Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

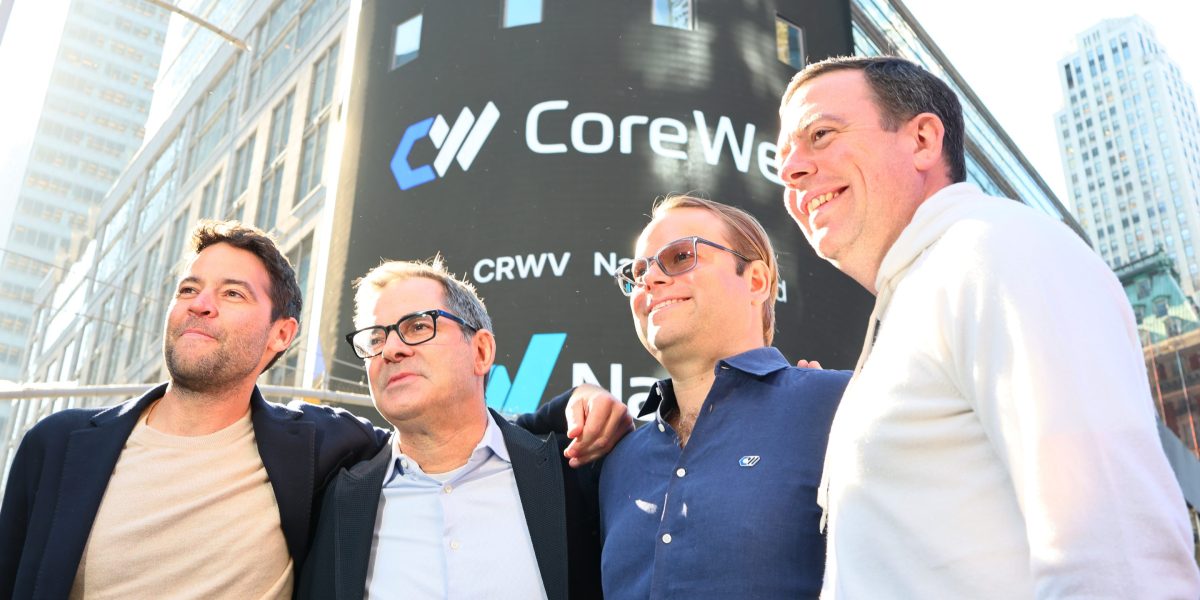

Shares in the AI cloud provider Coreweave began trading on Friday after the revealed to be a rocky iPo. However, this does not mean that other probable technological iPOs will be DUDs this year.

Coreweave’s shares fell to 5% in the first hours of Friday before returning near the IPO price of $ 40. In theory theory, the stock market trade in the apartment, but in fact, the company’s initially lost $ 47-55 to $ 55, hoping to be sold in IPO.

At some level, it was quite clear that something like this came. Company IPO documents There were several serious red flagsCustomer concentration (two customer evaluated 77% of income to a heavy debt load. Yesterday this was reported NvidiaOne major supporter was a stock market with a $ 250 million order in a $ 40 pop. Nvidia is also a remarkable customer of Coreweave, which started as a crypto mining company in 2017.

Other supporters of Coreweave are loyalty, magnetar capital and packaged.

Coreweave’s disappointment, high interest rates, long-standing technology with inflation and variability is not a pleasant sign for the IPO market. Again, there is a very clear number of noisy technological iPo in the pipeline, this year we will still talk about iPos.

Take notice to spokesman and SEQUOIA and SoftBank after the purchase of Clarina. The company prepared to go to the public on March 14 indicator Ready to dare to investigate public markets. The stockholm-based work has increased more than 2024, in 2024, and a small amount of $ 20 million in 202, $ 21 million, the Klarna has a net profit for more than $ 2024 million.

Another place, there is a social platform discord It was reported to have something Start working with Goldman Sachs and JP Morgan, in a possible IPO, software company Figma tastes It was reported to have something in negotiations with banks. And the information worth $ 62 billion and the AI infrastructure company Databricks are expected to be barreling against an IPO in general.

Today, Tech Ipo was not the day hoping for the audience, but it was not over yet.

This story was first displayed Fortune.com

[ad_2]

Source link