Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

In the world’s largest active manager a Bittoin The Exchange-Trading Foundation now gets more income than the S & P 500 index signature tracker.

About $ 75 billion, Ishares Bitcoin Trust ETF (Ticker Ibit), in the last 18 months, the same, institutional and retail investors from institutional and retail investors in the last 18 months saw the torrent of cash from institutional and retail investors. Funds of funds with 0.25% of the funds are 0.25%, $ 187.2 million worth of $ 187.2 million in the investment math by Bloomberg, $ 624 billion worth of assets and charges worth 0.03%.

“Although IVV’s annual payment revenues are also a significant compressor and Nate Geraci, Nate Geraci, Nate Geraci, Novadius ETFs are very competing, the proven to pay for the report of Ibit investors really as additives.”

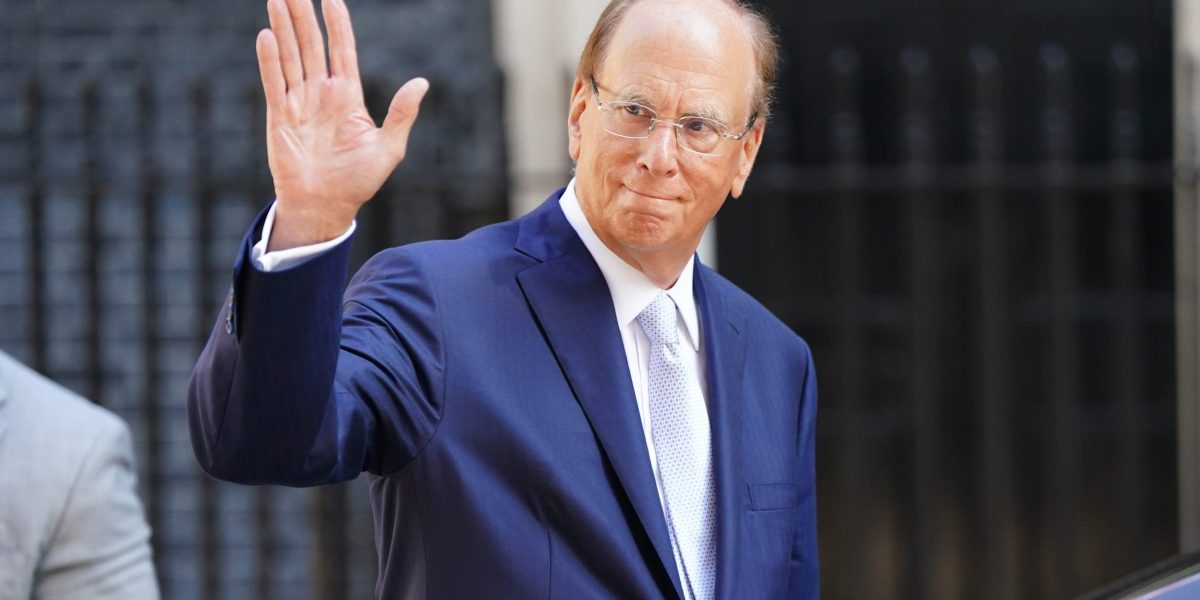

Blackrock refused to comment.

According to Ibit, Bloomberg, composed by Ibit, Bloomberg for trading on January 2024, 2024, according to Bitcoin ETF assets, for more than 55%. Meanwhile, 25-year-old IVV, more than 4,300 products in the United States, only S & P 500 are the third largest ETF between the Vanguard Group and State Street Investment Management Funds.

Under the hedge funds of the US regulators, pensions and banks, the increase in gas to the increase in capital, opened the door to the main adoption door, opened the door. Ibit, which is a similar cost rate of peers, Bloomberg is more than 20 ETFs in terms of trade volume.

“This is a sign of how much pent-up requirements, as part of the overall portfolio without opening an account of investors,” he said. “Also, the cryptoic leadership is considered to be accepted as a warehouse of cryptist.

Bittoin higher On small subsidiary, the world’s largest cryptocurrency, President Donald Trump has expanded with the world’s largest cryptic trading. Spree buying Wall Street was led by Michael Saylor’s strategy, which used the cash to collect the Bitcoin Mountain. Hedgehogs were also accumulated in the company’s debt, which is accumulated in the debt, which attracted the arbitration trading in which the shares attracted to receive bonds.

[ad_2]

Source link