Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

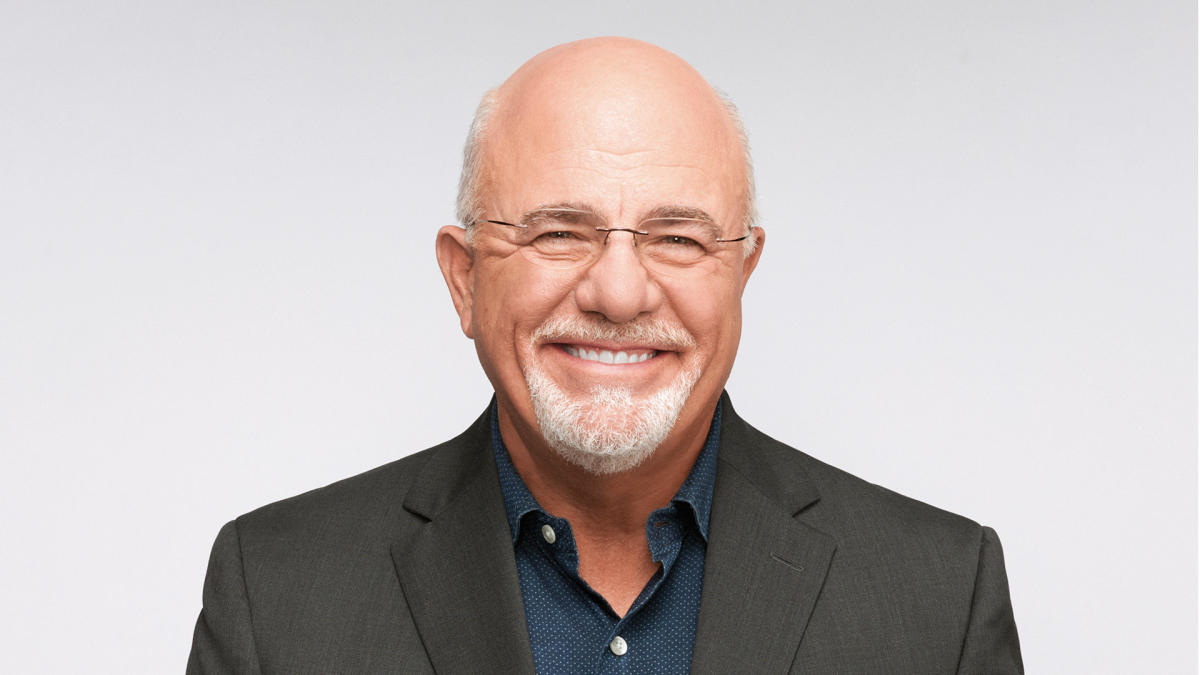

Dave Ramsey, a well-known radio talk show host and the founder of Ramsey solutions, is a little bit Advice on the host.

For those who do not know Ramsey warns its followers for decades owe. It is only a basket to take into account the incredible to use cash for purchases and just get what you can afford.

Now stretching: According to experts, the best states to get property in the next 5 years

Next: The minimum wage to be considered the upper class in 2025

But it excludes a little to get a home. This is probably worth taking this debt, because if you can keep the mortgage pay enough, it becomes an investment. Moreover, if you don’t go to a mortgage, you will pay this money to rent, so you will not spend money you can save anyway.

For this purpose, Here’s how Ramsey explains the philosophy when it comes to getting a house:

The most important note Ramsey wants to make sure we realize that we all prefer to do not receive.

Most of the Ramsey’s followers will grow up to $ 4 million in a wealth of wealth to grow the blue collar and traditionally real estate and investment. Unfortunately, this traditional method covers a lot of debt that Ramsey is overwhelming and unable to pay loans to banks.

He applied for bankruptcy in 1986, and he advised ways to prevent such a financial disaster since today. The basis of his teaching is to stay out of debt.

Yes, even when it comes to get home. Why?

When it comes to boosting, you can not pay, if you don’t have to pay, you can be caused by Dave, broken and financial ruins.

In an ideal world, you will make enough money to get an open home. However, many of us live in this ideal world, especially apartment prices continue to rise.

Think of it: The most decreased 10 home features in popularity (and how much houses of houses)

So, as Ramsey said, you should borrow and most of us need to be our goal to keep the mortgage from the bottom of a quarter of a quarter of your pay. This means that you have $ 4,000 per month, your mortgage should not be higher than $ 1,000.

Some may seem crazy, but this approach ensures that it will still make a lot of money to save for emergencies, save household needs such as groceries, gas and basic needs.

[ad_2]

Source link