Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

Nvidia reported Earnings in the fourth quarter After a call that defeats Wall Street expectations on Wednesday. The company also provided strong leadership for the current quarter.

NVIDIA report and his leadership, Chipmaker pointed out that the historical growth managed by the AI well in 2025. Shares increased by 3% in extended trade.

How was the company’s assessments of analysts questioned by LSEG.

Nvidia is expected in the first quarter in the first quarter, plus $ 43 billion or minus $ 43 billion or minus 2% in the first quarter. The first quarter forecast means year A year ago, an increase of about 65% a year ago, a year ago a slowdown of an annual increase of 262% per year in the same period.

In the quarter, net income rose to $ 22.09 billion or the diluted share increased to 89 cents in a period of $ 12.29 billion or 49 cents or 49 cents.

NVIDIA said a 73% common margin in the quarter of three points on the annual basis. The company said that the decline in General Marges is related to the products that are more complex and expensive.

The income continues to increase in NVIDIA, as the company continues to ride AI Boom with the center graphics processors, which includes the vast majority of the market for accelerators. In the quarter of NVIDIA, 78% of the income for NVIDIA increased by 34% to $ 130.5 billion.

However, the company’s growth is slow down as they grow older. FISCAL is sold in NVIDIA in a quarter of 2024 three times as many.

The company’s next generation of AI processors in the focus of the calendar year can send the next generation’s processors, Blackwell.

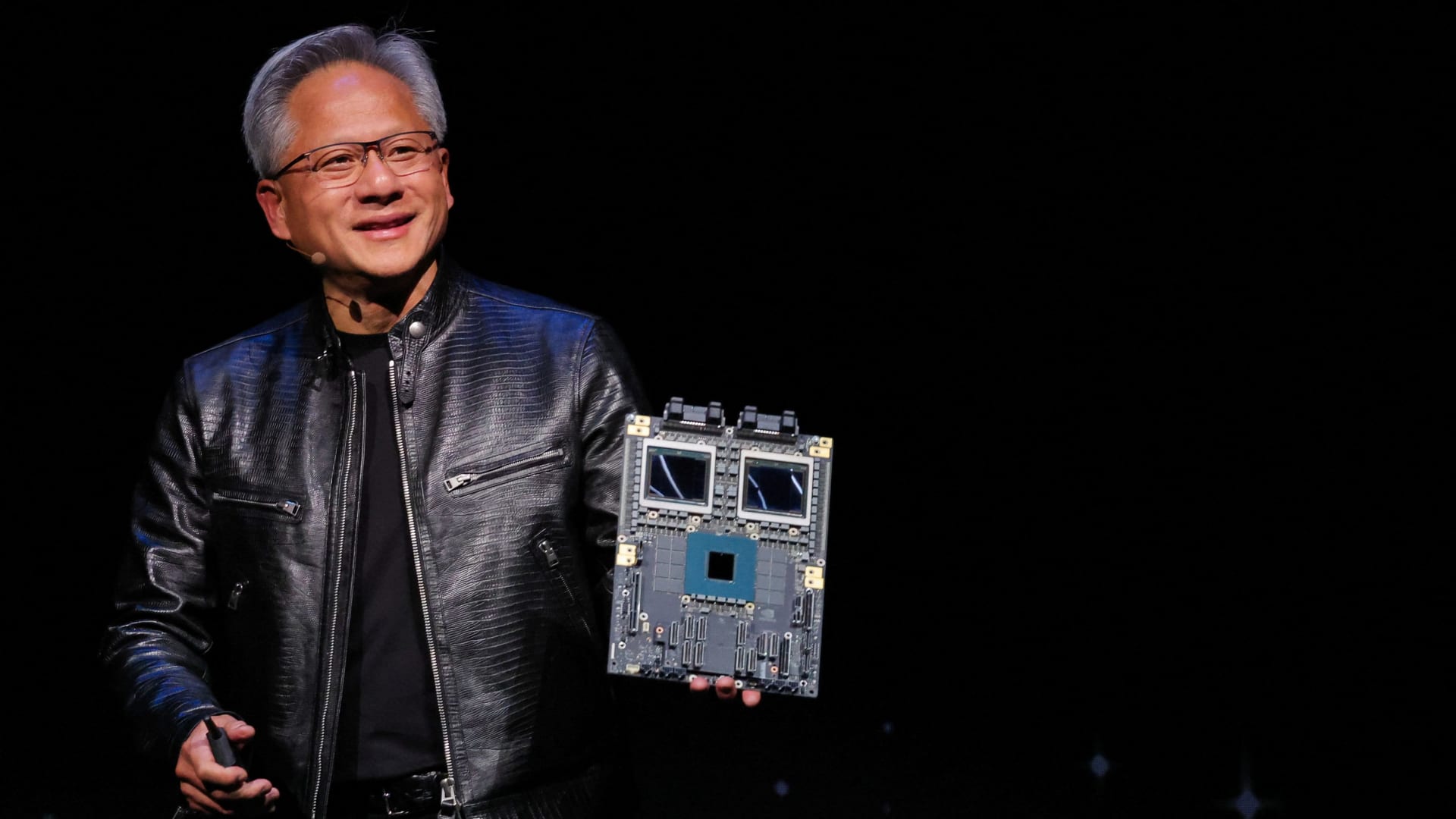

Nvidia said it was $ 11 billion in Blackwell Income during the fourth quarter. NVIDIA CEO Jensen Huang said that the demand for Blackwell was “amazing” in a statement and called the CFO Colette Kress “the fastest product landing in the history of our company.”

“Blackwell sales have led the Great Cloud Service providers representing about 50% of the information center’s revenues,” he said in a sharp statement.

Sales of Blackwell sales, as well as the sale of the previous generation Hopper AI chips, now it is 91% of the company’s total sales, and the company’s information center, which represents 60% in 2023.

Nvidia, in the fourth quarter, 93% of the data center in the data center has earned $ 35.6 billion. This also exceeded $ 33.65 billion to the expectations of the street schedule.

The company’s data center business included $ 3 billion sales for the company’s network parts used to unite GPU’s scores in this quarter. However, the NVIDIA network has the ability to grow the company, and network sales are below 9% per year.

The company’s gaming work, which includes graphic processors to play the 3D game, gave $ 2.5 billion in sales of $ 3.04 billion. NVIDIA’s graphics sales decreased by 11% on the annual basis. The company announced new graphics cards for consumers in a quarter that shares the same Blackwell architecture as the company’s AI chips.

One of the company’s growth categories is to sell work for cars and robots. Nvidia, on Wednesday, a small part of the company’s AI work, but in the quarter of a 103% increase, the $ 570 million in the quarter of the company, he said, he said.

Nvidia said he spent $ 33.7 billion in 2025 sharing sales.

This is the news. Please check again for updates.

[ad_2]

Source link