Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

The same technology giants, the giants that helped to drag the S & P 500 to the threshold of a bear market in April, restore their feet in the US capital.

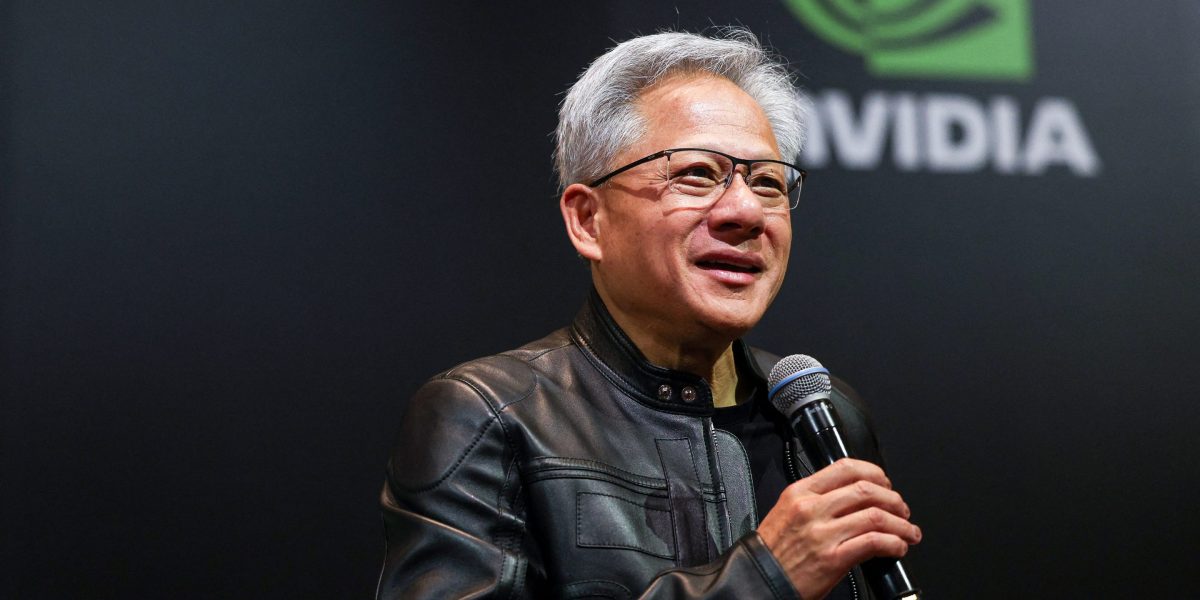

Nvidia Corp. Put a bow to a summer season for a better saving season than expected for the Great Tech last weekdeliverDespite the restrictions on the sale of chips in the United States, a strong outlook for income. Nvidia and Microsoft Corp. Rally reinstalling the board licenses, the traders are preparing to raise a wider market in the group.

“I feel really good to get out of the technological season from this profit season,” Brett Ewing, the first Franklin financial services General market strategist. “It’s more gas in this tank.”

The S & P 500 index remains intact as well as large-scaling services, as well as large technological results, as well as large-scattered services, software, electronic device and digital advertising, which are required to reduce tensions between the United States and its trading partners.

Tesla Inc. is 56% since 40% and 30%, 40% and 30%, 40% and 30% of NVIDIA and Microsoft.

As a result, a Bloomberg size of the so-called seven shareholders – Nvidia, Microsoft, Tesla, Apple Inc., Alphabet Inc., Amazon.Com Inc and Meta platforms Inc – superior to S & P 500 over the past eight weeks – a critical change for benchmark, taking into account the group of the group. According to Kohort, compiled by Bloomberg, 19% of the S & P 500 are responsible for about half of the 19% rally.

Despite the strong performance, the group still follows S & P 500 for years – arare hoopin the last ten years. Apple and Amazon shares facing risks than tariffs due to imported products, aggravate the cohort and leave the general market.

“Tech Diver will be a top-round theme,” said ewing. “Sids are still a lot of money and need to be put on work.”

Tariffs and other Trump policies are the overlap of a large market. Friday, Benchmark sank more than 1% after TrumpdefendantHe broke the agreement with the United States for the Chinese, tariffs and newsreportThe United States plans to put a wider restriction on the technical sector of the country. S & P 500 managed to return most of these losses until the end of the day.

Another obstacle will have serious assessments of large techniques. According to Bloomberg, Bloomberg, Bloomberg’s magnificent seven size measures are estimated at a profit projected 30 times. Meanwhile, S & P 500, saving 21 times for the next 12 months, 18 times in April and 18.6 times in the last ten years in the last decade.

Barry Knapp, a partner in the IRonsides macroeconomics, despite the fact that the group looks attractive from the main perspective, he said, he said. He expected the sector “modestly overweight” and more expected to restore capital expenditures in the second half of the year than in industry, materials, energy and finance.

“Being overweight here, it is likely that this is a great rate of your portfolio in this sector and makes you sensitive,” he said.

Truist advisory services’ Keith Lerner, the largest market in the last half of 2025 continues to spend the highest level at the highest level at the highest level of artificial intelligence.

Meta platforms raised the forecast for capital costs this year and Microsoft said thatIncrease costsIn the next fiscal year, after the two-year growth of companies, it facilitates concerns that it can take time.

“We look forward to the fact that the earnings may still be flattered, but probably thinking of a profit season,” said Truist’s header investment officer and Lerner Lerner.

In 2025, a magnificent seven profit calculation was stable in the last two months. The Group is drawn to the expectations of analysts in the middle of the reporting season to the expectations of analysts, and before starting the expectations of analysts and twice the S & P 500.

“Investors will be withdrawn to these names with secular growth,” Lerner said. Technical “This catalyst can be this catalyst to see if the market is recharged again during the year.”

This story was first displayed Fortune.com

[ad_2]

Source link