Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

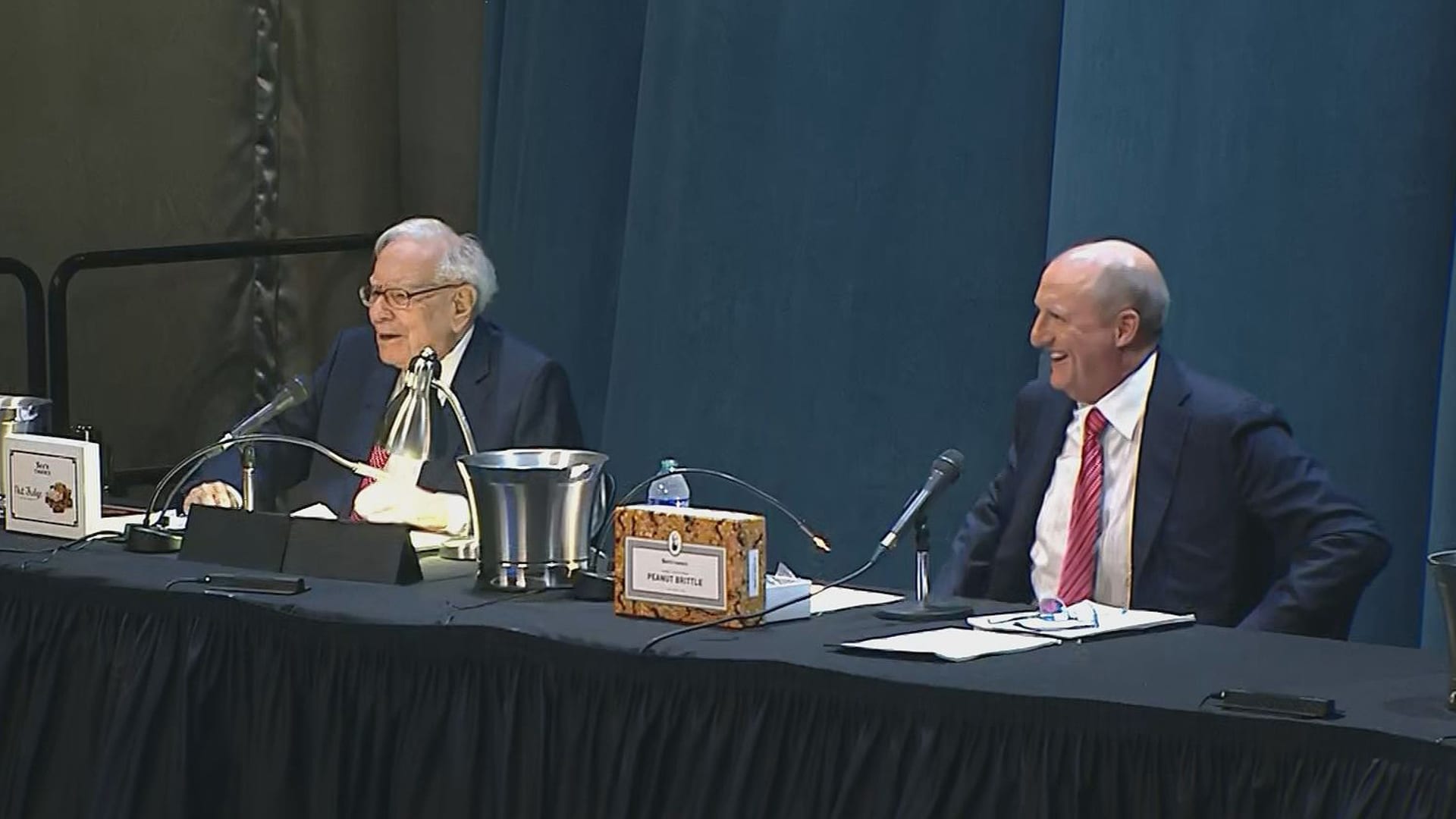

Warren Buffett and Greg Abel, Berkshire Hathaway, May 4, 2024 in Nebraska, Nebraska in the annual shareholder meeting.

CNBC

Warren Buffett has been a mother on fares and the latest market confuses, but 94-year-old investment legend will finally mind when the legend of investment legend Berkshire HathawayAnnual Saturday Joint Stock Meeting.

Tens of thousands of RAPT shareholders will land this weekend in Nebraska this weekend for the annual collection of “Woodstock for capitalists”. This year’s meeting celebrates the 60th anniversary of the company’s leading Buffetti, and Buffettin, who lost his life in late 2023, has been a long time.

The biggest event in the state of Cornhusker, which is next to a Nebraska-Oklahoma football game, this year’s meetings, President of the most imports in the markets Donald Trump’s aggressive visit to the markets was uncertain. .

“Because Berkshire has so much enterprise, mainly in the frontress of the economy in terms of falling economy. Is it worse than the numbers already show?” Berkshire’s biggest holding is Steve Check, the founder of the inspection capital considered the largest holding. “I hope that more than anything else, the tariffs speak. Everyone is looking for what Warren Buffett said.”

Omaha Oracle may have been able to speak of his actions. Berkshire sold more shares than the purchase for nine rectangles worth $ 134 billion in 2024. This was mainly due to the decline in two largest capital owners in Berkshire – Apple and Bank of America. As a result of Sale Spree, December Berkshire’s Giant money grew Another record, $ 334.2 billion.

The world is eager to hear the Buffett’s most popular value investment defender, hunting for transactions and use the melting in the April market to prepare the ground for deals. Although Buffett does not create forecasts on short-term market, investors will listen to any signal of the US economy, despite the tariff shock.

“I think it’s what everyone’s mind is used in the mind, which is a portfolio manager, which is a portfolio manager, which is all clearly pointed and placed more accurately,” Warren tends to see Warreni as a northern star. “

Buffett will speech several times a few times at 9 o’clock, followed by an hour-to-answer panel. Buffett’s appointed successor, Greg Habil and Berkshire’s insurance chief, Ajit Jain will join the Buffett, Buffett and the Sonahirt in the morning. Q & A session will Getting out in CNBC And the British and Mandarin Webcast.

Shareholders are interested in explaining the motivation of Buffett’s motivation on a long time Apple Share. After a quarter of a number of quarters, Berkshire Apple Holding remained in 300 million shares because of many of the buffet sector of the buffet from the end of September.

At the annual meeting last year, Buffett claimed that sales were for tax reasons after the profit of sales. It can also be a higher tax invoice to sleep in the US financial shortage of the US, which sells Apple to the desire to prevent a higher tax bill in the future. With the change in the government in Washington, shareholders want to hear the justification of the buffet today.

“You can’t use this explanation, because it is not clearly applied,” he said, Prof. at the University of Maryland. “If more is sold, it was probably seen in front of some risks that could encounter Warren Buffett, the genius of Warren Buffett, where Warren Buffettin is the trade war and tariffs.”

Berkshire’s first quarterly profit report will show the best capital owners of Conglomeritis that can make a sign of the share of apples to investors on Saturday morning.

[ad_2]

Source link