Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

Will the new CEO of the UnitedHealth Group take a heavy salary package he wanted to give him a plaque?

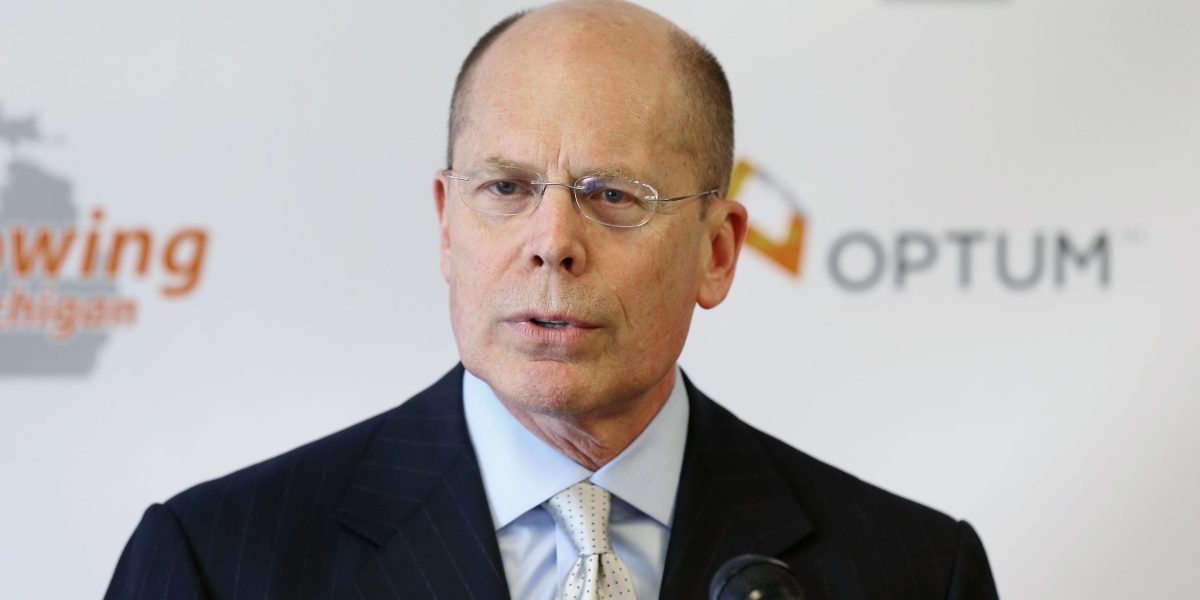

This eight-digit question increases the loss of unprecedented value in the last few weeks of UHG. UHG America’s largest healthcare company, Fortune 500, but in April, but in April, he said he was performing in a surprisingly terrible first quarter. The stock market price then plunged for weeks. CEO Andrew has resigned suddenly for unspecified personal reasons for the prepared person, and the Chairman of the Board took the Stephen Hemsley, CEO.

Hemsley, 73 in June, from 2006 to 2017 to 2017, will try to rescue the Colossus established by the CEO since 2017. Investors have been waiting for a new CEO, Hemsley and other views of the board. The highly unusual payment package created for Hemsley indicates how.

He will receive a basic salary of a year old, but in fact the usual salary of such large companies for the profession. The more important, with a Thing would receive a grant of $ 60 million in a $ 60 million share option: if he had been to CEO for three years, he would receive the payment. He would not receive another shareholder award at that time.

The shareholders will vote for this non-traditional payment plan at the June-annual meeting of the UHG. Institutional shareholder services advise the biggest company to advise large shareholders on voting.

Iss It sees more than one problem with Hemsley’s salary package. So much, the forewords, multi-year-prizes “limit the ability to adjust the future payment capabilities to a meaningful way,” he says. In addition, Hemsley did not need to pay any performance criteria to win the Mammoth Stock Selection Prize; Got everything a day. Hemsley also received a reward for the lowest level of bad news for about five years, ie “a waterfall” is returning to “a waterfall”. “Team, ISS says, says ISS and no voice” does not guarantee. “

UHG, allegedly allegedly allegedly allegedly, why Hemsley returned to the payment package. The company’s central point: “Only the value of the stockholder of the award is only the value.” As for the “wind point” argument of ISS, UHG is “actually” smooth (Emphasized in the UHG document, bold and courageous) shareholders will earn by the company’s share price than the current levels. “

Who is the probability of collecting this sound? The bottom line, Hemsley and UHG will probably get a salary package they negotiated. ISS recommendations are taken seriously, but shareholders generally vote in favor of governance. Although UHG has lost the shareholder of the shareholder of the shareholder to keep these companies in law, the result is just offered and advice; The Board of Directors simply ignored the desires of shareholders. In addition, UHG notes that the main rival, glass Lewis, the shareholders recommend voting the Hemsley’s salary package. “Looking at a cursor”, “(Hemsley’s) (hemsley’s) annual compensation is not excessive.”

Regardless of the result, the dispute voting will be important. UHG will raise already high stakes for its directors and hemsley. For three years, the success of the opposition would be more severe than the heroism and failure.

This story was first displayed Fortune.com

[ad_2]

Source link