(Bloomberg) – Federal Reserve officials have continued the ratio of interest for the second flat congregation, among the second flat congregation, because the economy is slowed and the inflation is stubborn.

Most read from Bloomberg

The department Jerome Powell has acknowledged the degree of uncertainty from the important policy changes of the President Donald Trump, but the repetitive Central Bank is not in a hurry to adjust the debt costs. According to him, officials can be more clarified to influence these policies before the acting economy.

On Wednesday, the Federal Open Market Committee voted to keep the ratio of federal funds at 4.25% -4.5%, and it will slow down the pace that reduces the balance sheet. Governor Christopher Waller, supporting the caught ratios, moved on the balance sheet, which is not separated from the decision.

The decision to be a continuous proportions, Trump’s ambitious and often wrong policy agenda is also in addition to the ability to keep it on the road under the growing pressure. Trump’s US-trade tariffs have cut off the economic slowdowns to pay tariffs and increased fresh concerns on inflation – new concerns that can draw politicians in the opposite direction.

“Inflation began to move upwards,” said Powell said: “This year may have a delay in progress in this year.”

Powell said that the main thing will be “passage” of any tariff bulging in inflation, but it will be very difficult to say how much inflation is caused by other factors.

S & P 500, Powell’s spoke and the treasure product was moved down.

Updated forecasts

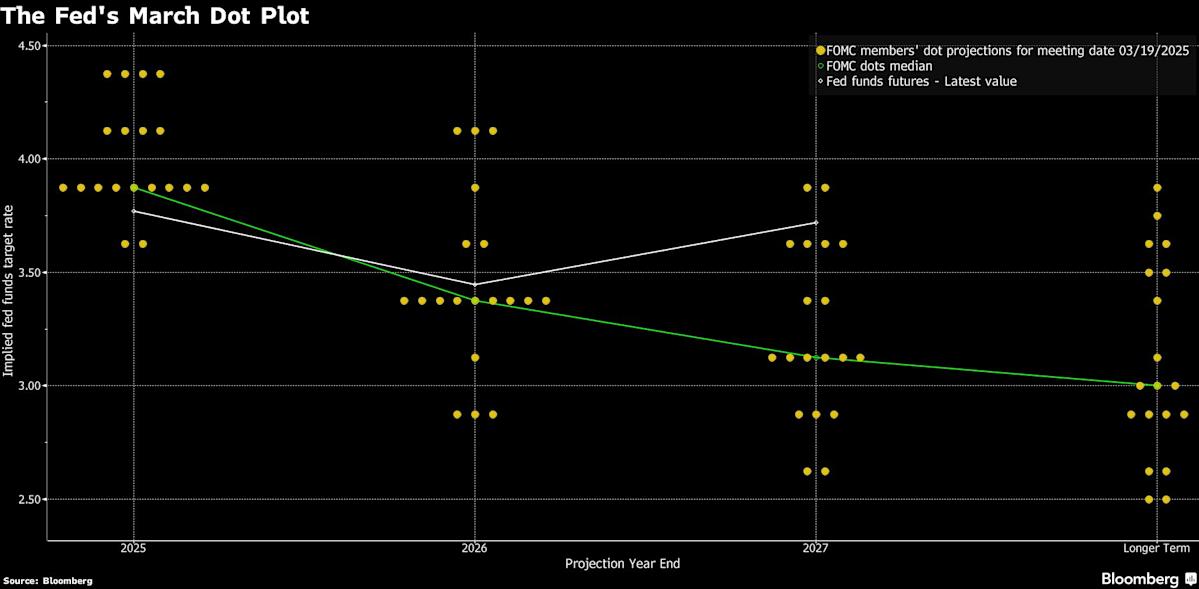

New economic forecasts showed that the authorities have increased their predictions for growth this year and increasing inflation assessment. In addition, the authorities showed that the two-point percentage of parents this year continued to reduce the pen-half percentage of the two-point rate.

This saw a reduction or less of the officials, saw this year less, and the solution of politicians – at least, even if so far the inflation is lying on inflation, but also put inflation so far.

Powell said that for the lower growth and higher inflation, the worldview of money policy is not changing because it balances each other.

DOT plot, explained: how the Fedin understands how to understand

“Uncertainty has increased in the economic outlook,” the committee post-session statement. Authorities also reported that the risks of achieving their work and inflation goals are about balance.

Authorities lifted the median estimate for such so-called inflation, which leaked volatile food and energy prices at the end of this year, up to 2.5% by 2.8% at the end of this year. Their outlook was cooled by 2.1% to 1.7% of the economic growth of 2025.

In December, 4.3% of them saw up to 4.4% to 4.4%.

Changing picture

Fed officials continued this year after the end of 2024 in the end of 2024.

Inflation in that period, the expectations for the future price increase in consumers climbed as a result of an increasing trade war. Expenses were softened and the consumer confidence was dramatically deteriorating.

Powell said that the recession rises the strangers, but not high. Specifically, as a concern, especially stressed that Fedin stressed, but stressed the fed. He opposed the University of Michigan, showing a sharp increase in long-term inflation expectations, called “foreign”.

“We understand that the feeling fell into a very sharp, but we still watch the economic activity,” Powell said. “I would say that the economy looks healthy.”

Investors reacted negative to the installation war and concerns about the growth worldview, S & P 500, S & P totaling more than in the middle of February before receiving part of these losses.

Trump management facilitated the president’s degradation in March 9, the President of the President of the US economy “transition period”. Treasury Secretary Scott Bessent said that the US economy and financial markets need “Detox”.

Balance sheet

Fed, starting in April, in the amount of treasures in the balance sheet, said that without re-investment, to grow up to $ 25 billion without investment, he said. It will leave the lid on mortgage-supported securities for $ 35 billion. California preferred to continue the current pace.

Various officials think the committee in the January session of the federal government to the debt of the federal government until the debt ceiling, until the federal treasure debt will be resolved. The United States has hit this limit in January.

The Fed first reduced the portfolio of assets in the PACE – offered to reduce potential tension in the money market.

– Help the Assistant from Jonnelle Marte, Matthew Boesler, Vince Golle, Liz Capo McCormick, Laura Curtis and Craig Torres.

(Additional comments from Powell starting from the Tenth paragraph.)

Most of the Bloomberg read from BusinessWeek

© 2025 Bloomberg LP