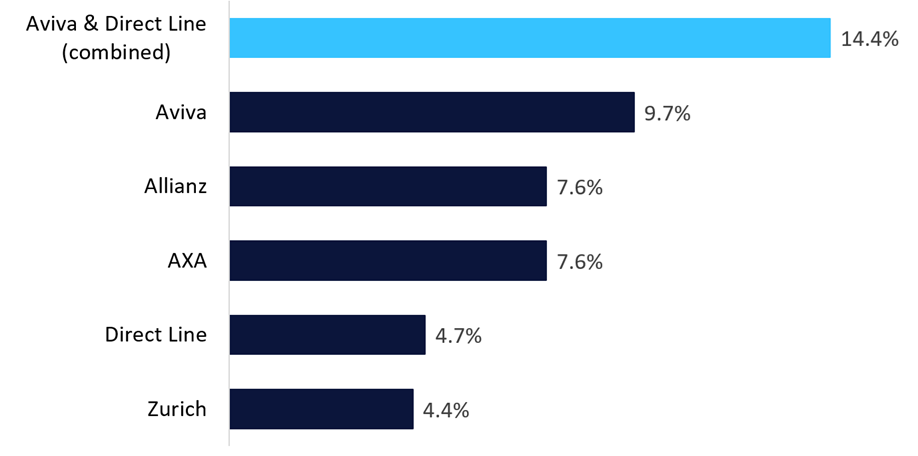

Aviva’s 3.7 billion pounds, the purchase of a direct line to the final line for completion in July 2025 and the combined group is expected to be a great power for Globalata analysts in the UK’s general insurance sector. The reserve is ready to continue the bargain before the reduction of risk purchase and creation of competition and clearing markets.

Aviva is the largest general insurance player in the UK; In 2023, GLOBALDAT’s top 25 common insurance rivals are 9.7% in 2023 according to analytical analyst. There is a healthy lead on AVIA, Allianz and AXA; Each management, the second largest player in common with 7.6% of the market. Aviva’s leading player, with the purchase of a direct line, which twice the second largest player’s market share (14.4%), especially in the combined group (14.4%) will be in addition to the control of aven-fifths (19.6%) in the market. This would be an important part of the UK’s total property insurance market (17.3%).

The purchase of Aviva’s direct line is a significant event for the British overall insurance market and is now approaching its final stages. The proposed sales have adjusters by both the financial behavioral authority (FCA) and the Prudential Adjustment Authority (PRA) to date, and now it should be formalized from the CMA. The completion of the transaction is expected in the sanctions of the Supreme Court on July 1, 2025; This provided the Aviva CMA clearance. Expressing confidence that the Avıva will be seized, the Supreme Court sanction is suitable, it is ready to oppose the acquisition of the CMA official decision. This announces a decisive history of the high court sanctions. The decision of the AVA to accept the decision of the CMA is interested in the assignment of unconditional clearance and the acceleration of the transaction. Unlike some jurisdictions, the British merger control system is not suspended; to think that a transaction can be completed before the CMA. However, due to the conclusion that the scale of the combined group will result in a significant reduction in the market, it is not risky. If so, CMA can apply treatment (such as refusal) to reduce the impact of CMA to cause harm to the glory. Under the offer of purchase,

[ad_2]

Source link