Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

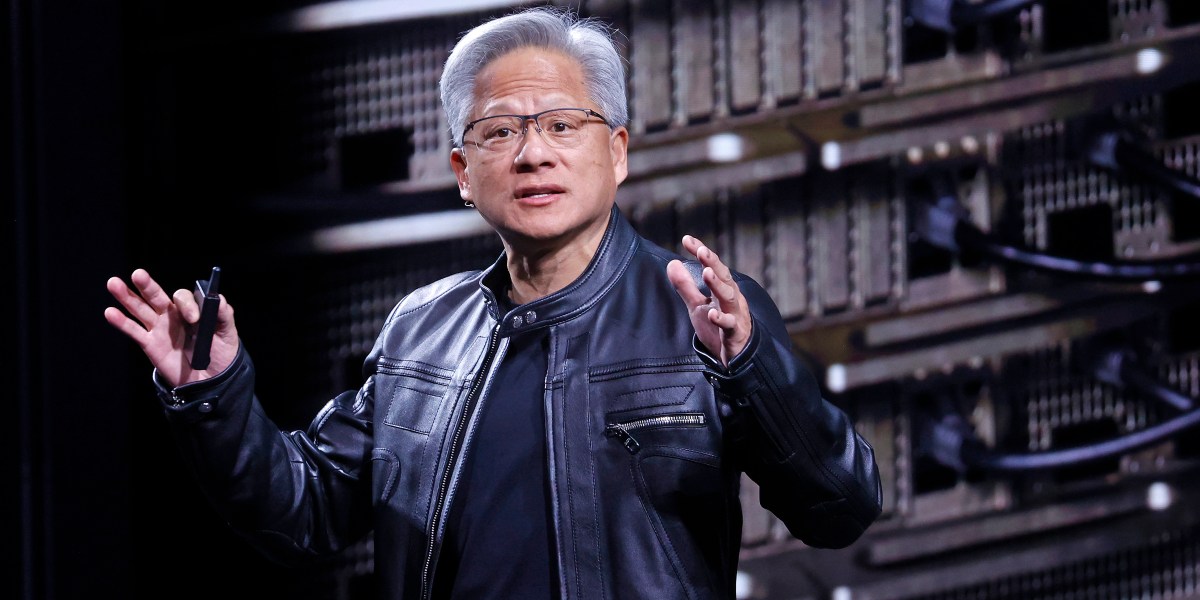

Two years later Nvidia Corpd developed by history weedless The first chipMaker to achieve a market capitalization of $ 1 trillion, the more remarkable stage is in its own: become the first company to reach $ 4 trillion.

Sent shares after China’s DeepSeek revealed turmoil Early this year and the concerns that vehicles related to artificial intelligence infrastructure delayNVIDIA shares gathered a record again.

The largest customers remain in advance spendMost of them flow into computing systems. 66% of a April 66% earned market capital to $ 3.8 trillion Microsoft Corp. It is $ 3.70 trillion to become the world’s most valuable company again. Nvidia shares increased by 1.3% in early trade on Friday.

With expansion The Customer base for the latest AI speeds and competitors of NVIDIA, the bulls are still far from the chip’s shares.

“We believe that NVIDIA is really unparalleled and coincides the next decade to overlap the next decade,” he said.

Hamzaogullari is not alone. This week, Loop Capitalst analyst Ananda Baruah Nvidian price target increased to $ 250 to $ 250 from a level equal to $ 6 trillion. Baruah, a purchase rating in the stock, expects various types of customers to increase to $ 2028 to $ 2 trillion.

“Although NVIDIA seems to be fantastic, it is said that NVIDia is a monopoly and the strength of the price (and margin) for the critical technology.

NVIDIA and AI gears are a knife behind other manufacturers, the emergence of developed conversations such as Deepseek, developed in China, the fears that Nvidia will cut off. Instead, US is technological giants plow More money to the calculation infrastructure.

Read more: Nvidia S & P attempts breaking the range compared to 500

Microsoft, Meta, Amazon.Com Inc and Alphabet Inc. for $ 310 billion in the average of $ 350 billion in capital expenditures in the approaching fiscal years, $ 310 billion in capital expenditures, 310 billion dollars in the current year and analytical calculations. These companies make up more than 40% of NVIDIA revenues.

Of course, there are a large number of risk that NVIDIA may disrupt the rally. The company trusts Taiwanese semiconductor production CO for the production of NVIDIA, which is exposed by NVIDIA to the US President Donald Trump’s trade policy, which can change in the whim. Trump’s 90-day break, will end on July 9.

At the same time, there is no guarantee that NVIDIA’s largest customers in the coming years do not change the tune. Many of them develop their chips to prevent steep prices commeded by NVIDIA.

“Assessment depends on the continuity of the growth, and we must understand the ways of being more effective with their silicons, but also in the Pollen Capital Management Prime Investment Director” and there is no good idea to be comfortable with the evaluation. ”

NVIDIA shares are earned 32 times the projected in the next 12 months compared to 22 times for S & P 500.

The stock exchange rate is not worried about Loomis Sayles, which is a believer who will change the EU society and the main victory for Nvidia’s productivity.

“This does not mean that the spending will not be sustainable, but it is a worldly changing change, and NVIDIA is one of the biggest beneficiaries,” said Hamzogullari. “The stock still looks attractive, taking into account this background.”

[ad_2]

Source link