Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

Global Stable Income Rick Riederin Blackrock Cio analyzes US economic activity because some observers are concerned about a recession.

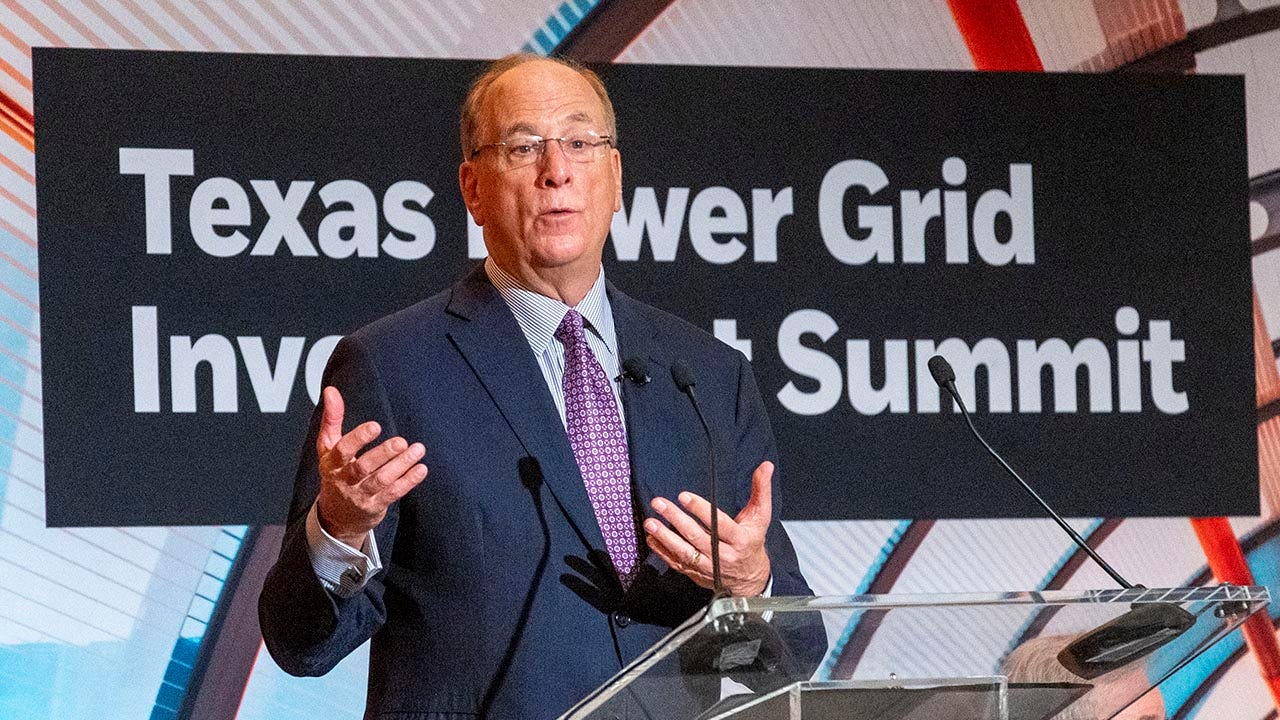

Blackrock CEO Larry Fink’s Investors were politically controversial, such as policies, as well as the policies of the company, the diversity of the company, the company, and the environment, social and management (ESG).

FINK, annual chairman issued a letter to investors on Monday, and released potential controversial references to the 2025th anniversary of the letter, ESG, ESG and climate change. In February, the income after Blackrock, moved away from the Internal deI policy, and the annual reference focused on the annual report, instead of connection and inclusiveness.

When the annual report was released, the BlackRock fox has said that the company is committed to creating an environment that supports the upper talent and not grouped. “

In the letter to investors, Blackrock’s Fink Along with increasing the power of financial markets and the market is attached to many investors, as well as in markets, a section has been included in the market.

BlackRock, script flips in DEI politics in the company’s wide email: ‘announces a few changes’

Blackrock CEO Larry Fink’s annual letter to investors has moved off politically controversial issues such as the company’s diversity, capital and entering (DEI), as well as the policies of the environment, social and management (ESG). (Houston Chronicle via Kirk Sides / Getty Images / Getty Images)

“Today there are many countries in a twin, inverted economy: the existence of wealth; the difference has created difficulty. Share, restore our policy, policy and our policy, our policies and our policies, and our possible. Protectionism is back by force. The absence of no assumption is that capitalism did not work and it’s time to try something new, “Fink said.

“But there is another way to look at it: Capitalism has done – for very few people.”

| Ticker | Safety | Last | Change | Change% |

|---|---|---|---|---|

| Black | Blackrock Inc. | 944.84 | -1.57 |

-0.17% |

“Markets are not perfect, as people build. We are not perfect, but not smooth, and have a meaningful share of what is happening in the market,” he said.

To this end, the Finskistan wrote that he was looking for Bronkrock Investment democratize By helping current investors, limited part of their financial markets, but also to allow more people to start as an investor. One of these areas is special markets that are currently unavailable for most investors.

Blackrock turns the dei references from the annual report

BlackRock, moved outside the past and ESG investment. (Getty Images / Angus Mordant / Bloomberg through Getty Images)

“Most of ‘Markets’ with public markets – shares, bonds, goods, goods,” Fink said. “But you can usually get a network of the next generation on a new high-speed railway line or in the London or New York Exchange. Instead, Infrastructure projects Usually only invests through private markets. “

“Assets will determine the future – information centers, ports, power grids, the fastest growing private companies in the world – are not available for most investors. Private marketsHe was locked behind high walls with the richest or largest market participants, “he said.

“The cause of the exclusivity has always been risky. Therefore, only certain investors are allowed. However, nothing in finance does not change. Or does not have to be opaque.

23B $ 23B for Blackrock Panama Channel Ports

BlackRock has recently announced a contract to buy two ports in the Panama Channel, as well as a number of other ports around the world. (Justin Sullivan / Getty Images / Getty Images)

In the last 14 months, in the last 14 months, along with infrastructure and private loans, including infrastructure and private loans, including infrastructure and private servants, including infrastructure and private markets, he received two companies with another company.

FINK offered that growing access to investment in private markets can develop investors’ portfolios growing diversificationWriting, “The beauty of investing in special markets is not a certain bridge, tunnel or a medium-sized company. These assets complement your shares and bonds – diversification.”

The future standard portfolio can change from a classic 60/40 shares and a mix of bonds, 50/30/20 shares, bonds and private assets – such as a mixture of real estate, infrastructure and private loans, fink wrote.

Get the fox work on the way by clicking here

“Clean, more time, as in the S & P 500, it is possible to index private markets. This is easy to get accessible, simple markets are available.

[ad_2]

Source link