Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

Unlock Watch Bulletin Free from White House

Your guide to Washington and the world for the 2024 election of the United States

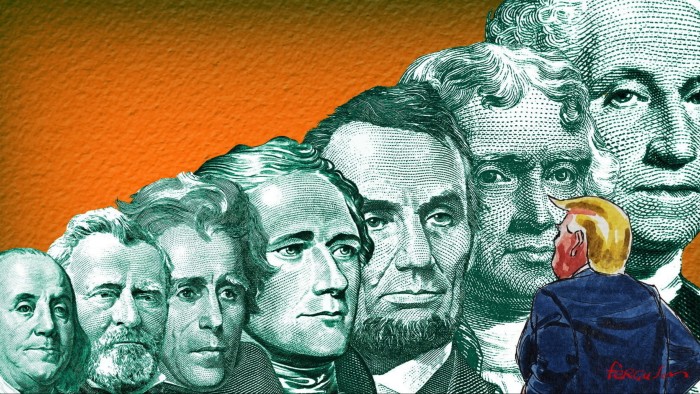

Last week I tried things that condemn the Trump Administration’s international economic policy as Sanewashing. In other words, I asked Logic and evidence that the members of the leadership could be the logic and evidence that Stephen MiranChairman of the Council of Economic Consultants, arguing.

Professor of Berkeley Brad support These counters unrelated: “To make deals, you need the opposite parties to take you as a bargain. Donald Trump shows that he is not every day. “I agree – and said.

However, still there may be important policy issues here, and if so, what you can do about. So, Scott betThe Treasury Secretary, in the beginning of this month, along with global security in the beginning of this month, “(USA),” offers reserve assets. Similarly, Miran, Dollar, “The dollar, which brings benefits to the American production sector that benefits the financial sectors of the economy, claims that the dollars are chronically appreciated.

The starting point of the mera is the dispute of Robert Triffin in the 1960s that has created demand for foreign exchange reserves and related trade and current account deficits. However, this country is not the only way to collect foreign exchange reserves. Like Maurice barrierThe IMF’s former chief economist, Peterson claims to be able to replace other foreigners in a blog for the International Institute of Economics and other foreigners for the holding in the United States. They do not contain the only reason for foreigners to buy US assets. Like Paul Kargman Notes can only ask the US assets.

However, the requirements for reserves are sometimes an important factor in the global balance of global payments. Their total cost was almost sevendrangs since 1994 since 2014. This was controlled in a large part of the desire to develop to protect against future financial crises. However, in Chinese, the largest owner, it was stiled from the desire to find a speech for deposits and create export-managed growth. Meanwhile, Eurozone, one of the other goals of Trump, increased its reserves to $ 72 billion in the late 1999 and 2024. (See diagrams.)

More fundamental forces are in the workplace than the desire to collect resources. These are differences in trends to save and invest. Some countries will increase deposits over investment and therefore manage the current account surpluses and a suitable capital account shortages.

This is not necessarily problematic. But problems may arise. One is that the system creates crisis for the capital between the world. The only countries that can manage such crises safely, the home money is also a reliable reserve currency. In developing countries, politicians often have been the reason for the operation of the current account.

Another reason is that if a country is running such surpluses, which will produce a surplus of goods and services supplied in domestic consumption and contrary. Thus, a factor of relatively large production sectors of economies with high deposit rates such as China, Germany and Japan, another factor for the United States and the United Kingdom is good for further reduction of exported exports).

In general, then, the countries that are used in the countries are also accompanied by the accompanying immigrants. Thus, the masters in this administration, including Trump, are not wrong: If the US current account surplus, the production sector would really be larger. But they died just to believe that it belongs to the resources. They do not properly solve the necessary conditions for such a balance.

If the United States will eliminate the current account deficit without investing, it is necessary to increase the deposit rate at least 3 percent (or $ 850 billion) in GDP. This would be up to half of the financial deficit. As it is like Kimberly claising Peteron Beynəlxalq İqtisadiyyat İnstitutunun, gəlir-maksimum dərəcədə, the-the-the-the-the-the-the-the-the-the-the-the-the-the-the-the-the-the-the-the-the-the-the-the-the-the-the-the-the-the-ildə ildə 780 milyard dollar qazana bilər. Moreover, such a tariff can improve the terms of the United States by reducing the relative prices of imports. But it would be regressive and including global and internal economic activity, including pest Competitive US exporters. In any case, Trump seems unconditionally in such management policy.

Thus remains a great question: How do Trump technocrats expect the necessary macroeconomic adjustments to take place? Their suggestions are half baked. If the goal is not to use inflation tax, foreign public debt does not mean compulsory conversion plans and depreciation. The United States tested this in the 1970s: badly ended!

It is more important, what is this? Yes, if the current account deficit is eliminated, the production sector would be a little larger. However, the parts of the security or another deeper purpose would not necessarily grow. Moreover, nothing can prevent a long decline in the employment part of the production. The manufacturer is going to agriculture: Rising productivity will win.

Even the cutest, then, Trubonomics irrelevant and not appropriate. The actual life version is worse.

[ad_2]

Source link