Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

Tuesday, Canadian raw products are expected to increase gas prices as part of the Tariff Plan of President Donald Trump.

Trump management 25% tariff applied Overcoming from Canada and Mexico to imports, caught in 10% of carved oil products.

The United States is grossly imported 4 million barrels One day from Canada. The majority is sent through pipelines to the Midwest, Rocky Mountains and the Great Lakes region. The new England gets delicate products as gasoline, diesel and jet fuel, ie fuel prices, ie fuel prices will be likely to grow in the first place in this region.

Maine, Vermont, Connecticut, Massachusetts, Rhode Island and New Hampshire, Gasbuddy will start to rise from 0.20 to $ 0.40 per oil analysis, Patrick de Haan.

Read more: What Trump’s tariffs mean for your economy and wallet

“It’s only the effect of tariffs” de Haan Yahoo finance, noting Annual Change to a More Expensive Summer Mix There may be more impact prices.

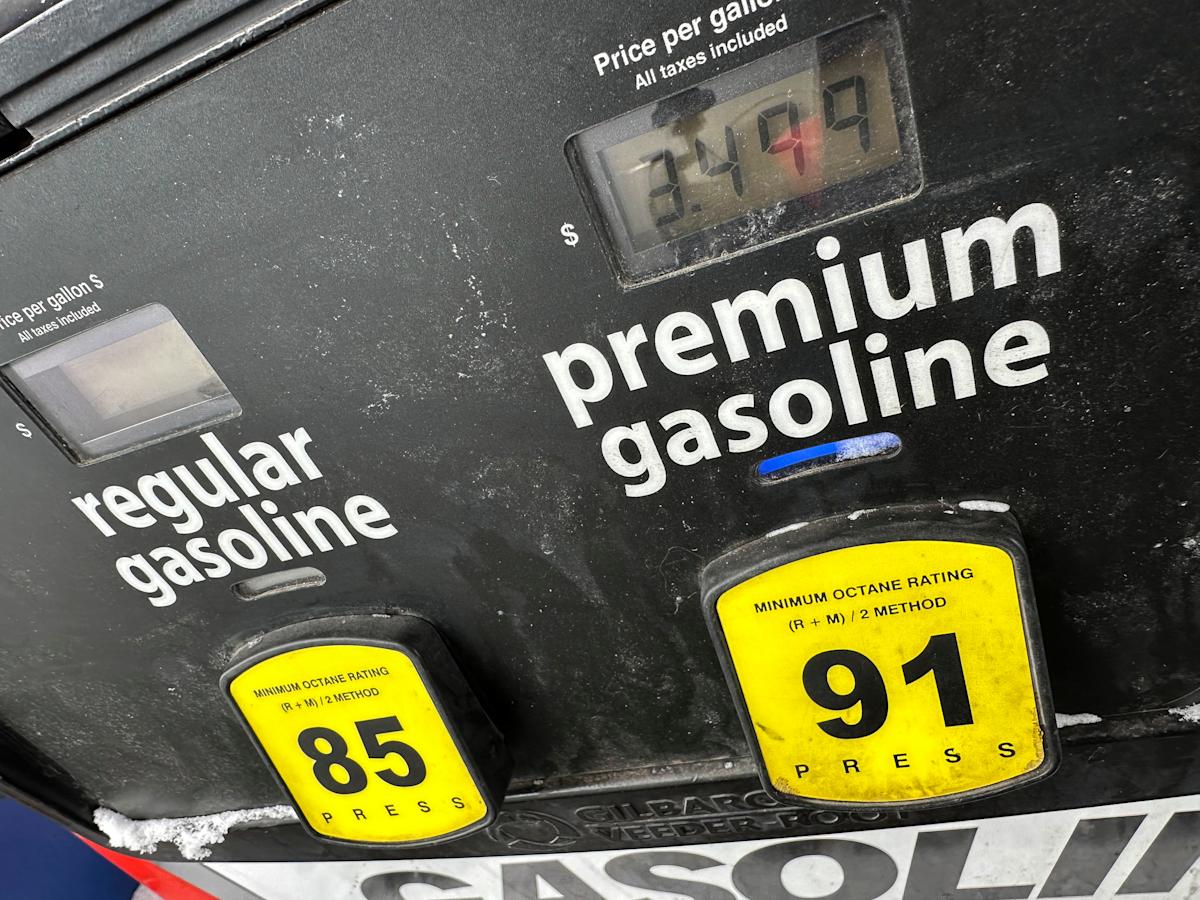

National average price for gasoline on Tuesday, a month ago and a year ago, about $ 0.25 per year, $ 0.25 and $ 0.25 According to AAA data.

“Many service stations expect to rise to $ 0.155 to $ 0.25 per gallon,” Andy Lipov, Lipow Oil Associates told Yahoo Finance.

Canada’s largest oil refining operator, Irving oil, He said last month If tariffs are carried out, it will increase the prices for the North-Eastern United States, where most of the company’s customers are located. Irving oil did not respond immediately to a survey for comment on whether prices did not increase prices from Yahoo finance.

In the event of a strong importance of crude oil, Goldman Sachs analysts, taking into account the limited infrastructure to export Canadian companies to other markets, waiting for Canadian companies to be partially.

Canadian manufacturers and US consumers will share the lower part of the cargo of “Most of the cargo” because the apartments will begin in the middle distance, “Daan Struyven, Goldman Sachs will further decrease in Goldman Sachs.

The medium term, the company may fall, because oil prices can fall, because continuous extensive tariffs will draw on global growth and demand. This will affect the price of gas.

On Tuesday, after restoring part of the Oil Exporting Countries (OPEC) organization (OPEC), it decreased by 2% to reduce damage from the previous session.

[ad_2]

Source link