Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

Business correspondent, BBC News

Getty pictures

Getty picturesTrust to the US economy decreases because of the increasing concerns due to the influence of Donald Trump’s tariffs of Donald Trump.

Governments bonds – mainly to collect money from financial markets for the public expenditures and pay interest in exchange for it.

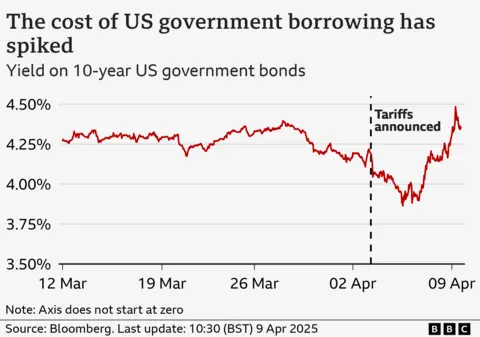

As the US bonds are evaluated as a safe investment, the US do not see high interest rates on high interest rates, but on Wednesday prices have been dramatically spoiled sharply 4.5%.

If the dance, Trump’s goods imported to the United States, Washington’s trade war with China increased further.

After the United States applied 104% of tariffs from China to Midchure products from China, Beijing returned to American products with 84% Levy.

For several days a few days, the stock markets were severely afraid to react to the Global Trade War and a higher price.

However, the sale of bonds in the United States is a great problem for the world’s largest economy.

Interest rate – or productivity – for more than 10 years for the US government, from 3.9% to 4.5% over the past few days, has been the highest level since February.

Economists were found to economists, because the US bonds traditionally seen as SAFHING as SAFHING for investors during financial conflicts.

“Rising bonds, bond productivity, debt and, of course, are higher expenses for governments,” said investment analysis at AJ Bell

“Bonds must do good in Turmoil times, because the Trump’s trade war now violates the US debt market, because the investors fled to safety,” he said.

US government debts have fallen as lost due to interest rates and bonds due to investors downloaded by investors.

Mohammed El Eriri, General Economic Adviser and the largest bond manager Pimco’s former boss, a reason for the costs brought by debts, said it was a reason for the “erosion” of bonds seen as a reliable shelter.

Tariffs added concerns about inflation and the US government budgets.

Some analysts continue to reminiscent of the US Federal Reserve – the US Federal Reserve – the US Federal Reserve – the mini-budget of Liz Truss lasted in 2022.

“We do not see another choice for the Fed, but we do not step forward in the U.S. treasures in order to stabilize the US bond market,” he said.

“We are entering the unchanged area,” he said.

Mr. El Erian is taking into account the BBC world and the main mandates of the Fed, managing inflation and maximize employment.

Economists predict the tariffs to be paid by American companies from abroad by American companies, which will increase consumer prices locally.

Trump’s plan is to protect American work from a foreign competition and also increase local production.

However, additional taxes of the fears can cause additional taxes, companies’ profit, resulting in the work of firms and the interruption of the economic crisis.

Investment Banking giant JP Morgan increased the possibility of the recession from 40% to 60%, and warned American policy to “walk away from growth.”

Chief Economist Shimon French, Panmure Liberum, told the BBC, the Fed could decide to reduce a proposal to protect us to protect us to protect us to protect us for more expenses.

He said that the United States is a “throwing coin” in connection with the lack of a recession.

This is usually defined as a long and widespread dissemination of economic activity characterized by unemployment and income.

Mr. El Erian said that Britain can affect the sale of US bonds.

“When US sensitivity, the UK government bonds hold a cold – we have seen significant progress in British bond products, which are more pressurable to the budget,” he said.

The growing bond productivity of UK means “higher debt costs for companies and households.”

The Bank of England has contributed to the growth of material growth in “global growth risk” and financial stability. “

“Uncertainty has strengthened,” he said.

Investors now bet on the bank to reduce interest rates four times, increase the economy against potential economic decline.

US Treasury Secretary Scott Bessent’s “NOM” of “” NIN “of” of “” of “” of “” of “” of “” of “” of “” to return and produce income and increase income, increase income and increase income and increase income and increase income and increase income. ” He claimed that he would bring, increase salary, increase income, increase and increase purchase.

He said that the Trump leadership was looking for “the right mistakes of long-term global trade imbuilders.”

Questions remain on a scale and do what kind of bonds of investors are.

Some foreign countries, such as China, can buy some foreign countries, such as China.

Mr. Saravelos warned this trade war could be “not winning”. “There will be a global economy,” he said.

[ad_2]

Source link