Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

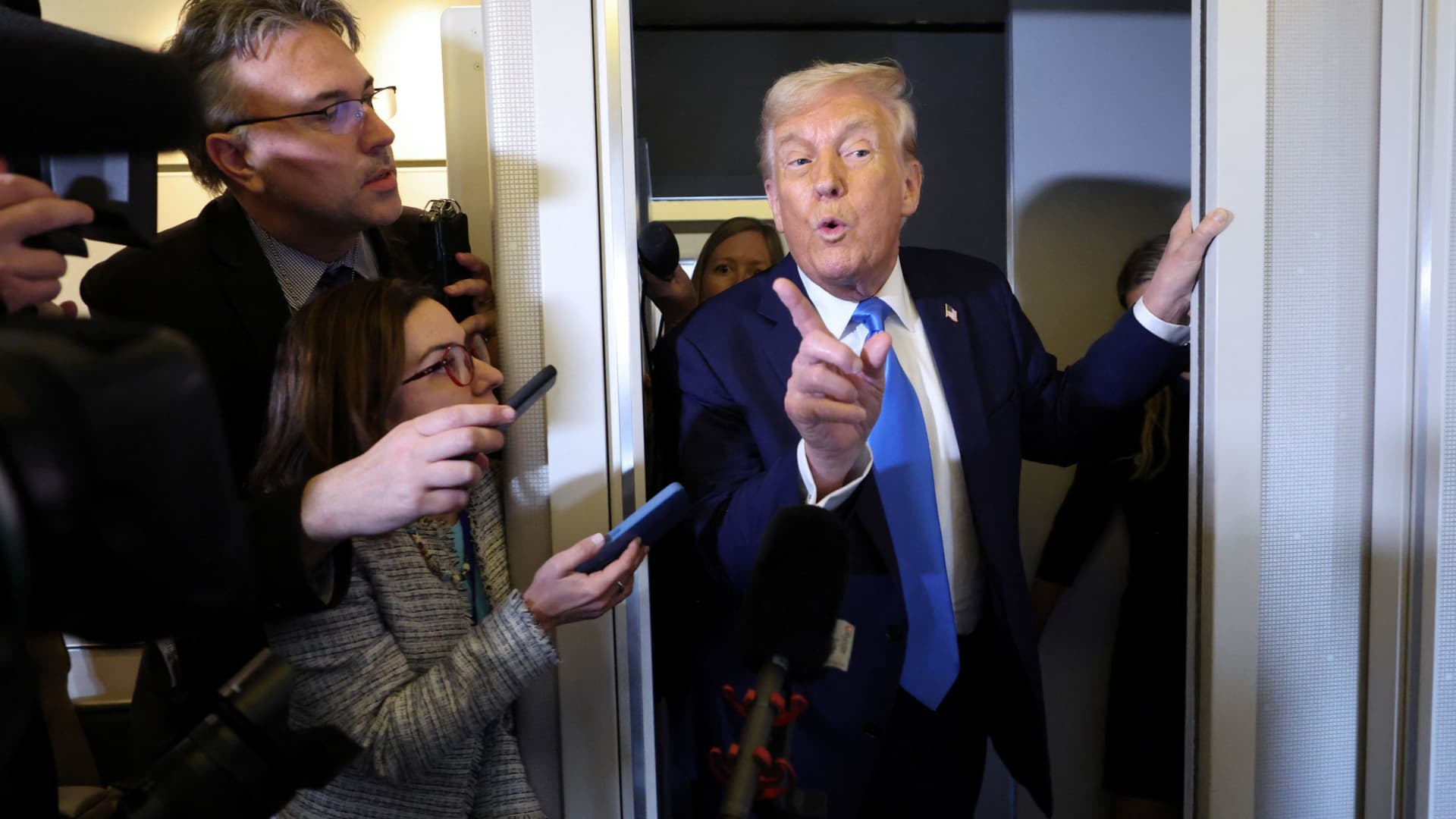

US President Donald Trump, Military Palm Beach, Florida, USA, 28 March 2025, Florida, the United States speaks for media members before landing in West Palm Beach.

Kevin Lamarque | Reuters

Politics are united to create a stagflationary outlook for the U.S. economy in the latest CNBC fast updates from the uncertainty and Trump control, the latest CNBC fast update.

The rapid update, the average price of 14 economists and inflation from GDP and inflation, in the fourth quarter of 2024 in the first quarter, the 0.3% increase in the first quarter compared to 2.3%.

The main ppe inflation, in the meantime, the Fed’s prefdition indicator will remain approximately 2.9% for most of the year before continuing the descent in the fourth quarter.

Rears of GDP forecasts, the decline in consumer and business is a new evidence of real economic activity. The Trade Department said that in February in February, the total or inflationary spending in January was 0.1% after reducing -0.6% in January. The activity economy threw a worldview to an increase of 4% in this quarter to 0.2%.

“Signs of slowing in hard action data are more convincing, after getting more deteriorating in the previous feeling,” Wrote the weekend Barclays.

Another factor: an increase of imports (leaving GDP) that appears before the pre-tariffs.

The good news is that only two of the 12 economists who have a import effect and participating in the survey sees a negative increase in Q1. None of the economic contractions do not predict a consecutive quarter. Oxford economy with the lowest Q1 estimate is waiting for a resistant driver to continue, but the second quarter GDP reaches 1.9%, as it will increase the growth when the imports are considered in inventory or sales events.

On average, the majority of economists gradually predict re-rebound, in the second quarter, 1.4% in the second quarter, and 1.6% in the third quarter and the final quarter of the year and the final quarter of the year increases to 2%.

Danger, total 0.3% is an economy with anemic growth, easily slip into a negative area. And this week’s new tariffs that happen with new tariffs, everyone is not sure of a rebound.

“Although our basic does not show a decline in real GDP, there is a good chance for the work and financing of the global trade war and the doge, this year has a first and even second quarter,” said Moody’s Analytics. “And if the president does not start withdrawing to the tariffs of the third quarter, the decline is also probable.”

Moody’s, anemic Q1 growth of anemic Q1, which is up to 0.6%, growing up to 1.6%, is still modest.

Stubborn inflation will complicate the ability to respond to the Fedin Flag device. Core PCE increased by 2.8% in this quarter, to 3% in the next quarter and will remain at about 2.6% in this level.

In terms of banking regarding the ratio of market ratio, the Fed is difficult to justify until inflation falls more convincing in the end of the year.

[ad_2]

Source link