Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

During the meeting in the President Biden’s Oval office, his leadership made it a point to invest in the internal production area. One of the successes of the administration signed a law in the United States, which signed a law in the United States, which is a law trying to invest $ 280 billion in the US and semiconductor production

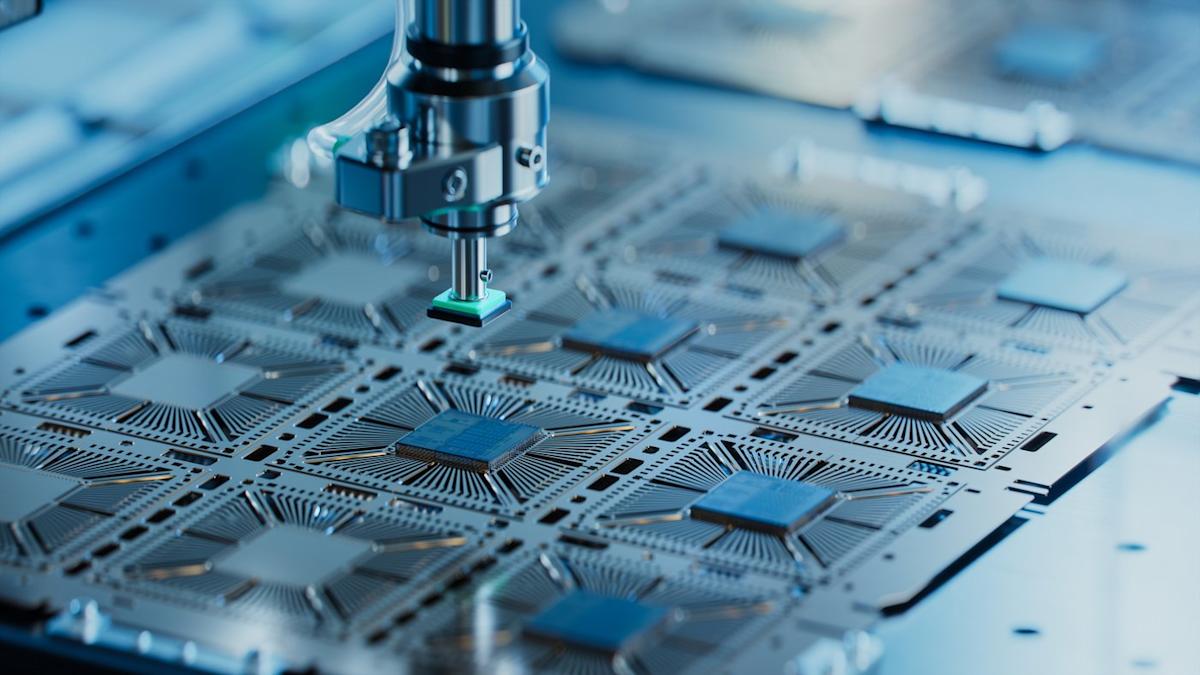

In the last few years, Intel emerged as one of the largest The actor of the beneficiaries of the chips. Investment in the infrastructure of artificial intelligence (especially in data centers and chip containers, as well as under a fine, new Trump Office, it is directed to increase domestic production investments.

But the last announcement Taiwanese semiconductor production (NYSE: TSM) It looks back in my cautious optimism around Intel.

Let’s examine Intel’s latest Damascus and why Taiwanese Semi’s latest examination against the American cast opponent will be the most recent examination.

Last year, Intel won $ 53.1 billion with total income. Although this year was represented only 2%, the results of the company’s casting were more concerned.

Intel casting in 2024, $ 17.5 billion sales – decreased by 7% over the years. The casting business competes with Taiwan Semi, which has a direct global cast market. Considering that the Intel Casting Company has slowed up to a degree compared to the company’s overall work, I do not have a thin that it is not gentle that it proves that it can catch up to long-term opponents.

To add salt to the wound, now it has now announced that it is postponed to open a new factory in Ohio until 2030. The plant was used this year and between 2026 for reference.

Taiwan Semi, three additional fictional plants, two packaging factories and a Research and development (R & D) center. This investment comes to a project of $ 65 billion in the existing 65 billion project in Arizona, where the additional production opportunities were established.

TSMC’s investment in the United States is to help strengthen operational relations with the company, including large customers Nvidia, Very, Broadcomand Qualcomm.

Over the past few weeks, in seven groups, several technologies announced their plans to invest in the AI infrastructure for several years. On the surface, Intelin can think that the capital costs (CAPEX) from the largest contributors of the EU can benefit from the rising. Instead, I noticed the struggles of TSMC Intel and I see the company’s new $ 100 billion in investment in the United States, as an action that can further strengthen the dominant pulse in the enrollment market.

[ad_2]

Source link