Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

The tax season is made.

And this year, Republicans in the congressional turned the tax season into the “Sales” season. Republicans and President Donald Trump 2017 They push the tax cutting package to confirm a bill to re-adopt. Otherwise, these taxes end this year.

“We have to completely make tax discounts permanent,” he said. Tom Tiffany, R-Wis., Fox business.

“We must get the president’s tax discounts and workplaces. This is completely important,” he said.

If the Congress does not move in the next few months, approximately each of the proportions for each American spike.

Belief in Democrats lowers all the time in the new survey

Home speaker Mike Johnson, R to. (Tom Williams / CQ-Roll Call, INC via Getty Images)

“We are trying to prevent tax increase in the most sensitive populations in our country,” he said. “I’m trying to avoid the recession.”

If the Congress stumbles, a partisan tax foundation estimates that a couple of married couples who have two children have earned a few years a year – the tax added $ 2,400. A parent who does not earn $ 75,000 every year can see a $ 1,700 load with a tax account. A parent of two children who brought $ 52,000 in a year in a year is charged for $ 1400 a year in a year.

“It is very important. It is an additional Mortgage or an additional rent, “he said. And returning to politics before the 2017 tax discount would be a dramatic tax increase for many.”

However, the technicalities do not cut taxes.

“This is as simple as I can do the bill. This is to keep tax rates the same,” he said.

Congress, 2017 tax reduction should be reduced this year that the bill should have written a project in a way. Was for accounting purposes. Congress, thanks to some challenging mechanisms, it was not necessary to consider tax discounts against the shortcomings – when it ends inside a window. However, the result was that the deputies were able to rise when the taxes updated their old discounts.

“It sinks the sun and thus you only return to the level of taxes automatically before 2017,” S you said. Chuck Grassley, R-Iowa.

The last Fox News request believes 45% of those examined and 44% of independents have sufficient taxes.

Democrats hope to be angry with the tax differences accepted against Trump.

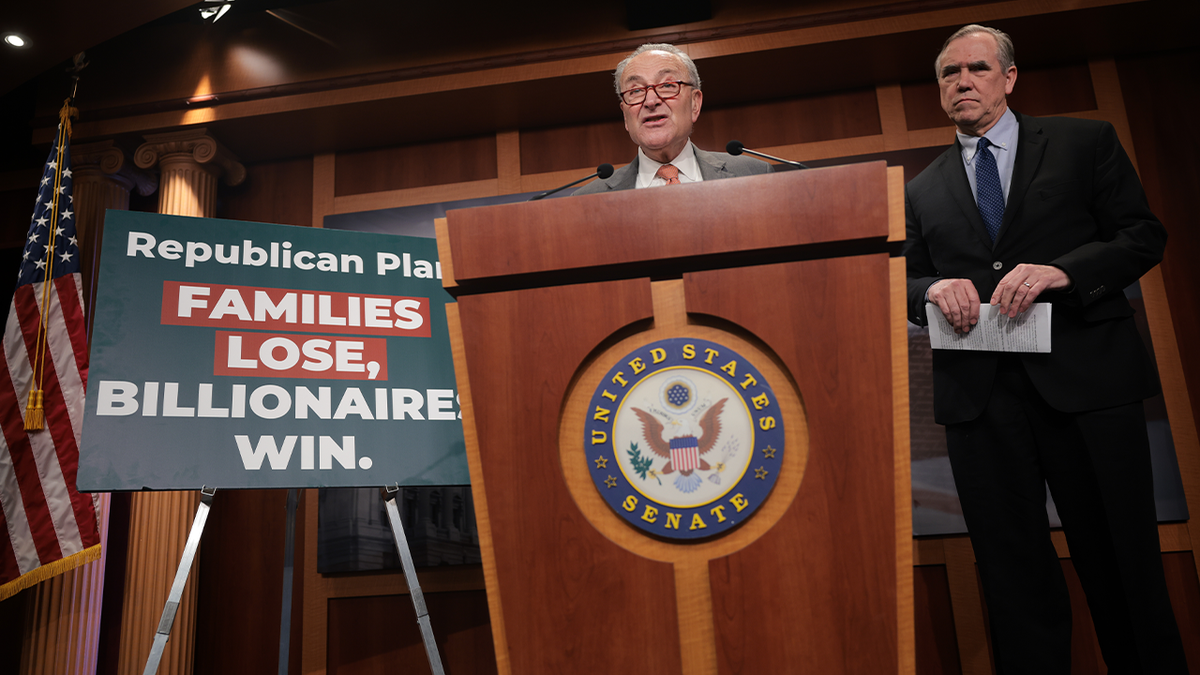

“The billionaire wants to get a bigger tax discount of his friends. Is this disgraceful?” Senate Minority Leader Chuck Schumer, DN.Y., in a rally in New York.

“Demorefall!” She shouted someone in the crowd.

“Degrador! Demorefriave!” followed by schemer.

The US Senate Socaty Leader Leader Chuck Schumer, DN.Y., (R) speaks to D-Ore in Sen.SY. (Kayla Bartkowski / Getty Images)

Some Republicans are now in the wealthy or the growing rates in corporations. It’s been a conversation Capitol hill and about exploring the set of additional tax brackets in the department.

“I do not believe that the president has established him to support him or not White house Scanner Caroline Leavitt.

“We will see where the president is,” said Treasury Secretary Scott Bessentin, while traveling in Argentina, he said. “Everything is on the table.”

A treasure spokesman later clarified Bessent’s words.

“Those who left the table are $ 4.4 trillion tax growth in the American people,” he said. “In addition, corporate tax discounts will produce the production boom and re-enhanced the US economy.”

Top Congress rejected the idea of gop leaders.

“I’m not a big fan to do it,” he said. “I say that the Republican party and for everyone to reduce taxes.”

The federal judge is temporarily limiting IT access to individual social security information

“I do not support this initiative,” he said.

But if you’re a President Donald Trump and GOP, consider creating a new corporate tax rate or a policy of creating walking taxes in good work.

Sunrise Light strikes Capitol Dome on Thursday, Thursday, Thursday, Thursday, Thursday, Thursday, Thursday, Thursday, Thursday. (Bill Clark / CQ-Roll Call, INC via Getty Images)

The President expanded the GOP base. Republicans are no longer the “wealthy” party. Hand workers, shops and warehouses and small businessmen are now trading Trump’s GOPs. Thus, the protection of this tax discounts helps the core of this work class. The removal of taxes to those in the varia will help repay the Republicans for tax discounts and reduce the deficit shot. This protect the Republicans from the evidence of Democrats that the tax reduction is for the wealthy.

Congress is now in the middle of a two-week break for Easter and Easter. GOP deputies and employees actually work behind the scenes to write a bill. No one knows exactly what happens in the bill. Trump promised tax on tips for food service workers. There is no more time tax.

Republicans from high tax states such as New York and Pennsylvania want to see the reduction of “Salt”. This is where taxpayers can write “state and local taxes.” This provision is very important to ensure the support of Republicans as reps. Nicole Malliotakis, RN.Y. and Mike Lawler, RN.Y. Increases the deficit, including salt reduction.

What does the bill look like?

“The small adjustments inside it are naturally on the table,” he said. “Key, (‘is) at home 218 and 51. in the Senate

In other words, this is about math. Republicans should develop the right legislative brew, who ordered the right amount of voting in both pals. Means including certain provisions or to empty others. It’s hard. Especially with the majority of the subtle house.

People, on April 10, 2025, in Washington, participate in a press conference on the support of a fair taxation near the US Capitol and the rally. (Bryan Dozier / Middle East Pictures Via Middle East Pictures / AFP)

“This bill has many people who are dissatisfied with many people,” the 2017 bill said. “And it is not clear how the package comes together with these different trade-offs.”

Johnson wants the bill completed with the Day of Memorial. Republicans know that this enterprise cannot drag much late during the year. Taxpayers see tax increases – Even if Bill is temporarily, the IRS is preparing for the next tax season.

It is also thought to be completed sooner and provide some stability to variable stock exchanges. The creation of tax policy for next year will calm the concerns about the economic outlook of the nation.

“Big, beautiful bill,” Trump calls it, wants the legislation to do “coming soon.”

Click here to get FOX News app

And so the tax season is now the sales season. To both MPs. And to the public.

[ad_2]

Source link