(Bloomberg) – President Donald, along with futures for Europe and US markets, the work for Europe and US markets, the work on the steps of the economy for the economy and growth for the economy and the growth of the work for the economy and growth.

Most read from Bloomberg

Australia’s Benchmark S & P / P / ASX 200 index is sold in near a correction near an amendment, a regional stock is sold. Treasures were strengthened against one-10 peers before the consumer inflation reading of flowers and dollars on Wednesday.

After 100 after 100, after 100 after 100, after 100, after 100, the United States did not see the fall of Wall Street around the US Commercial War. Contracts for Europe jumped up to 1% after Ukraine accepted the US proposal for a 30-day reconciliation of Russia.

Trump’s tariff policy, geopolitical realizations on Ukraine, adhesive inflation and the federal spare rate increased and the unknown pace hit the markets this year, leaving us on the verge of adjustment. The second size of the exchange rate is the highest level since August, and a similar measure for treasures since November, market participants are seen as annoying about the US economic growth.

“Any relief from all this geopolitical noise is now a good thing for the markets.” The tension between the ceasefire and the United States and Canada in Ukraine helps. “Things are completely different in just eight hours ago.”

Trump, the best managers, especially the environmental rules, especially in the priority of the environmental rules, said it was planned to announce a large power project. If a company produces products in the United States, a company repeated a proposal that business taxes can be reduced.

Goldman Sachs Group Inc, strategists have cut off the largest economy and the struggles for the increase in the “magnificent 7” shares.

Get a daily newsletter to learn what the Daily Bulletin moving shares, bonds, currencies and goods.

Trump tried to riss the degradation of the recession in the US economy.

“I don’t see it in general. I think this country’s boom is going to go.” In the White House. He added that the markets “intend to rise and descend. But you know that we need to rebuild our country.”

In geopolitics, Ukrainian President Volodymyr Zelenskiy, who is in a confrontation of a low oval office in less than two weeks in less than two weeks, put pressure on Russia to adopt a ceasefire agreement with US President Zelenskiy’s consultants.

The United States and Ukraine talks were reached by the US and Ukrainian talks in Russian President Vladimir Putin for a 30-day conflict in connection with the hinges in connection with the 30-day conflict.

The latest tariffs in Trump’s steel and aluminum imports on Wednesday, the best trade partners of the United States are most often the best trade partners in the United States in a risky proposal in the United States, in a decades. The President announced the last month’s plan to apply a 25% fee in metals.

The European Union has been plans to apply a duty worth 26 billion euros ($ 28.3 billion) against new US tariffs of steel and aluminum. The European Commission announced that the EU executive branch will advance to the “fast and most proportional” measures.

In Asian corporate news, Hong Kong Cathay Cathay Cathay Pacific Airways Ltd, gave the earnings to defeat the assessments. The airline warned about a vague worldview due to the cargo compartment due to global trade conflicts.

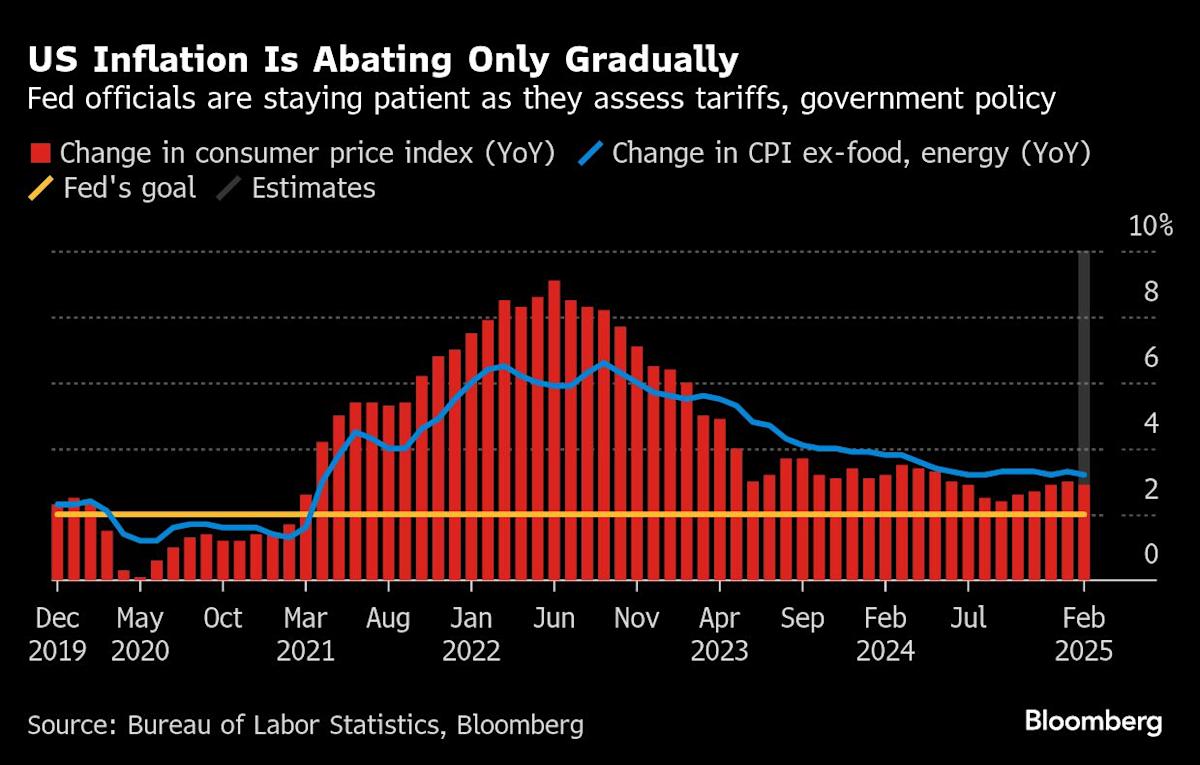

US consumer inflation forecasted Wednesday, economists, the evidence that prices were not fully in January. The consumer price index is considered by 0.3% in February after increasing by 0.5% earlier year.

Markets “will be careful about the signs of glue prices,” he said. “The more proof of inflation to squeeze the current level, Fedin, Trump’s economic policy will increase the importance of reducing the proportions when the sediment decreases.”

In commodities, the United States has made an oil profit as the forecast for a global oversupply. Supported by gold, Haven’s request.

Is tariffs more important to US stock markets in 2025? Share your views here in the latest MLIV Pulse request.

The main events this week:

-

Canadian Degree Decision, Wednesday

-

US CPI, Wednesday

-

Avrozona Industrial Production, Thursday

-

US PPI, Preliminary Unemployed Claims, Thursday

-

US Michigan University Consumer Sententi, Friday

Some basic movements in the markets:

Shares

-

S & P 500 futures increased by 0.2% to 29 hours

-

S & P / ASX 200 futures decreased by 1.3%

-

Japan’s topix growth has increased by 1.1%

-

Hong Kong was hanged in Seng 0.3% fell

-

Shanghai composite rose 0.1%

-

EURO Stoxx 50 futures increased 1.1%

Currencies

-

Bloomberg Dollar Spot Index increased by 0.2%

-

Euro fell from 0.2% to $ 1,0896

-

Japanese new fell to 0.3% to each dollar 0.3%

-

Sea yuan fell to 7,2392 to 0.2% for each dollar

Cryptovalas

Bonds

Commodity

This story was produced with the help of Bloomberg automation.

– Help Matthew Burgess, Chris Bourke and Abhishek Vishnoi.

Most of the Bloomberg read from BusinessWeek

© 2025 Bloomberg LP