Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

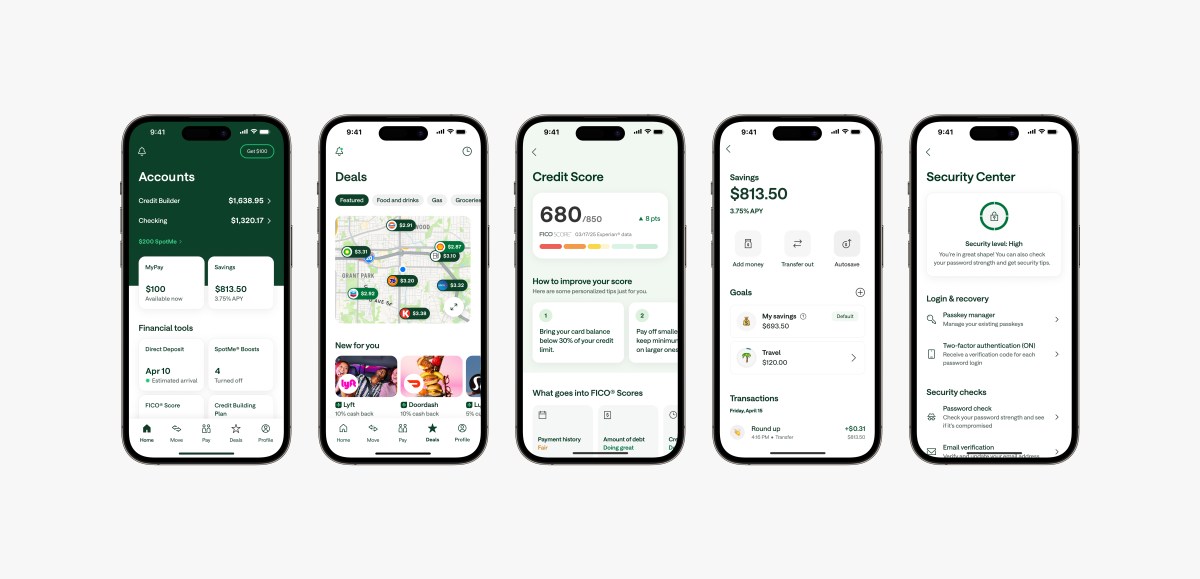

As soon as you bite go outCHIME, more customers have new features to attract.

Digital Bank offers customers that they agree on a chime deposit to a chime deposit, or checking the account directly, it only applies to TechCrunch. The 2% interest rate for standard users is still competitive for non-selected ones directly.

For comparison, in the opinion of Bankolio, the national average deposit account productivity is 0.61% APY Investigation of organizations Like the week of March 24.

CHIME Head Product Officer Madhu Muthukumar did not say this clearly, at least the movement appears in a part to attract more adhesion between customers. Since last summer, according to reporting, there was $ 1.5 billion in revenue of 7 million clients and annual income in the past summer Forbes. The company refused to give updated figures.

In December, Cymar Confidential paperwork To go to the public with the US Securities and Exchange Commission. Chime was worth $ 25 billion in recent Raised $ 1 billion 2021 In the height of the evaluation anger and only $ 2.65 billion, the Pitchbook evaluations increased. Its investors include Foreunner Ventues, Menlo Enterprises, Crosslink Capital, Sequoia, Softbank, Tiger Global and others.

The company also refused to comment on the potential IPO on time.

To be appropriate for 3.7% APY, CHIME customers must agree to be a member of the CHIME +, must comply with the award membership level that requires a contract to combine direct deposits. There is no payment to join as a reward member.

Founded in 2012, Chime markets as a bank alternative to the daily Americans. Since it does not require or requires or requires overdraft, exploitation or low balance fees or score minimum.

“These are the preparation of a coffee in your local store, deliver your children, deliver a package or help you find anything in your large box retailer. This is your neighbor.”

Customer base, somewhere, he said to TechCrunch, as “Super Young People”, who are more than the age of the 30th, and the “profitable”.

In 2020 Credit card began to offer He claims that he claims that users to determine purchase restrictions on account balance and help develop and develop their loans by acting as a debit card. Now members should not focus on the deposit via Chime to apply and use Chime’s credit card VISA credit card.

Other features that announce the pair are announced on Monday, re-workers, cashback suggestions and a set of “deals” or discounts specifically for “dedicated” customer support. He also announced the new one on March 21 “Instant Loans” product.

Financial technology companies continue to be creative in trying customers. Robainhood last week, announced that he would start Wealth offers management and private banking services Retail investors were “not divided for wealthy” such services. ” As part of the new proposal, Robinity says this will help 4% apY on the deposit, as well as property planning and taxes and other things. He will also offer cash delivery to the user’s door.

[ad_2]

Source link