Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

Unlock the editor’s digestion free

FT editor Roula Khalaf, chooses his favorite stories in this weekly newsletter.

Blackstone Group is preparing to significantly increase their investments in Europe until the odds of the privately capital group bets will grow after the aftermost years.

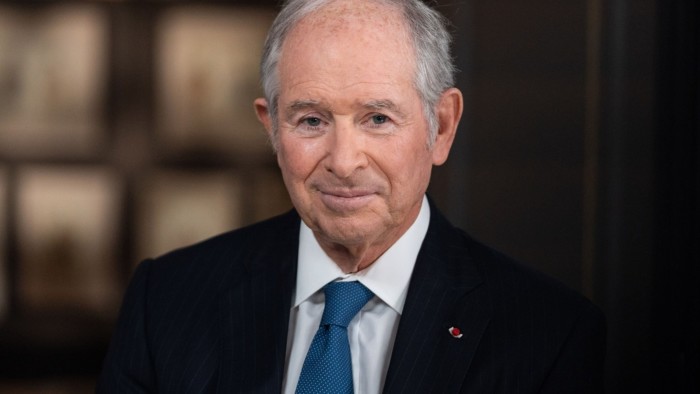

1.2TN In-Assets Investment Group Co-founder Stephen Schwarzman, explained financial time in an interview Black stone In the next ten years, he planned to invest in Europe at least 500 billion, because the continent has a large lender and large infrastructure and huge infrastructure and private capital.

“Now we see the signs of change Europe“Schwarzman.” European leaders are generally more sensitive to the fact that growth rates are very low over the past decade and are not continuously for them. Thus, they look at the European Union in connection with the regulation. We think that Europe has a better job prospect than they have in the past. “

Schwarzman, new Chancellor Friedricher Merz, as a positive change in Europe, a new chancellor Friedricher Merz, allowed to finance a positive change and defense investment.

“In the next 10 years, we will put a new asset for at least $ 500 billion in Europe. I hope things go well and more,” he said, “said the continent” there is no momentary treatment for the economic NASA. ” “In different countries in Europe, the old people recognize the need to change all older people … Positive.”

SCHWARZMAN’s investment target, which first informed the region for about 25 years, records an important acceleration in Europe for about 25 years. “To make $ 500 billion (investment) in 10 years,” he said.

Blackstone’s opponents in the special capital industry are also increasing more optimistic about investment outlook in Europe. Apollo President Jim Zelter This month ago said He planned to invest up to $ 100 billion in Germany for the next ten years. Special capital group Thoma Bravo, who found a nest in a program, recently opened a European headquarters and began to hit the US opponents to take advantage of the evaluation cavity.

Schwarzman spoke to FT and many large black stone leaders celebrated the 25th anniversary of Europe, which established a new regional headquarters in Berkeley Square.

In recent years, the Italian Infrastructure Group of Italy in late 2022, 54bn privatization of the Atlantion and Norwegian online announcements Adevinta, including 14 billion euros privatization, including 54 billion euros.

Schwarzman said the growing excitement for the European factors in a vacancy in the assessments between European companies and peers and peers of the US peers listed in the United States. However, it is mainly hed on an increasing conviction that made economic reforms.

“There are clear assessment differences between the United States and Europe, which we have found in special capital and real estate and real estate and infrastructure. But you need all these factors,” he said, economic reforms and interest rates are declining. “Only cheap prices are not always the correct answer.”

[ad_2]

Source link