Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

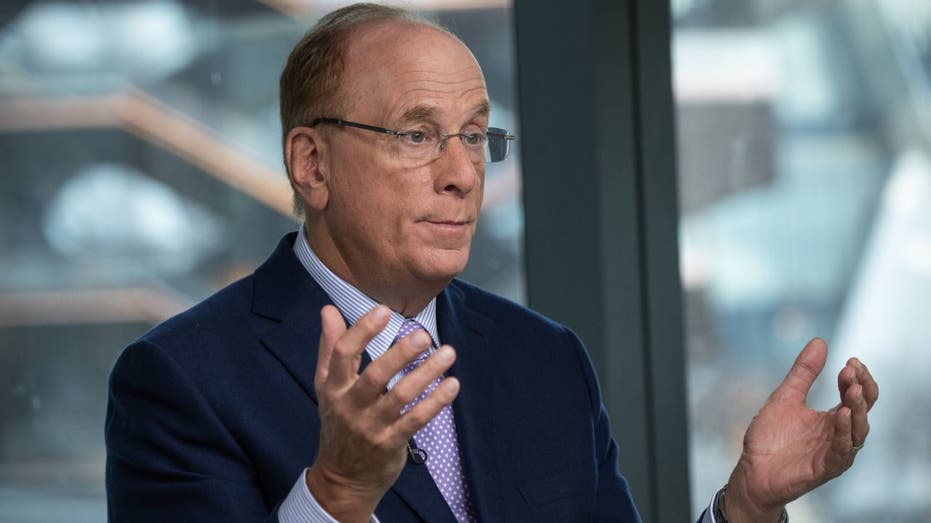

Blackrock Chairman and CEO Larry Fink, ‘Claaman Countdown’ accepts tariff talks with variability of China and market.

60/40 Portfolio, shares on bonds, diversified diversification network with the decent network, have been a test for those who set up pension slot eggs. But times, they recommend a makeover from Larry Fink, a variable and draft CEO Larry Fink.

“The generations of investors have done good work after this approach, not the generations of this approach, not individual securities, but the whole market. Fink wrote to investors in 2025.

BlackRock CEO Larry Fink’s annual letter to investors

Larry Fink, Blackrock Inc. Chairman and CEOs and Adebayo Ogtesi, Chairman of the Global Infrastructure Partners (GIP), New York, USA, Friday, January 1 in January, Bloomberg TV (Photographer: Victor J. Getty Images / Blue / Bloomberg through Getty Images)

In the case of infrastructure, he punched the characteristics of inflation protection; The production of income from payments, stability and variable public markets and up to 10% solid returns to 10%.

BlackRock has recently paid $ 23 billion for Panama Channel ports. As an example, it is possible to get the ship’s fees to pass the revenue from waterways.

Blackrock pays $ 23 billion for Panama Channel Ports

| Ticker | Safety | Last | Change | Change% |

|---|---|---|---|---|

| Black | Blackrock Inc. | 875.75 | +9.64 |

+ 1.11% |

Ambitily Blackrock with more than $ 15 trillion With alternative assets, 50/30/20 mix or other split, smaller, retail investors can make sense.

“There are assets to justify a separation to privatize them and privatize assets, we think the diversification of a portfolio is a really interesting opportunity,” Katie klingensmithEdelman reported the head investment strategist in financial engines, Fox business.

Mortgage rates Spike among market volatility

“Generally, when we think about our prospects, really strong portfolios for our customers, it will be very excited to see how we think of the best for the majority of Ultra high net worth of investors and how they responded to this period.”

This S & P 500, the largest event of the US exchange10% lost this year.

Get the fox work on the way by clicking here

Morningstar’s US main bond index is about 2% this year. According to the company, the investment-level investment-level investment level measures US dollar-denominated securities for more than a year.

[ad_2]

Source link