Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

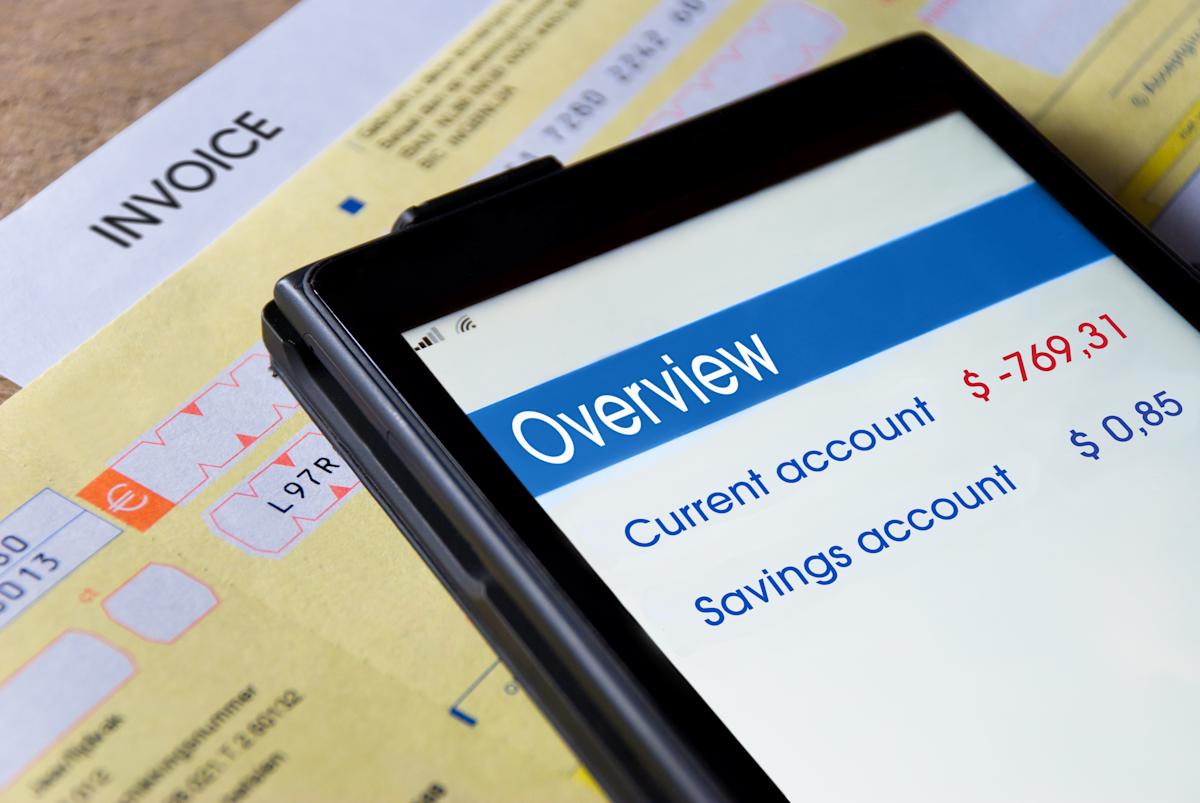

Understanding you spend more money than your hand Checking the account can be stressed. If you find yourself in this situation, you can be worried about what happened next.

Read how the overdrafts work and learn how the balance of a negative test account can affect your financial situation. Moreover, find useful tips that can help prevent overdrafts and prevent overdraft fees – in the future.

Overdraft occurs when you spend more Equilibrium available In your account, the negative leads to go. This occurs when the overdraft coverage of the agreement between you and your financial institution. This protection site, bank or credit union checking can cover transactions that exceed your account balance – in fact, you have extended a short-term loan.

In exchange for overdraft coverage, you usually pay each Overdraft fee when you use the service. (Your financial institution will also expect the overdraft amount to pay the Overdraft.) Overdraft coverage is usually a predefined restriction and financial institutions may still choose to reject certain operations at their request.

Some financial institutions can also offer overdraft protection It works slightly different from overdraft coverage. With the protection of overdraft, you avoid a negative balance by an associated bank account (such as a savings account) or the automatic transfer of your own money as a credit line. Some banks can still require a payment for overdraft protection, but less than overdraft fees. Other banks can offer this type of overdraft free.

Read more: How much can I overdraft my checking account?

Overcoming your audit account can lead to several annoying results. However, your accurate experience depends on the bank’s policy and overdraft coverage or place protection.

Here is a short review of the possible results of the Overdraft of the inspection account.

Overdraft fees: If you prefer overdraft coverage, your bank will generally pay for your account balance (up to the limit). But this coverage comes at a price. Overdraft fees cost about $ 35 for a transaction for FDIC and if you are not careful, a large number of payments can be added quickly.

Operations have decreased: If you have gone over the overdraft coverage – or overdraft – your bank can reduce transactions over your account balance. Although you become a member of the overdraft coverage, your bank can still deny certain operations at their request.

Account Shutdown: To excessively overturn or leave your account in a negative case for a very long time Your account closure. Thus, even if you are overdraft coverage, you should avoid exceeding your account if possible.

Debt collection: If your bank closes your account, you can still send a negative balance to the collection agency when you have a debt. Collection accounts will remain up to seven years and damage in your credit report Credit account.

It can add overdraft fees and negatively affect your material well-being. Good news: There are several ways to prevent overdrafts. The following instructions can be a good place to start.

If you do not build overdraft coverage, your financial institution can simply reduce transactions that exceed your existing balance. This approach is looking for ways to save money, this approach may be valuable Bank fees.

Although a transaction that was refused to potential, it means you avoid overdraft fees – an important thinking, if you follow tight budget.

Overdrafts often occur due to excessive rise. But if you are making a plan for your income, costs and spending (aka budget), it can be easier to prevent such financial shortcomings and make payments with them.

Read more: Your full guide for budget for 2025

When creating a budget, it is important to learn how your account payments and payment are compatible with your periods. Some creditors can even allow you to change your time. So if you have a big bill for paying a few days, if it makes it difficult to stay in the budget, consider calling your creditor and asking time to return the time last time.

Think to ensure that your payment will be installed automatically and benefit from your verification account. Direct deposit If you can give your money faster access and if unexpected transactions occur before depositing your next check, can help not be eroded.

Another way to lift overdrafts to a minimum is to save additional cash in your checking account – it is also known as a checking account buffer or cash background.

A checking account buffer can serve as a financial security network to protect you in several potential. Save additional funds (regularly) Monthly costs) Your account can only help to avoid overdraft charges, but it can also help to cover and prevent unexpected emergencies Minimum balance Rights.

Read more: How much money do you have to keep in your checking account?

Many financial institutions offer customers to register for text or email Bank warnings when the balance is lower than a specified limit. Setting down lower balance signals, from the transfer of money from the next salary) can enhance your action until you start to be overlooked.

If you are a member of the Overdraft coverage from your bank or credit union, it is important to treat the service as a backup. Ideally, you only need to trust the overdraft coverage in financial emergencies.

When your account enters negative and overdraft coverage, your bank can pay you a fee for each transaction. These costs can add quickly. Moreover, the overdraft coverage can lead to greater issues such as the closure of the score, such as the closure of the situation.

Yes, you have to pay overdrafts. When you overdraft your account, even if you have a few dollars, you borrow money from your bank or credit union to cover an operation. The money you borrow becomes a negative balance in your checking account. And any payment you pay to pay those funds, moreover, overdraft coverage of your financial institution.

When you spend more money than you have in your account, your financial institution is a loading fee and covers a bank or credit union operation. In some cases, a transaction can transfer your money from a deposit account connected to a bank to cover an operation and can still pay overdraft fee.

Typical overdraft fees cost $ 35, but it varies between financial institutions. If you want to avoid overdraft fees, let your bank want to give up the Overdraft coverage.

[ad_2]

Source link