Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The slogan of the gaming industry for last year was “to live in TIL 2025.” And in some aspects, this was not just a desirable thought.

Sunday researcher, which is divided into industrial 2024 Ddm saw the positive signs. In the books in a quarter of 2025, no one seems to be stretched in the right direction when it comes to Investment or M & A.

Q1 2025 is not only in the second quarter of growth, but also in the largest quarter, combined games and M & M & M & M & M & M & M & M & M & M & M & M & M & M. – $ 7.8 billion (+ 1%) compared to M & M & M & M & M & M & M.

Q1 2025 Investments increased significantly in the 1990s compared to $ 94.9 million compared to $ 94.9 million in $ 94.9% worth $ 94.9% worth 370% (worth + 370%) and Q2 in the largest quarter in 2022.

Q1 2025 M & worthless decline is $ 3.3 billion in 55 billion dollars of $ 3.3 billion (worth $ 53 billion in 36), $ 55 billion in operation.

And in the quarter of the quarter, $ 21.8 billion in the Fund, $ 21.8 billion (+ 122%), Q2 in $ 9.8 billion in $ 9.8 billion in $ 9.8 billion (+ 13%) has been observed; The increase in the value of 2.2 times by the increase in the cost of five funds in collectively above $ 14.3 (65% of the capital was removed).

Mitchell Reavis, DDM Games Investment Review Director, “The survival of Til 2025”, became a mantra for the game industry for the last turbulent years. the direction. “

Q1 2025 Investments $ 4.4 billion worth $ 4.4 billion in the 190s ($ 945.9 million) compared to $ 370% in the 207s) Since 2022, the cost of $ 2022 and -8%); This achievement can be linked to $ 3.0 billion and a phased investment from Sterling SELECT (67% of one quarter).

The company Said Q1 2025 was $ 4.0 billion in investments in the game development investments (+ 457%, 141 in investments worth $ 720.0 million and -27%, -27%).

Artificial intelligence and the game industry artificial intelligence investments in 32 investments in 32 investments ($ 2288 million) and $ 2,270.2 million in the games industry, $ 2,272 million (+ 74%) between 56 investments).

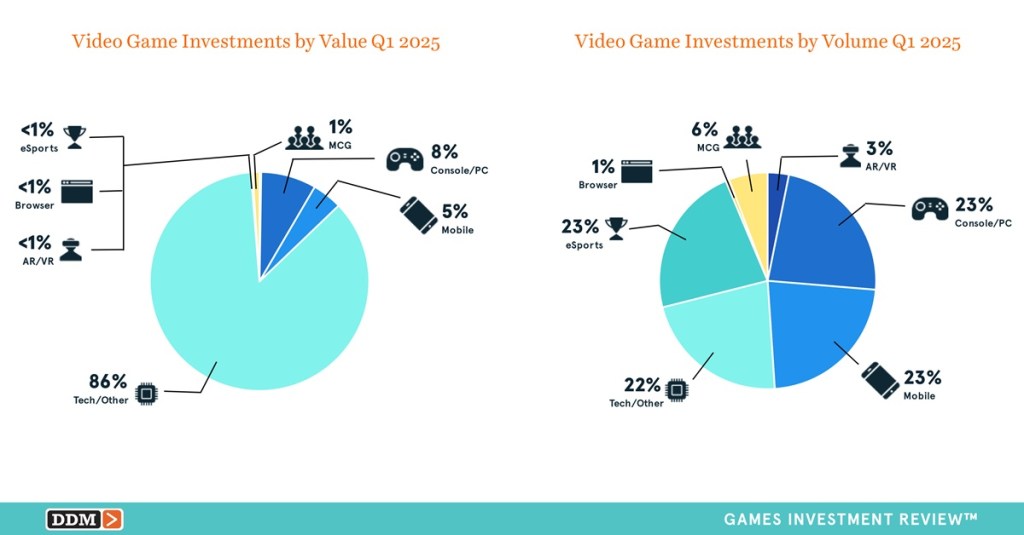

The highest segment, console / PC (8%), mobile (5%), especal (<1%), AR / VR (<1%), AR / VR (<1%) and browser (<1%) and browser (<1%) and browser (<1%) were carried out by technological / other (86%).

And 93 investments in Q1 2025 (49% of the quarter); Using a historical average to evaluate undisclosed investment values, Q1 2025 reached $ 4.9 billion [+/- $179.1 million].

Quarter’s M & 55 operation ($ 53 million worth of $ 53 million worth 36% (36% worth 36%), 63 transactions since 2022 years, the result of the total volume or total average of 67% of the average average.

Q1 2025 Game Developer M & 26 $ 2.1 billion in operation ($ 7% worth $ 2.1 billion (+ 7%, 17 billion in $ 2.0 billion between $ 2.0 billion). + 7% and + 53%).

The highest M & A segment, Concore / PC (36%), MCG * (1%) and mobile (1%) and the mobile (63%) were carried out by the Esport (63%).

Asia, in both European and North America’s cost and volume of Asia and $ 1.3 billion in the amount of $ 1.3 billion) and $ 1.2 billion worth $ 1.2 billion (worth $ 1.2 billion), and the value and 40% of the volume), and the value of the value and volume), and the contract values were not disclosed.

Q1 2025 outputs (M & A + IPO) 56 operations in 56 operations 56 billion (+ 10% value and $ 5.1 billion in volume worth $ 5.1 billion in $ 5.1 billion and 39%) have been $ 2024 in the largest quarter since 2027 to $ 2024.

Grand Centrex’s combination of the SPAC Reverse is the first such operation since Semper Fortis Esports’ Q4 2023.

Sole IPO of the First Quarter, a market capitalization worth $ 2.2 billion ($ 15.038% worth $ 15.9 million compared to market capitalization with 3 iPo) and -67%).

The highest performance with the cost of the segment (M & A + iPos), mobile (37%), console / computer (22%), MCG * (1%), esp (1%), espoop (<1%), was carried out by technological / other (40%).

[Note: DDM tracks announcements from venture capital firms and funds on the new capital they raise that eventually become deployed in the investments in its reports].

The new Foundation of the first quarter ads was 43 the Fund of $ 21.8 billion (+ 122%, 38 billion dollars between $ 9.8 billion), in the largest quarter for fund ads since $ 25.1 billion; The growth of the GOQ value of 2.2 times with five funds, over five funds (65% of the capital), China ($ 3.9 billion), Thoma Bravo ($ 1.9 billion), Haun enterprises ($ 1.0 billion) and the Indian government ($ 1.0B).

Worth to pay attention: All this capital will not be placed in games. Artificial Intelligence and Blockchain still targeting the EU from enterprise capital companies amounted to $ 5.2 billion (+ 128%) and $ 2.3 billion in the Fund, $ 22% (+ 22%), $ 22% in 14% of $ 1.7 billion (+ 22%).

The 28-billion dollars of the pounds of the stage-agnostic funds were $ 10.9 billion (65% of the value and 65% of value) (65% of value and 50%) worth $ 10.9 billion (value and 50% of the value); only 50% of value and 50% of value and volume); only 50% of value and 50%); only $ 65% of value and sound levels $ 2.1 billion (cost of 10% and 5% of volume)

* Mass community games (MCG) are games controlled by online community game. Includes MMOs, Mobas, Battle Royale and Metaverse games.

In reports values, the DDC only includes deals when it is not just announced when the investment or purchase is concluded. This methodology has been consistently used with DDM data for 17+ years and ensures the measurement of the actual activity instead of the company’s potential activity.

In addition, with Spacs, DDM, the work of the work raised in the operation, is not considering the company’s evaluation, but to be in the next assessment. This follows how the DDC is watching the investment information, which follows the money that the company’s influence on the company’s total enterprise value.

The expulsion of the defined transactions may result in a large difference between the total quarterly and other companies of the DDC, but the DDC has a clear view of the money placed in the last quarter, the gaming industry for investment and shopping companies.