The heads of the country’s largest apartments finally give two cents that tariffs, trade wars and economic tumulti could affect the work of the economy.

A worldview in the save season should be equal to the course. But the industry is mainly been wax Since the “Azadlig Day”, “Azonbay Communities and Camden Proportions” to make a straight conversation on the earnings of a profit by Azonbam communities and Camden Proposals.

“So far, he is like a hurricane of the only apartment, which speaks of resident concerns,” he said.

Blual balls of your bug done. They still shared the divine.

Upshot: Market basics are preparing to strengthen and strengthen; Now is the greatest unknown job market.

All three districts said that the demand is as strong as the request is received – at least.

Mortgage rates and home prices are high, which refused to cancel the buyers and put pressure on the national unequivocal housing market. Meanwhile, the peak rental season approaches creating a perfect storm for owners.

The problem is conversation.

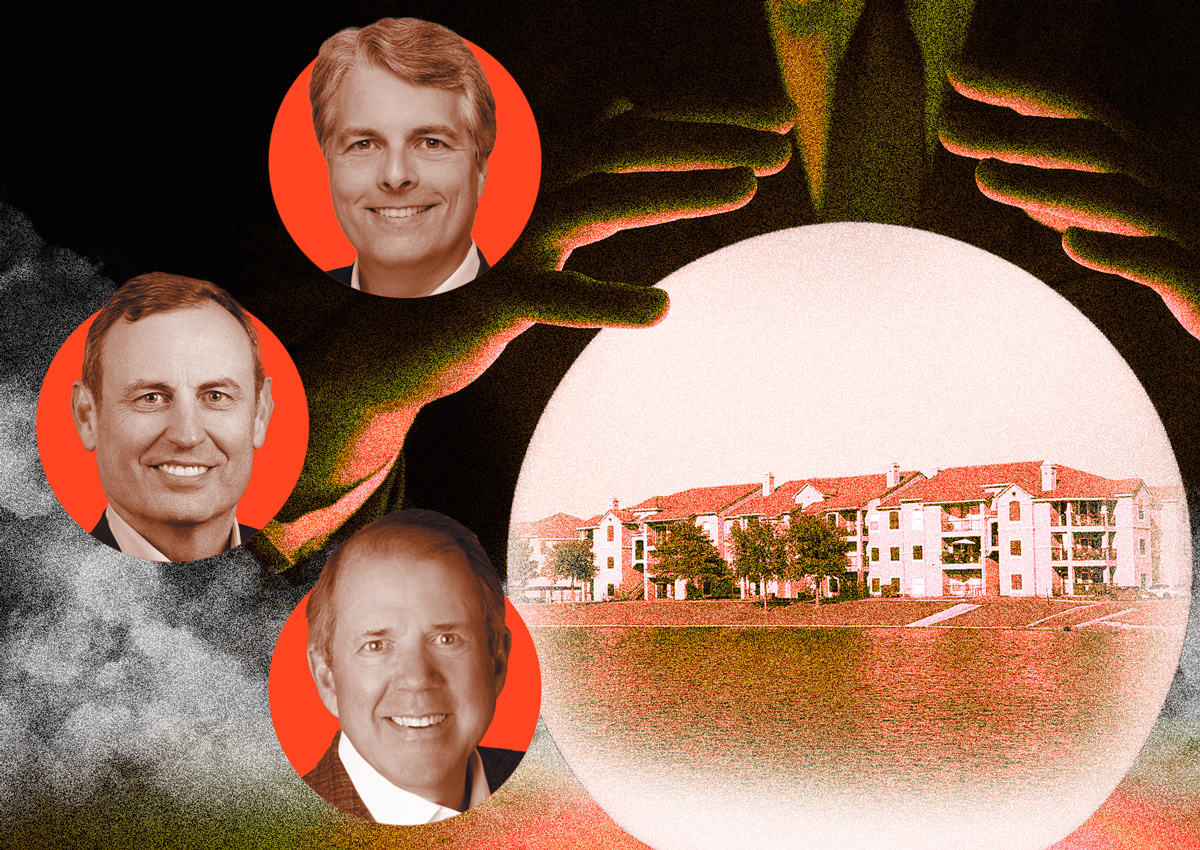

Avalonbay CEO Sea Breslin, both promising and current and current and current and current, and I have a job today; I have a job tomorrow? “

The headquarters, headquarters Arlington, Virginia, especially in 12 states, in especially, Washington, DC, especially in the work market of the federal floors and still develops a continuous fear among those who are still working.

The Federal Workforce for DC in DC is projected to reduce 21 percent until September 21, which forecasts the metro region to enter the district region with a year.

Change local lenses for a national and 260,000 federal employees – Option, power or some mixture – since President Donald Trump, according to Reuters

Avalonbay will feel the absence. Breslin said that 12% of residents work for the Federal government.

Neither the reit nor peers hit capital and Camden, leasing numbers. However, the effects usually show itself from six to eight months, said Breslin; CEO Mark Pararrell, CEO, echoed it.

“We are the leading indicator of changes in the economy,” the company is one of the company’s call on Wednesday.

“People don’t give up buttons immediately if they lose their jobs.”

Currently, tenants are stuck in these buttons.

Coo Michael Manelis, in the first quarter in the first quarter, capital in the first quarter reported a record little round of turnover. Camden, one of the highest proportions of the company, 3.3 percent Pop, the chairman of the President of the Executive President, said he was Keith Oden.

It is good news at the moment. However, these signals respond to uncertainty and difficult days may be on the horizon.

Breslin announced a typical chain of typical events when the economic outlook was purchased.

There are signs. The cost of use is below. According to Deloitte, although it was above 2023 and 2024, it has been collapsed since November 2025. From February, the tenants said that there are more anticipated expenses for housing and utilities, signal pocketbooks are squeezed.

“The probability of a recession remains at 60 percent,” JP Morgan openly announced in the secondary report of April.

Again, those lubricants still do not flush their speeches. Or they claim.

“We do not see the signs of consumer weakness from today,” Kaysan’s mannel. When showing weakness, it shows itself as a broken rent, low rent, less update and actions for late payments.

“People came in and said,” I have lost my work in the federal government, I have to leave my lease, “Camden CEO Ric Campo said.

“We just didn’t see.”

However, good news is that there seems to be in the rear view mirror of the story, and the increase in unemployment should be provided to increase supply.

It is expelled since 2021 in the first quarter, the planes marked for the first time, they are leasing new compounds than developers.

Last year, compared to the demand of Washington, DC, tenant, the largest surplus of apartments pumped. Then came Houston and Las Vegas.

Libra, Dallas, Atlanta and Denver, Atanta and Denver, the capital investment officer Alec Brackenridge touches the favor. Austin, Charlotte and Phoenix, “he did not bleed the bleeding of all the supply they fell underneath,” but did not reduce the signals of the pipelines recently.

In the first three months of 2025, Austin, which rented the package overly, produced less units – for the first time in three and a half years, was the positive net absorption.

The pipeline is still strong, but the construction is “slowing down” in a very significantly the rear half of 2025, “Camden’s Camp said.

About two years later, after a negative increase, the rent changes are projected to make the rent changes until 2026.

Teams like Avalonbay bets on the sea change. The company in the first quarter in the first quarter in eight Texas – two two, the remaining two, Dallas-Fort value, more than $ 600 million.

“Look at the basics we can enter these markets,” Breslin said that the Texas deal was about a door for $ 230,000. For comparison, the unified valuable prices in Austria have recently overlapped in the level of $ 275,000.

Houston Basic One-Athonbay, February Avalonbay, Austin’s Emerin has exceeded $ 68 million or $ 192,000, for a single unit – 16 percent discount.

Along the sunstrip, trouble This is the values since 2022 last year work The way that the system and investors are waiting for the turn of the turn is removed.

“Lenders only had some kind: they don’t extend loans; they do not extend the caps in interest rates,” Kaysen Brackenridge said.

S2 Capital, for example, one of the multifaceted syndicators go out The lowering of the solar pipeline drew a good part of the buildings owned Guz – a syndicator that doesn’t go so well.

One of the largest investors in the period, the GWA lost its assets pledge and Mandatory sales Interest rates after increasing its floating-grade loans; Faces a large number Investor suits claims shaded deals.

S2 has chosen one of the GVA fight in partnership with wind capital (third syndicator) Austin assets In January $ 50 million. S2 also stepped as a general partner in the 1,768 GVA portfolio, which has buildings in Dallas and Nashville and Knoxville and Knoxville, Tennessee.

“We see a few items that start to come to the market,” said Brackenridge. “At the same time, there is a lot of interest to buy this product.”

Currently, Capital scans Dallas, Denver and Atlanta for obtaining opportunities. Unlike their peers, it still does not have appetite for Austin.

“Supply has a glud – this is a little later for us,” CEO Pararrell said.

All three loneliness, which are double-growing as developers, said that the tariffs will pressure the costs. Avalonbay, 5 percent of heavy expenses, said, “It can be enough to make some projects inaccessible,” he said.

“Even if there is no change in the costs, it is really difficult to make deals at the moment,” Brackenridge said. The mixture of uncertainty and still high proportions complicates math.

However, as new development activities, the contractors and subcontractors, the prices for the higher the price of materials, are more prepared to have more peakrooms.

“Contractors (there are) are really hungry,” Brackenridge. “They see the pipeline reduced and therefore accept the call of a margin.”

Avalonbay, who acted as his own contractor, “Our phones ring the hook with a deeper offer and a stronger subcontractor, than in years.”

“It shuts down,” the head invested officer Matt Birenbaum.

This article first appeared in the real deal. Click here To read the full story.