Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

Unlock the editor’s digestion free

FT editor Roula Khalaf, chooses his favorite stories in this weekly newsletter.

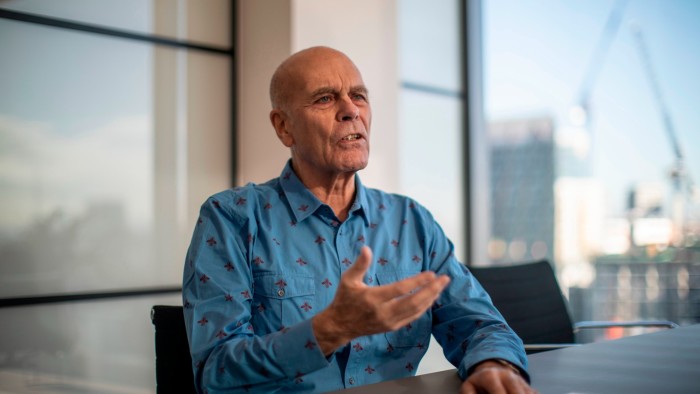

Europe’s Jab Holdings Chair and Management Partner Peter Harf, for more than 40 years, as a fortunate investment group of Germany’s billionaire, a sliding investment group focused on insurance and asset management.

The 78-year-old German CEO Joachim Creus and Frank will be successful by managing the head of the Engelen Jab Announced on Monday. The Creus will be a chair and will serve as an obstacle vice chair.

Harf’s pension ends in four decades, one of the strongest deals in Europe.

A dark German chemicals managed by the Reimann’s family, Keurig Dr. Peppers, Krispy Kreme and JDE Peet, including large countries in the world, including large stakes in the world, are credited to large shares.

Harf, the chemical substances in Bencycer, in 1823, in 1823, helped to burn the heirs of the intensive individual Reimann family, which returned to the Bencycer’s formation.

In 2012, the letter invested in the investment group was built by Jab Holdings. Investments in the family, including consumer brands, JAB partners raised the share of other wealthy families and gifts to more than $ 50 billion.

However, according to the overfier in the CAB’s consumer brands, it was badly affected by dramatic changes in behavior during the pandemic and the consumer spending with the increase in further inflation. Jab, in search of more reliable lucrows, diversifying life insurance and asset management.

Reimann’s family spokeswoman Creus and Engelen “The next generation has made a binding strategic vision to prepare a jab for continuous long-term growth generation,” he said.

The Saft company has launched the couple’s new life insurance section, which has been launched in the last year and the first purchase in the sector. Agreement for the life of a prosperity managing a $ 25 billion asset valuable The insurer is more than $ 3 billion.

Despite its new attention, the beauty group with CAB, bread and coffee shops continues to hold important shares in consumer companies, including Coty and Panera brands. The cost of the Jab portfolio is more than $ 70 billion.

On Monday, the company will remain “full investment” in the company, and said that the non-profit organization of the Revimann’s family will continue to serve as chairman of the Alfred Landecker Foundation.

“More than 40 years ago, I would like to thank the Reimann’s family who entrusted the journey to a lifetime,” he said. “Now it’s time to pass the bat on a new generation management.”

[ad_2]

Source link