Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

Be informed with free updates

Simply register Global economy Myft Digest – Delivered directly to your box.

I am impressed with the concept of “social silence” three decades – or advanced idea by intellectuals like Pierre Bourdieu no Talk is more important than we do.

Currently, this silence is hung very much to the markets. This week has a cocoophony of terrible noise around geopolitical events – epitomized by the President Donald Trump’s warning America may or not “” attack “” to Iran’s attacks “” “” “” attack “.”

And matte economic information continues to fall. World Bank last week cut the forecast Global growth (2.3 percent) and the 90-day break from the American (1.4 percent) – Trump’s “Freedom Day” tariffs, we will see “global trade in the second half of this year”. This week, the federal reserve also dramped the U.S. growth project and raised the inflation forecast. This is for Stagflation-Lite.

Again, the United States has risen more than 20 percent since the beginning of April in recent weeks – Freedom Day has recovered so far. Indeed, they are close to heights. The 10-year bond productivity is 4.4 percent, a higher point of interest than the last fall, which has recently stabilized – even US financial forecasts have worsened.

Thus, today the big market is not increasing risky expressions today, so far the lack of an investor panic.

What’s behind this back withdrawal? What’s an explanation colleague Robert Armstrong Called the “Taco” effect – Trump’s always the chicken out of his threats. The other is the second “T” problem: the time is fulfilled.

The Central Bank of Denmark, for example, recently learned Capital markets have reacted to trading shocks since 2000. The research “The uncertainty of trade policy () has a significant negative impact on economic activity. “.

Similarly, the bank in international settlements warned that we face the “negative contribution to both investment, investment and exit, both investment and exit.” However, this year calculates the greatest impact on investment in 2026 – this year is not placed in the tone of a 2 percent lower ratio of capital expenditures in the United States and Japan next year.

Separately, an investigation was requested that a research in danger of deporting millions of undocumented employees Can damage the American economy. Raids of immigration and customs security agencies are currently holding headlines, the real economic impact will not be seen for several years. To shoot an example: The Peterson Institute considers This year, if this 1.3mn migrant is deported, this year “only” 0.2 percent “only” (only “only” (only 1.2 percent in 2028) would cut the GDP. So, time lag problem.

In addition, there is a third possible explanation for the lack of panic: disaster fatigue. Rather, investors, pain, without panic (in the worst case), (in the worst), (in the worst), (in the worst) so admiring that they are so impressed in good way that they are not able to process it.

If you want, the problem of “death with a thousand cuts”. Currently, there is no big shock that can cause a market crash. Yes, when the oil, the further increase in the Middle East War and the closure of the Strait of Hormuz, it would undoubtedly hurt it. And at least, according to the energy economist, according to the energy economist, because Israel’s initial attack on Iran “has been caught with low reserves” and “very large calls” (ie derivative bets ”

However, so far the price of oil is $ 75 or a barrel. Today, the investors are inevitable today, inevitable, a tailored tail risk more than a disaster. Or to use another analogy: the markets are a “heart attack” shock (as during the CovID-19 pandemic), but an economic cancer, in the future. This is not 2020.

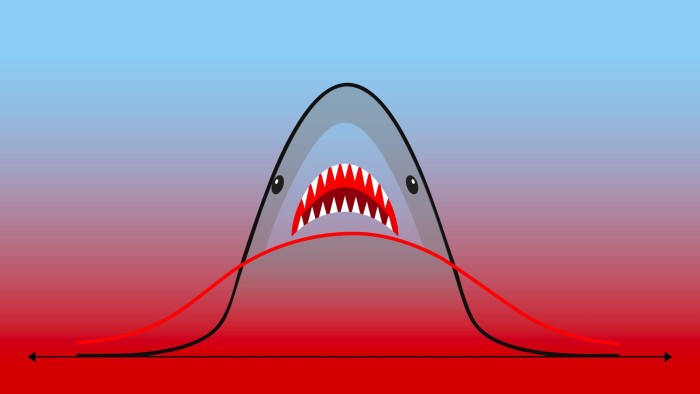

Thus, short explosions of market volatility – as measured by the vix index – then die. This is the reason for this, the reason for the lack of a message from different assets classes. “US capital behaves like a trump, followed by short-term victories” Jack Ablin, Cresset’s Chief Investment Officer. “Long bonds (elon) acts as a musk, it is corrected in longer term, anxious truths.”

And here we are back to the problem of social silence. As investors try to analyze confusing tail risks, most of them do not have deep doubts and even professionals. This means that it cannot get a lot to crack the capital markets; But this means that when it can happen (or if). Sometimes it’s really the silence that shouts in the loudest sound.

[ad_2]

Source link