Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

Kate_sept2004 | E + | Getty pictures

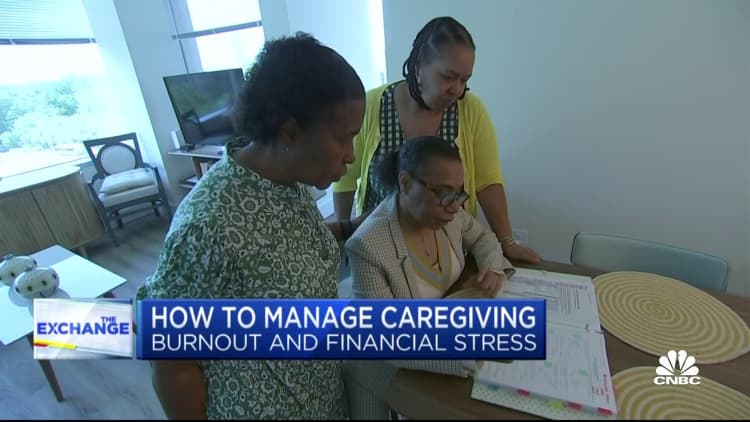

Long-term care can be extended above $ 100,000. Again, financial advisers say many homes are not ready to manage expense.

“People do not plan it,” said Caralyn McClanahan, a doctor and certified financial planner in Jacksonville, Florida. “This is a big problem.”

Today, 57% of Americans reached 65, will develop a serious disability to demand long-term care in 2022 report The United States has been published by the Institute of Health and Human Service and the Urban Institute. Such disabled people may include cognitive or nervous system disorders such as Alzheimer’s or Parkinson’s disease or consequences from a shot.

Today, for someone who turns 65, long-term career is 122,400 dollars in the HHS-city report.

However, some people have been spending a lot in the amount of $ 1,000, for many years, for hundreds of thousands of dollars, for hundreds of thousands of dollars, and “many Americans.”

The number of attention is expected to be swelled as the age of the US population In increasing longevity conditions.

“It is very clear (employees) retired deposits, verification or deposits in savings accounts and the majority of the majority are not long-term.”

“So where will the money come from?” He added.

According to the HHS-Urban report, 15% of people in need of long-term care will spend $ 100,000 from at least $ 100,000 from the pockets of 15%.

Expenses may be very different from the state to the state and depending on the type of service.

Nationwide, for a home health assistant costs about $ 6,300 per month, a special room for a typical person for a special room for a special room for a special room, according to An insurer from Genworth to 2023.

It seems that many houses or are unaware of potential costs for themselves or their relatives.

For example, 73% of employees say that the Institute for Employee Benefits, for a new questionnaire, it is said that at least one adult to take long-term care in the future.

However, only 29% of these future caregivers – will be able to watch at least part of the future bill – the value of future care was found and EBRI was found. The group said that 37% of what he did, the price label would fall below $ 25,000 a year.

The Eybri research has elected 2445 employees from 2445 employees aged 20-74 in late 2024.

Mascot | Mascot | Getty pictures

According to experts, the most funding for long-term care is a good chance.

Medical insurance does not generally provide long-term care services and Medicare does not cover many costs, experts.

For example, Medicare can take care of “qualified” care for the first 100 days, Partially “qualified” of McClanahan, a member of the member of life planning partners and CNBC. Financial Advisor Assembly. This may be when a patient requires a nurse to take a nurse or medicine for a nurse.

Where will the money come from?

Bridget Seaden

Research and development strategy at the Institute of Investigation of Employees

“Guardian” does not take care of the “guardian” when using the bathroom and food using the bathroom and food, McClana. According to the HHS-Urban report, these basic daily duties make up the majority of long-term care needs.

Medicaid is the largest payer for long-term care costs today. Although everyone is, it is not: The fact that many people who receive the benefits of Medicaid are the purchase of less profitable households. To obtain benefits for long-term care, households first have to exhaust a large part of their financial assets.

“Must be mainly teitut” said McClanahan.

Are Republicans in Washington Gravity to Medicaid as part of a large tax-cut package. If successful, Americans are likely to benefit from Medicaid for long-term career.

Good Brigade | Digitalvision | Getty pictures

Several households have a long-term risk of insurance policy specifically, a specially hedge: About 7.5 million Americans are a kind of long-term care insurance in 2020. according to Congress to research service.

For comparison, more than 4 million baby boomer is expected to retire Since 2024 a year since 2027.

Social Long Term for Washington State Residents Other States such as Long-Term Care Insurance Program and California, Massachusetts, Minnesota, New York and Pennsylvania they investigate themselves.

McClanahan, long-term care insurance policy makes it very meaningful for people who are highly needed for a long time. He said that the risk of dementia can be high or those who have longevity in family history.

MCCLANAHAN APTING offers Hybrid insurance policy that combines life insurance and long-term care; According to him, traditional stand-alone policies are designed only for long-term care.

He said how the politics pays for the benefits.

For example, “Payment” policies require the insured to demand their choice and allocated back from the list of preferred providers, require receipts to return McClanahan. For some, especially for the elderly, he said it could be helpless.

McClanahan recommenders, insurers, as soon as possible, as soon as possible, as soon as possible, they can spend their benefits as soon as possible and spend the money they see in accordance with them. However, the amount of benefit is often lower than paid policy.

“The problem with long-term care costs is unpredictable,” said McClanahan. “You always don’t always know when you need your sick and care.”

McClana’s biggest mistakes do not think about long-term care, do not think about long-term care needs and logistics or discussing them with family members before you need care.

For example, you can consider the following questions, McClanahan:

Proactive can help families can help save money in the long run, because the reactive decisions often said “the road is more expensive,” McClanahan said.

“When you think in advance, the decisions are more level-tempered.”

[ad_2]

Source link