Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

(Bloomberg) – US shares’ Last week’s back, a stack of contracts of a pile of contracts, a pile of contracts to end with an event of a variable event in the past will face a new test.

Most read from Bloomberg

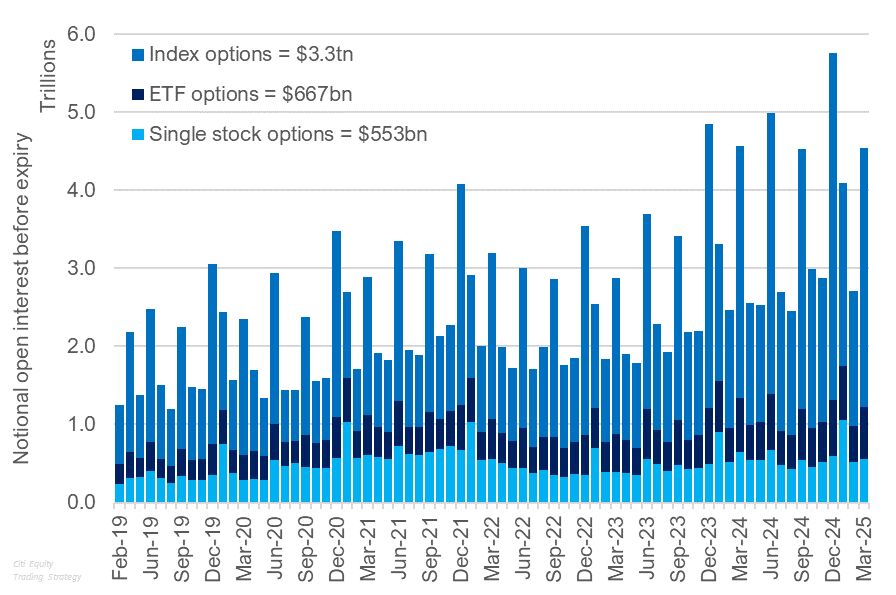

The so-called “triple witch”, shares developed by Citigroup Inc., exchange and exchange exchanges with indexes and exchange and exchange agreements on exchanges and exchange exchanges will take about $ 4.5 trillion contract.

A large part of these contracts is not justified for some market watchers, some market viewers who cause the positions of some market viewers to cause outside movements caused by sellers caused by external movements. Again, the incident was known to cause sudden price movements in the past, and traders travel over their existing positions.

Until the capital of Iur, Gareth Rayanya, a day without a big contract period can be as active as the OPEX session itself.

“Options can be very volumed in many volumes on the listed products, on Thursdays, rolls, round and position closing, especially until the day of ending,” he said.

On December 20, the last ‘triple witch’ event, the CBEE Vix Index, which is above 28, Federal Reserve Ghabin forecast, since the beginning of August, the largest route in the structure of Benchmark.

The mood was calmed down on Wednesday, S & P 500, Powell said there was no reason to change the current path of the current road, relucturing and relieving concerns about inflation. President Donald Trump has forced the S & P 500 to worry about the influence of trade policy on the economy.

Read: Powell rely on the economy and jumped back to focal bulls

The quarterly OPEX event can probably cancel their flights when traders’ bet their flights, and the dealers will carry any vix futures positions. Whether it is morphine to a stock market sweeps, it remains to be seen.

Citi Capital Trade Strategy Trade Strategist Visal Vivek, Friday’s triple witches are “less important” due to the placement of the historical open interest in the historical open interest.

“Sellers are prepared forever,” said Kevin Darby, the Vice President for Executive Technologies, Financial Software.

[ad_2]

Source link